- Home

- Credit Score

Credit Score

Instant Results

No Hidden Fees

Secure & Confidential

No Impact on Your Credit Report

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

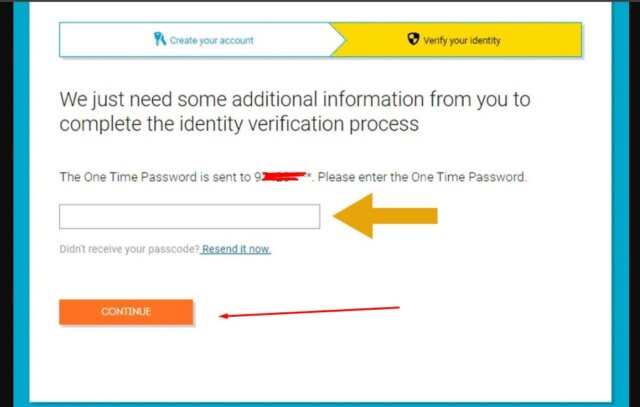

Verify your number

Enter 6 Digit OTP

Change mobile number

Table of Content

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It is generally based on your credit history and financial behaviour. It ranges from 300 to 900, with higher scores indicating better credit health. Lenders and financial institutions use it to assess the risk of lending money or extending credit to individuals.

A good credit score can lead to better interest rates and loan terms, whereas a lower score may result in loan rejections or higher interest rates. Monitoring and maintaining a good credit score is essential for financial stability and access to credit products.

Check Your Credit Score For Free on Urban Money

Given below are the three easy steps to check your credit score for free by entering minimal information.

- Step 1: Visit our credit score page.

- Step 2: On this page, enter details about yourself, like Name, Mobile Number, and Email Address. This will trigger an OTP being sent by Experian to the phone number you entered.

- Step 3: Verify the OTP, and your credit report will be displayed on the screen. A copy of the same will be sent to the registered email address simultaneously by Experian. You also have the option to download the report in PDF format.

- A healthy credit score can also result in you getting better offers and rewards. Applicants with a good credit score can get lucrative promotional offers and rewards on their approved credit cards. Further, elite credit card applicants can also get access to an array of exclusive promotions and events.

However, if you are unable to obtain your credit report through this method, you will be required to enter some additional details like Permanent Account Number, City, and Gender. The credit report will be displayed to you once all these details are verified. You will also get the same on your email.

But, in case you are still unable to view your credit report, you will be required to fill in a Q&A form deftly curated by Experian to verify your authenticity. You should be able to view your detailed credit report by submitting this form.

How to Increase Credit Score?

To improve your credit score effectively, consider these detailed strategies:

- Paying your bills on time is crucial. Late payments can significantly impact your credit score. Consider setting up automatic payments or reminders for due dates.

- Aim to use less than 30% of your total available credit across all cards. Paying down balances and keeping them low relative to your credit limits shows lenders you manage credit responsibly.

- The age of your credit history matters. Older accounts contribute to a longer credit history, positively affecting your score. Think twice before closing old accounts, which could shorten your credit history and increase your utilisation ratio.

- Having a mix of different types of credit accounts, such as revolving credit (credit cards) and instalment loans (auto loans, personal loans, mortgages), can be beneficial.

- Every time you apply for credit, a hard inquiry is made, which can temporarily lower your score. Apply for new credit sparingly and only as needed to avoid too many hard inquiries quickly..

- Regularly review your credit reports for any inaccuracies or fraudulent activities. If you find errors, dispute them with the credit bureau and the lender to get them corrected.

- Keep an eye on your credit score and report through services offered by credit bureaus or third-party apps. Monitoring can help you understand the impact of your financial actions on your score and alert you to potential identity theft.

- If you’re building credit from scratch or repairing poor credit, a secured credit card might be a good option. These cards require a cash deposit that serves as your credit limit. Use it like a regular credit card and pay the balance monthly to build a positive payment history.

- If you’re overwhelmed by debt or unsure how to improve your credit, consider consulting a credit counseling service. They can provide personalized advice and may help you set up a debt management plan.

What is Known as a Good Credit Score?

According to the FICO scoring model, A good credit score is considered in the range of 670 to 739. This range indicates to lenders that the borrower is a dependable applicant with a solid track record of managing credit responsibly. Scores within this range are often associated with higher approval rates for loans and credit, more favorable interest rates, and better credit terms.

