- Home

- Home Loan

- Indian Bank

- Eligibility Calculator Hlelgcalc

Indian Bank Home Loan Eligibility Calculator

Indian Bank home loan eligibility calculator helps home loan seekers obtain clear estimates of the loan amounts they’re eligible for. The digital financial planning tool is available on the bank’s website at no additional cost. Indian Bank lends housing loans for purchase, construction, repair and renovation purposes to Persons of Indian Origin (PIO) and Non-Resident Indians (NRIs). Apart from loan estimates, the calculator offers multiple advantages to borrowers and helps them make informed financial decisions.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Last Updated: 1 March 2026

Indian Bank Home Loan Eligibility Calculator – Key Features & Benefits

The bank’s home loan eligibility calculator eases the home loan application process. Some of the prominent features of the calculator are mentioned below:

- Quick Results: A home loan seeker can check their loan eligibility within seconds. The calculator immediately produces the eligible loan amounts after the user enters income and expense inputs.

- Easy to use: Indian Bank’s housing loan eligibility calculator has an extremely simple user interface. Input fields are self-explanatory and can be easily filled.

- Time and Cost Effective: The calculator produces estimates with the click of a button. Users no longer need to visit the bank to verify their home loan eligibility physically. Moreover, the bank charges no extra money on online eligibility checks.

- Financial Planning: Users can input different values to create the right income-expenditure ratio, making them eligible for the desired loan amount.

- Comparisons: If you find yourself stuck between two home loan options, you can use the calculator to select the loan that suits you best. The calculator can help you verify your eligibility and plan your future course.

- Decision Making: Home loans are substantive borrowings. The digital calculator ensures that the home loan remains a financial assistance, not a burden for a borrower.

- Straightforward result: The Indian Bank’s housing loan eligibility calculator provides clear numerical computations for deeper insights. This helps eliminate any ambiguity and make informed choices.

Indian Bank Home Loan Eligibility Calculator Usage Guide

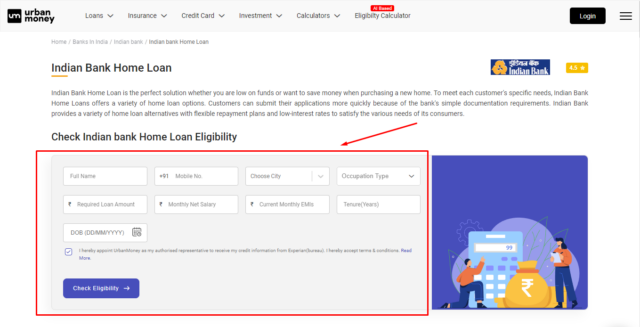

Urban Money’s free Indian Bank home loan eligibility calculator can be used following these simple steps:

- Log on to www.urbanmoney.com

- Select ‘Home Loan’ from the ‘Loans’ category.

- Choose ‘Indian Bank’ from the wide range of home loan providers.

- The portal will lead you to the ‘Indian Bank Home Loan’ page.

- Enter the required information and accept the T&Cs.

- Click on ‘Check Eligibility.’

- Enter the OTP sent to your mobile number and get instant eligibility results.

The Urban Money calculator offers the estimated loan amount a candidate is eligible for, along with the applicable interest rate, tenure and EMI estimates. Click ‘Apply now’ to proceed with the offer, or select ‘View All Offers’ to surf through other options.

Indian Bank Home Loan Eligibility Criteria

Customers require home loans for different purposes. Indian bank offers a variety of home loans to the following candidates:

- Salaried Employees

- Self-Employed Individuals

- Pensioners

- Indian Bank staff and their spouses

- NRIs

- Existing Home Loan borrowers

Factors Affecting Indian Bank Home Loan Eligibility

The following factors influence the results of Indian Bank’s home loan eligibility calculator:

- Age: Indian Bank prefers lending home loans to young professionals. Working-class candidates represent greater chances of loan settlements than others, ensuring minimum risks for the bank.

- Income: An applicant’s income level establishes their financial strength and repayment ability. Banks verify if the candidate’s earnings align with the loan amounts they’ve applied for. Applicants who fulfil the monthly income criteria of the lender are easily granted home loans.

- Work Experience: The bank conducts a professional background check to verify an applicant’s current and previous professional engagements. Loan applicants who display consistent employment over the years are considered more reliable and credible by the bank.

- Nature of Employment: Most banks offer home loans to salaried and self-employed applicants. Indian Bank, however, also makes room for pensioners looking for housing loans.

- Credit Scores: Credit scores reflect a loan applicant’s financial history and repayment patterns. Strong credit ratings provide easy access to a plethora of financial services beyond home loans as well.