Benefits of a Good Credit Score

Having a good credit score is vital to holding a key that unlocks numerous financial opportunities. Here are the detailed benefits:

- A good credit score can significantly reduce the interest rates you’re charged on loans and credit cards. Lenders view you as a lower-risk borrower, which can save you a substantial amount of money over time.

- With a good credit score, your applications for loans and credit cards are more likely to be approved. Lenders trust your ability to repay, making them more willing to extend your credit.

- A strong credit score qualifies you for credit cards with better rewards, cashback offers, travel perks, and lower APRs. These benefits can make managing expenses and planning vacations more rewarding.

- Your credit score directly influences your borrowing limit. A higher score can lead to higher credit limits, giving you more financial flexibility.

- Landlords often check credit scores during the application process. A good score can make it easier to secure the rental you want without needing a larger security deposit.

- Many insurance companies use credit scores to determine premiums. A higher score can lead to lower premiums for auto and homeowners insurance.

- A good credit score gives you the leverage to negotiate lower interest rates on loans and credit card debt. You’re in a stronger position to request better terms.

- Utility companies sometimes waive security deposits for customers with good credit scores. This can save upfront costs when setting up electricity, gas, or internet services.

- Beyond tangible benefits, a good credit score provides financial security. You have the assurance that you can access credit during emergencies or take advantage of financial opportunities as they arise.

Credit vs CIBIL Score

Table below compares the general concept of a credit score with the specific CIBIL score, highlighting their key differences and similarities.

| Aspect | Credit Score | CIBIL Score |

| Definition | A numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. | A specific type of credit score is provided by TransUnion CIBIL, one of the four credit bureaus in India. |

| Range | Generally ranges from 300 to 850, depending on the credit bureau. | Ranges from 300 to 900. |

| Credit Bureaus | Can be generated by different credit bureaus such as Equifax, Experian, and TransUnion. | Exclusively generated by TransUnion CIBIL. |

| Usage | Used by lenders globally to make lending decisions. | Primarily used by lenders in India to evaluate loan or credit card applications. |

| Factors Considered | Payment history, credit utilization, length of credit history, new credit, and types of credit in use. | Similar factors as any credit score, including payment history, credit mix, loan amount owed, and new credit. |

| Impact on Loan Applications | A higher score generally means better chances of loan approval and favourable interest rates. | Like a generic credit score, a higher CIBIL score improves loan approval chances and can lead to better interest rates. |

Range of Credit Score

This range helps lenders assess the lending risk and decide on loan approvals and interest rates.

| Score Range | Credit Quality | Impact |

| 750 – 900 | Excellent | Eligible for best interest rates and loan terms |

| 700 – 749 | Good | Favorable loan terms |

| 650 – 699 | Fair | May face higher interest rates |

| 550 – 649 | Poor | Higher interest rates, limited credit options |

| Below 550 | Very Poor | May not qualify for most credit |

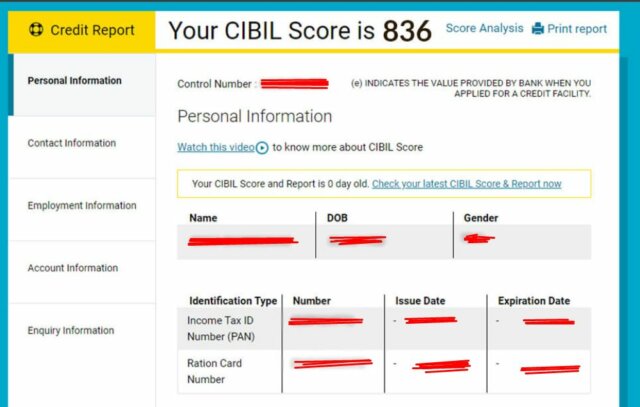

Check Credit Score Online Step-by-step on the Offical Website

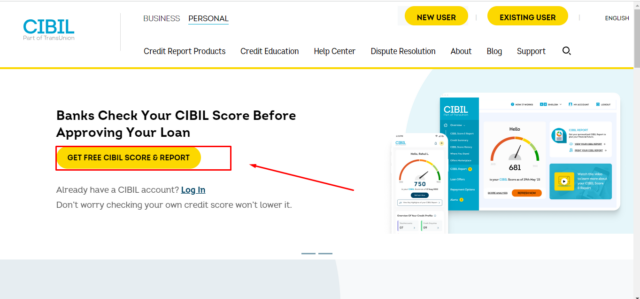

Step 1: Go to the official website https://www.cibil.com/.

Step 2: Find “Get Free Cibil Score & Report”: on the homepage.

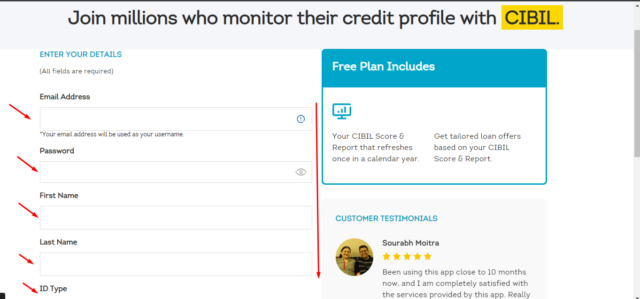

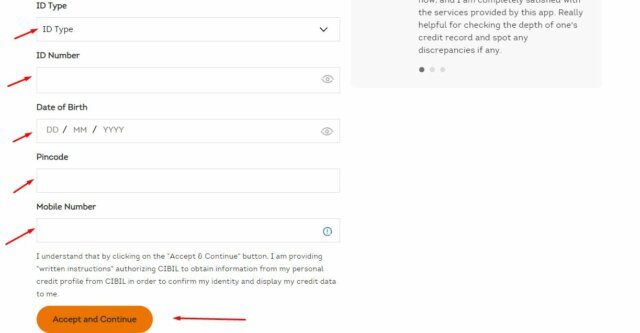

Step 3: Fill in your personal information.

Step 4: OTP sent to your phone or email then enter OTP here

Step 5: Credit score will be displayed.

How is Credit Score Calculated?

To calculate a credit score, credit bureaus analyze your financial habits using these key factors:

- Payment History (35%): This is the most significant factor affecting your credit score. Lenders want to know you’re reliable, so they look at how promptly you’ve made payments on loans and credit cards. Late payments, defaults, bankruptcies, and foreclosures have negative impacts.

- Credit Utilization Ratio (30%): This measures how much of your available credit you use. It’s calculated by dividing your total outstanding credit card balances by your total credit limits. High utilization can indicate that you’re over-reliant on credit, which can lower your score. It’s recommended to keep this ratio under 30%.

- Length of Credit History (15%): Older credit accounts are beneficial because they provide a longer track record of your financial behaviour. This component considers the age of your oldest account, your newest account, and the average age of all your accounts.

- Types of Credit Used (10%): A mix of different types of credit (e.g., mortgage, car loans, credit cards) can positively affect your score. It shows you can handle various types of financial responsibilities.

- New Credit (10%): This refers to recently opened credit accounts and inquiries from lenders (hard inquiries) when you apply for new credit. Opening many new accounts in a short period can be seen as risky behaviour and may lower your score. Each hard inquiry might slightly reduce your score, but the impact diminishes over time.

Factors That Affect Your Credit Score

Understanding what can drag down your credit score is crucial for maintaining financial health. Here are the key factors that can lower your score:

- Timeliness in paying your bills is critical. Late or missed payments on loans and credit cards are red flags to lenders and can significantly hurt your score.

- Using a large portion of your available credit can signal financial distress. Experts recommend keeping your credit utilization under 30% to avoid negatively impacting your score.

- Applying for several credit accounts within a short period can lower your score. Each application typically involves a hard inquiry, which can slightly decrease your score.

- Consistently carrying high balances, can indicate over-reliance on credit and lower your score.

- Failing to repay loans as agreed upon can lead to defaults or settlements, severely damaging your credit score.

- A short credit history provides less evidence of your ability to manage debt responsibly, which can lower your score.

- Closing your oldest accounts can shorten your credit history length, potentially lowering your score.

- A mix of credit types can positively affect your score. Having only one type may not showcase your credit management skills effectively.

- Sometimes, errors in credit reports can unjustly lower your score. Regularly reviewing your credit report for accuracy is essential

Importance of Upholding a Strong Credit Score

Maintaining a strong credit score is crucial for several reasons:

- Primarily, it influences your ability to secure loans and credit cards, as well as the terms and interest rates offered by lenders.

- A high credit score signals to lenders that you’re a low-risk borrower, which can lead to more favourable loan terms.

- In some cases, your credit score can affect your insurance premiums, which involve money management, rental agreements, and even employment opportunities.