- Citizenship Status: Indian Bank extends housing loans to Indian citizens. Residents, as well as Non-Resident Indians, are eligible for Indian Bank home loans.

- Property Details: The bank thoroughly studies the property agreement. Establishing the authenticity and genuineness of the property raises the bank’s trust and increases the chances of loan approval.

Ways to Improve Indian Bank Home Loan Eligibility

If your Indian Bank home loan eligibility calculator doesn’t display favourable results, don’t panic. Follow these simple suggestions to improve your home loan eligibility:

- Indian Bank appreciates a credit score of 700 or higher. Maintaining strong credit ratings can be extremely helpful. Timely repayments, a good credit mix and proper credit utilisation, can help increase one’s credit scores.

- Joint home loan applications provide quicker approvals for loan seekers and lower default risk for the bank. Applying for a home loan with your spouse, parent, or any trusted co-applicant can improve your chances of securing the loan.

- Applying for the right loan amount that aligns with one’s earnings is essential. Loan seekers applying for reasonable amounts have higher chances of approvals than others.

- Communicating additional income to the lender can showcase your financial strength and convince the bank of your repayment potential.

- Maintaining a low debt-to-income ratio communicates the applicant’s financial discipline to the bank and increases their home loan eligibility.

Impact of Credit Scores on Indian Bank Home Loan Eligibility

Credit scores is representative of a candidate’s financial behaviour. The credit ratings serve as a guarantee of timely repayments and loan settlement for the bank. A loan applicant’s credit scores directly impact their home loan eligibility. Higher scores ensure greater chances of approval and vice versa.

Moreover, loan terms like loan amount, interest rate and loan tenure are also influenced by credit scores. The higher the score, the more competitive will be the loan offer.

Eligibility across Different Indian Bank Home Loan Products

Indian Bank offers its customers a variety of home loan products. The Indian Bank home loan eligibility calculator can efficiently conduct eligibility checks for all these products. The table below highlights the eligibility criteria across the bank’s home loan products.

| Product/ Criteria | Age | Target Group | Security |

| IB Home Loan | 18 years or more | Salaried, Self-employed, Pensioners. | Mortgage of property purchased/ constructed from loan proceeds. |

| IB Home Improve Loan | 18 years or more | Salaried, Self-employed, Pensioners, Existing Home Loan Borrowers. | Equitable Mortgage of the property.

Extensions of equitable mortgage. |

| NRI Plot Loans | Up to 50 years | NRIs with regular income.

NRIs employed with a residual contract period/ service of at least three more years to run. |

Equitable Mortgage of Property bought from loan proceeds. |

| NRI Home Loans | Up to 50 Years | Same as NRI Plot Loans. | Equitable Mortgage of property purchased using loan amounts. |

| IB Home Advantage | 18 years or more | Salaried employees, self-employed professionals, pensioners

Indian Bank staff and their spouses.

Existing home loan borrowers. |

Equitable Mortgage of property purchased using loan proceeds. |

| IB Home Enrich | 18 years or more | Resident and Non-Resident Indians

Salaried employees, Self-employed professionals, pensioners, the bank’s staff and their spouses.

Existing home loan borrowers. |

Lien on the bank’s term deposits.

Pledge of 3-year-old NSC.

LIC Policies. |

| IB Home Loan Combo | N/A | Previous loan borrowers with successful repayment records. | Equitable Mortgage and other prescribed securities. |

People Also Asked

How to check Indian Bank home loan eligibility?

One can easily check their Indian Bank home loan eligibility using the Indian Bank Home Loan Eligibility Calculator.

How much am I eligible for an Indian Bank home loan?

The loan amount the bank will be willing to offer depends upon one’s financial standing. By entering details of one’s monthly income and expenses in The Indian Bank Home Loan Eligibility Calculator, estimates of eligible loan amounts can be gained.

How can I ensure that I’ve met the eligibility criteria for Indian Bank home loans?

You can check the details of the desired home loan on the bank’s website and check if you’re eligible to apply. An even easier method would be using the bank’s home loan eligibility calculator available on its website.

Can I improve my eligibility and get higher home loan amounts?

Yes, there are several ways to improve your chances of securing a home loan from Indian Bank. Maintaining good credit scores and submitting joint applications can significantly boost your home loan application.

Quick Links

Loan Offers By Indian Bank's

Home Loan Calculators

Indian Bank Calculators

Bank wise Home Loan Calculators

- Axis Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Hsbc Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Aditya Birla Finance Limited Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Iifl Finance Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Bank Of Baroda Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Citi Bank Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Yes Bank Home Loan Calculator

- Icici Bank Home Loan Calculator