Comparison: Credit Score, Credit Rating, and Credit Report

Confused between the three? Well, here is a table to answer all your questions:

| Feature | Credit Score | Credit Rating | Credit Report |

| Definition | A numerical expression based on credit history, typically ranging from 300-900, indicating the creditworthiness of an individual. | An evaluation of a borrower’s credit risk, often assigned to businesses and governments, represented by letters (AAA, BB, etc.). | A detailed record of an individual’s or company’s credit history, including loans, repayment track record, and credit accounts. |

| Purpose | To help lenders quickly assess an individual’s likelihood of repaying borrowed money. | To give investors insight into the creditworthiness and risk level associated with investing in a company’s debt or a government’s bonds. | To provide a comprehensive overview of an individual’s or company’s credit history for detailed analysis by lenders. |

| Provided By | Credit bureaus such as TransUnion CIBIL, Experian, Equifax, and CRIF High Mark in India. | Credit rating agencies like S&P, Moody’s, and Fitch. | Credit bureaus and credit information companies. |

| Users | Banks, financial institutions, and individuals checking their own credit health. | Investors, financial institutions, and analysts are looking at the credit risk of entities issuing debt. | Individuals and lenders review credit history for loan eligibility, creditworthiness, and financial stability. |

| Representation | Numerical score (e.g., 750) | Alphabetical or symbolic ratings (e.g., ‘AAA’ for highest creditworthiness) | Comprehensive report detailing credit accounts, payment history, inquiries, and other credit-related information. |

| Frequency of Update | Regular updates based on new credit information and activities. | Ratings can change based on the entity’s financial condition and market conditions. | Updated regularly as creditors report new credit information. |

| Impact | Direct impact on loan and credit card approval and interest rates offered. | Influences the interest rates a company or government pays on its bonds and its ability to raise funds. | Used by lenders to decide on loan approval and to identify specific areas of financial behaviour needing improvement. |

Factors Leading to a Low Credit Score

A low credit score can hinder your ability to secure loans and enjoy favourable interest rates. Here are several key reasons why your credit score might be low:

- Payment history is a critical factor. Late or missed payments on loans and credit cards negatively affect your score.

- Using a large portion of your available credit signals high reliance on credit, which can lower your score. It’s advisable to keep the credit utilization ratio under 30%.

- A short credit history provides limited information on your borrowing behaviour, making it harder for credit bureaus to assign a higher score.

- Applying for several credit lines within a short period can result in multiple hard inquiries, indicating you might be taking on more debt.

- Accounts in collections, defaults, or bankruptcies have a severe negative impact on your credit score.

- Sometimes, errors or inaccuracies on credit reports, like incorrect account details or fraudulent activities, can unjustly lower your score.

- Carrying high debt levels, especially on revolving credit like credit cards, can decrease your score.

Impact of Credit Score Inquiries

Checking your own credit score, known as a “soft inquiry,” does not impact your credit score. Soft inquiries occur when you review your credit report or when a lender pre-approves you for an offer without your initiation. These inquiries are unrelated to a direct application for new credit and, therefore, do not affect your score.

In contrast, “hard inquiries” happen when you apply for credit, such as a loan or credit card, and the lender reviews your credit report as part of the application process. Hard inquiries can slightly lower your credit score, indicating you may seek new credit. However, the impact is usually minor and temporary, lasting a few months.

Influence of Payment History on Your Credit Score

Your payment history is the most significant factor influencing your credit score. It accounts for a substantial portion of your score’s calculation. This history reflects whether you’ve made your credit account payments on time. Late or missed payments can significantly harm your credit score, indicating risk to potential lenders. On the other hand, making payments on time can positively affect your credit score. This history gives lenders confidence in your ability to manage and repay borrowed funds.

Credit Mix and Its Impact on Your Score

Having a variety of credit types can positively impact your credit score. It shows your ability to manage different forms of credit responsibly. Credit scoring models, such as those used by FICO and VantageScore, consider your credit mix a factor. This mix might include credit cards, retail accounts, instalment loans, finance company accounts, and mortgages.

However, taking on credit you can manage effectively is important only. Making timely payments across all your accounts is key; mismanaging even one type can negatively affect your credit score.

What is the Limit to Check Your Credit Score in a Month?

There is no limit to how many times you can check your credit score. Checking your credit score is considered a soft inquiry, which does not affect your credit score. However, using reputable sources when checking your score is important to ensure your information is secure and accurate. Many credit bureaus, banks, and financial institutions offer free access to your credit score monthly. It’s a good practice to monitor your credit score regularly to detect any inaccuracies or fraudulent activity early on.

Myth Busters About Credit Scores

Understanding the myths and their truths below can help you navigate your credit more effectively:

Myth 1: Checking your credit score will lower it.

Truth: Checking your own credit score is considered a soft inquiry and does not impact your credit score. Monitoring your credit score to understand your financial standing regularly is a good practice.

Myth 2: You must carry a credit card balance to build a good credit score.

Truth: Carrying a balance is unnecessary to build a good credit score. Paying off your balance in full each month can positively impact your credit score by showing responsible credit management.

Myth 3: Closing old credit cards will improve your credit score.

Truth: Closing old credit accounts can actually harm your credit score. It reduces your overall available credit and can increase your credit utilization ratio, negatively affecting your score.

Myth 4: All debts are bad for your credit score.

Truth: Not all debt is bad. A mix of different types of credit, such as revolving credit (credit cards) and instalment loans (auto, personal, mortgage). Managed well can improve your credit score by showing your ability to handle diverse types of credit.

Myth 5: Making more money will increase your credit score.

Truth: Your income does not directly affect your credit score. Credit scores are calculated based on your credit behaviour, such as payment history, credit utilization, and length of credit history, not your income level.

Myth 6: You only have one credit score.

Truth: You have multiple credit scores. Different credit reporting agencies use different scoring models. Lenders may use various scores from different sources to assess your creditworthiness.

Myth 7: Paying off a negative record will remove it from your credit report.

Truth: Paying off a debt in the collection does not automatically remove it from your credit report. Negative records can remain on your report for up to 7 years, although their impact on your score diminishes over time.

Myth 8: Co-signing doesn’t make you responsible for the debt.

Truth: Co-signing a loan makes you legally responsible for the debt. If the primary borrower fails to make payments, it can negatively affect your credit score.

Trusted Credit Information Companies in India

These entities, more commonly referred to as credit bureaus, are the backbone of credit scoring systems in India. They play a pivotal role in shaping the credit landscape. Here are the credit bureaus you can rely on for checking your Credit:

TransUnion CIBIL

Established: 2000

TransUnion CIBIL is the first Credit Information Company in India and has the largest consumer credit information database. It provides credit scores and reports to individuals and lenders, aiding in informed lending decisions. The Credit score numerically represents an individual’s creditworthiness, ranging from 300 to 900.

Equifax

Established: 2010 in India

Equifax is a global data, analytics, and technology company that offers comprehensive credit reports and risk assessment tools. In India, it provides services to both individuals and businesses.

Experian

Established: 2010 in India

Experian is another global leader in consumer and business credit reporting and marketing services. It offers detailed credit reports and scores that reflect an individual’s credit behavior and history.

CRIF High Mark

Established: 2007 in India

CRIF High Mark is known for its comprehensive database covering retail, agriculture, and SME sectors. It provides credit information solutions across the entire customer lifecycle, from acquisition to portfolio management to collections.

FAQs

How do you get a 900 credit score?

To achieve a 900 credit score, pay all bills on time, maintain low credit utilisation, have a mix of credit types, and have a long history of responsible credit use.

Who calculates the credit score in India?

In India, credit scores are calculated by credit information companies (CICs) like TransUnion CIBIL, Equifax, Experian, and CRIF High Mark.

Is checking credit scores on third-party websites safe?

Checking credit scores on reputable third-party websites can be safe if they have strong data protection measures. However, always ensure the website is secure and trustworthy.

Why do lenders check the Credit Score?

The lenders usually check the credit score of individuals to gauge their repayment ability. It helps the financial institution to understand the risk factors associated with lending to an individual.

What information is included in my credit report?

Some of the information that will be mentioned in your credit report is as follows:

- Individual’s full name, address, and other information.

- Contact number and PAN details.

- Credit card/loans.

- Credit history.

- Repayment behaviour.

- Lender inquiry details.

How long does the information remain on a credit report?

This usually depends on a number of factors like hard inquiries, loan applications, credit card details, and payment details. As soon as changes in any of these are detected, your CIBIL score will also change. The credit agencies obtain such information from banks on a monthly basis just to update the credit score.

Is it possible to delete information from the credit report?

Your credit report can only be accessed by you, government approved regulatory bodies, and lenders.

Can I build a credit report with no credit history?

A sound credit history is crucial for maintaining a proper credit history. This indicates that you have successfully cleared past obligations. Given below are some of the ways that you can build a CIBIL report with no credit history:

- Obtain a secure line of credit.

- Make timely payments.

- Use credit cards wisely.

- Refrain from applying for multiple bank loans.

- Keep tracking and monitoring your credit report and history.

What is SBI CIBIL score?

SBI doesn’t have its own CIBIL score; it refers to the credit score provided by TransUnion CIBIL, which SBI and other banks use for credit evaluation.

Will the credit score be affected for owning multiple credit cards?

Owning multiple credit cards can affect your credit score if it leads to high credit utilisation or missed payments, but it can also improve your score if managed wisely.

Who generates credit scores?

Credit scores are generated by credit bureaus (credit information companies) based on your credit history and financial behaviour.

Quick Links

EMI Calculator

Eligibility Calculator

Top 10 Banks

Investment Options

Gold & Silver Rate

Home Loan By Other Banks

- Bank of Baroda Home Loan

- Axis Bank Home Loan

- HDFC Bank Home Loan

- ICICI Bank Home Loan

- Bajaj Finserv Home Loan

- Canara Bank Home Loan

- IndiaBulls Home Loan

- DHFL Home Loan

- Union Bank of India Home Loan

- YES Bank Home Loan

- CITI Bank Home Loan

- IndusInd Bank Home Loan

- Federal Bank Home Loan

- State Bank of India Home Loan

- Punjab National Bank Home Loan

- IDFC FIRST Bank Home Loan

- Hero FinCorp Home Loan

- IDBI Bank Home Loan

- Kotak Bank Home Loan

- Tata Capital Housing Finance Limited Home Loan

- HDFC Sales Home Loan

- Aadhar housing Finance Home Loan

- IIFL Finance Home Loan

- Clix Capital Home Loan

- Aditya Birla Finance Limited Home Loan

- Capital First Ltd. Home Loan

- Home First Finance Company Home Loan

- Capri Global Home Loan

- Reliance Capital Home Loan

- L&T Finance Home Loan

- SMFG India Credit Company Ltd Home Loan

- Indian bank Home Loan

- Bank of India Home Loan

- Piramal Finance Home Loan

- Edelweiss Financial Services Home Loan

- Bank of Maharashtra Home Loan

- Hero Housing Finance Home Loan

- Poonawalla Fincorp Limited Home Loan

- karnataka bank Home Loan

- DCB Bank Home Loan

- LIC Housing Finance Home Loan

- Punjab & Sind Bank Home Loan

- Punjab National Bank Housing Finance Home Loan

- Muthoot Finance Ltd Home Loan

- Ujjivan Small Finance Bank Home Loan

- karur Vysya Bank Home Loan

- Cholamandalam Finance Home Loan

- RBL Bank Home Loan

- Godrej Housing Finance Home Loan

- HSBC Home Loan

- Housing Development Finance Corporation Home Loan

- Vastu Housing Finance Home Loan

Personal Loan By Other Banks

- Bank of Baroda Personal Loan

- Axis Bank Personal Loan

- HDFC Bank Personal Loan

- ICICI Bank Personal Loan

- Bajaj Finserv Personal Loan

- Canara Bank Personal Loan

- IndiaBulls Personal Loan

- DHFL Personal Loan

- Union Bank of India Personal Loan

- YES Bank Personal Loan

- CITI Bank Personal Loan

- IndusInd Bank Personal Loan

- Federal Bank Personal Loan

- State Bank of India Personal Loan

- Punjab National Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- Hero FinCorp Personal Loan

- IDBI Bank Personal Loan

- Kotak Bank Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- HDFC Sales Personal Loan

- IIFL Finance Personal Loan

- Clix Capital Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- Reliance Capital Personal Loan

- L&T Finance Personal Loan

- SMFG India Credit Company Ltd Personal Loan

- PaySense Personal Loan

- InCred Financial Services Personal Loan

- Indian bank Personal Loan

- Bank of India Personal Loan

- Piramal Finance Personal Loan

- Edelweiss Financial Services Personal Loan

- Bank of Maharashtra Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- karnataka bank Personal Loan

- DCB Bank Personal Loan

- Punjab & Sind Bank Personal Loan

- FT Cash Personal Loan

- Muthoot Finance Ltd Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- AU Small Finance Bank Personal Loan

- karur Vysya Bank Personal Loan

- RBL Bank Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- HSBC Personal Loan

- MoneyWide Personal Loan

- Privo Personal Loan

- Prefr Personal Loan

- Bhanix Finance Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- Zype Personal Loan

- EpiFi Personal Loan

- Unity Small Finance Bank Personal Loan

- FatakPay Personal Loan

Latest from the Credit Score Blog

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba