- Home

- Cibil Score

Check Your Cibil Score

Absolutely, FREE

I agree to the Terms and Conditions of TUCIBIL and hereby provide explicit consent to share my Credit Information with Urban Money Private Limited.

Verify your number

Enter 6 Digit OTP

Change mobile number

Learn. Plan. Protect. All in one place. Here's how.

- - Free and Secure CIBIL Score Check

- - Credit Score Monitoring with Minimal Information

- - Get the Lenders Perspective

What is CIBIL Score and How Does CIBIL Score Work

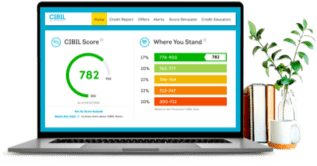

CIBIL Score is a three-digit number that ranges between 300 and 900 and indicates your creditworthiness. Scores closer to 900 represent better creditworthiness and vice versa. Nevertheless, the banks typically consider a credit score of 700 or higher, often associated with favourable rates and terms, when you apply for credits such as personal loans, mortgages, credit cards, overdraft facilities, etc. It is calculated based on your credit behavior. These can ideally include your credit utilisation, repayment history, and credit duration.

How do you check your CIBIL Score online?

Let’s examine the step-by-step procedure regarding CIBIL score check for free via the Urban Money website:

Step 1: Visit the official website of Urban Money

Step 2: Click on the “Credit Score” menu at the horizontal menu bar on the homepage.

Step 3: Enter your personal and financial details, such as name, gender, PAN card, and email address.

Step 4: Tap on “Check CIBIL Score”.

Step 5: A 6-digit OTP will be sent to your registered phone number and email address.

Step 6: Input the OTP and click on “Submit”.

Step 7: Your applicable CIBIL Score will be displayed on the screen.

Importance of CIBIL Score

Here are the key important of the CIBIL Score:

- Loan Approval: A higher CIBIL score increases your chances of loan approval. Lenders consider you to have responsible credit behaviour and low risk.

- Lower Interest Rates: A higher CIBIL score empowers you to negotiate lower-than-usual loan interest rates, eventually significantly saving your hard-earned money.

- Quick Loan Processing: A higher CIBIL score can result in faster loan processing. Lender approaches such applicants with moderate eligibility criteria and minimal documentation.

- Ample Credit Options: A higher CIBIL score opens up various credit options. These can primarily include premium credit cards, high-limit overdraft facilities, and mortgages with lower rates, among many others.

- Increased Credit Limit: Banks may offer a higher credit limit on your credit card if you have a strong CIBIL score.

- Better Credit Products: A higher CIBIL score may allow you to access credit products with better terms and benefits.

- Financial Security: Maintaining a good CIBIL score is a sign of good financial health and can provide security for future credit needs.

CIBIL Score Range

As mentioned earlier, a CIBIL Score ranges from 300 to 900. However, within this range, banks categorise scores into five different levels. These can include excellent, good, fair, subnormal, and poor. Let’s have a clear understanding of these categories:

Excellent Score: This refers to credit scores between 750 and 900. Borrowers with excellent scores can expect to avail themselves of various credit products, such as personal loans, mortgages, credit cards, etc. They also enjoy lower interest rates and better terms, making it easier and quicker to secure the necessary funds.

Good Score: This pertains to credit scores between 700 and 749. Many lenders consider this range ideal, making it a strong possibility for those requiring credit. Moreover, borrowers can expect more favourable rates and terms, though slightly less favourable than what is offered in the ‘excellent’ category.

Fair Score: This signifies credit scores between 650 and 699. Borrowers under this range might be sanctioned for their loan application but may not qualify for the most favourable rates and terms. Nevertheless, many lenders are willing to offer better deals to such borrowers, enabling them to obtain the necessary funds.

Subnormal Score: This represents credit scores between 600 and 649. Getting a loan or credit product with a ‘subnormal’ score might be difficult. Suppose one can locate any credit offer with this score; expecting a favourable offer is unreasonable. I.e., lenders typically charge higher interest rates and impose unfavourable terms, as borrowers with such scores are considered less creditworthy or higher risk.

Poor Score: Any number below 600 is considered a poor CIBIL Score. This indicates urgent action is required to improve credit health and a very minimal chance of loan approval. Various factors can be behind lower credit scores, such as default timely repayments, excessive credit usage, multiple loan applications in a short period, etc. So, it is recommended that you be informed about the reasons for your credit drop and strive to improve it.

Difference Between CIBIL Score and Credit Score

Here are the key differences between CIBIL Score and Credit Score:

| Aspect | CIBIL Score | Credit Score |

| Definition | This is a numerical representation of your credit history provided by TransUnion CIBIL, a widely used credit bureau company in India. | Any credit bureau in India, including CIBIL, Experian, CRIF High Mark, and Equifax, can numerically represent your credit history. |

| Usage | Lenders use your CIBIL Score to assess creditworthiness when you submit a credit application for personal loans, car loans, mortgages, credit cards, etc. | Lenders use your Credit Score to assess your creditworthiness when you submit a loan/credit application. Each bureau’s score would be considered equally and taken as an average. |

| Range | Range from 300 to 900, with scores above 750 considered excellent and above 700 considered good. | Typically, it ranges from 300 to 900, with a higher score indicating better creditworthiness. |

| Access | An applicant may check their CIBIL score for free via the official website of Urban Money | Credit scores can be checked via the official websites of India’s four credit bureau companies. |

Benefits of Good CIBIL Score

Let’s examine the applicable benefits of having a better CIBIL score:

- Easy Loan Approval

- Lower Interest Rates

- Higher Credit Limits

- Better Loan Offers

- Quick Loan Processing

- Negotiating Power

Factors That Affect and Don’t Affect Your CIBIL Score

Here is a list of factors that affect and don’t affect the CIBIL Score:

Factors That Affect Your CIBIL Score

- Payment History: Default on your loan EMIs and bills can significantly negatively affect your CIBIL Score.

- Credit Utilisation Ratio: A high percentage of credit usage can lower your CIBIL score, so it is advisable to maintain your credit utilization ratio below 30%.

- Credit Mix and Duration: A diverse credit portfolio and a longer credit history can improve your CIBIL score as the credit bureau considers you to have responsible credit management.

- Outstanding Debt: High amounts of existing debt can decrease your CIBIL Score as it indicates a reduced capacity to manage additional debt.

- Number of Enquiries: Too many hard credit inquiries, which occur when you apply for credit, can lower your score.

Factors That Don’t Affect Your CIBIL Score

- Income Level: Your income does not impact your CIBIL score as it does not represent your earning capacity.

- CIBIL Score Check Online: Checking your CIBIL Score doesn’t affect your credit, as it does not reflect your credit report.

- Debit Card Usage: Transactions made through debit cards are not recorded for CIBIL score calculation.

- Marital Status: Getting married does not affect your credit score, as your financial profile does not merge with your partner’s, and vice versa.

- Denied Credit Applications: Rejection of your credit applications does not affect your CIBIL Score as it is not reflected in your credit report.

Tips to Improve Your CIBIL Score

Let’s take a look at the applicable tips you can keep in mind to improve your CIBIL Score:

- Pay Your Dues on Time: Paying your EMIs and credit card bills on time can improve your CIBIL score.

- Maintain Older Credit Cards: Keeping your old credit cards and bank accounts active can improve your CIBIL score.

- Limit Credit Utilisation: Making your credit utilisation ratio below 30% can help you improve your CIBIL Score.

- Have a Healthy Credit Mix: Your score can benefit from secured (like home loans) and unsecured (like credit cards) loans.

- Check Your Credit Report Regularly: Review your credit report for any inaccuracies and dispute them if necessary via the official website of TransUnion CIBIL.

- Avoid Multiple Credit Applications: Extensive research and choosing the one that suits you best can help you avoid multiple loan applications and rejections.

How Is CIBIL Score Calculated?

Following is the expected calculation process of the CIBIL Score:

Payment History

This is the most significant factor and includes your track record of paying off credit card bills and loan EMIs. Timely payments improve your score, while missed or late payments can harm it. Your payment history can influence approximately 30% to 35% of your CIBIL Score result.

Credit Utilisation Ratio

This measures how much credit you’ve used compared to your available credit limit. A lower utilisation rate benefits your score because it signals to the credit bureau that you maintain a healthy financial lifestyle. Your Credit Utilisation Ratio can impact approximately 25% to 30% of your CIBIL Score outcome.

Credit Type and Duration

Having a mix of credit types (secured and unsecured loans) and a long credit history can positively affect your score. This enables you to showcase to a credit bureau company that you are good at managing multiple credit options and have good repayment behaviour. This section can influence about 25% of your CIBIL Score result.

Other Factors

These refer to other minor factors that can affect your CIBIL Score. These can include the number of credit inquiries made, your outstanding loan amount, whether any discrepancy occurs, etc. However, this section can influence only 10% to 20% of your CIBIL Score result, making it less significant than others.

What Is a CIBIL Report?

A CIBIL Report is a type of document. This is also known as a Credit Information Report (CIR) and is prepared by TransUnion CIBIL, a widely used credit bureau company in India. It illustrates a detailed overview of your creditworthiness. The report contains personal information, contact details, employment data, and a comprehensive record of your loans and credit cards, including account numbers, loan amounts, and payment history. Moreover, it summarises all this information into three-digit numbers ranging from 300 to 900, recognised as the CIBIL Score. This ideally enables both you and the lender to understand your financial responsibility at just a glance. Namely, lenders use this CIBIL Report to assess your credit risk when you submit a loan/credit application. A positive CIBIL Report can result in faster loan approval, lower interest rates, favourable terms, and more.

Impact of Credit Inquiries on a CIBIL Score

Credit inquiries, particularly hard inquiries, can impact a CIBIL Score. When a lender checks your credit report due to a loan or credit card application, it’s termed a hard inquiry and is recorded in your credit history. Multiple hard inquiries in a short period can suggest to lenders that you may be credit-hungry, which can negatively affect your score. Each hard inquiry might slightly reduce your CIBIL Score. On the other hand, Checking your credit score or inquiries by employers are considered soft inquiries and do not affect your CIBIL Score. This is referred to as soft Inquiries.

What Is a Good CIBIL Score?

Lenders in India generally view a credit score of 700 or above as ideal. Applicants within this range can anticipate loan approval without much trouble. However, it is important to acknowledge that interest rates and terms can vary slightly based on how high their credit score is. Let’s examine a typical breakdown of the score ranges:

| CIBIL Score Range | Creditworthiness | Approval Chances |

| 750 – 900 | Excellent | Very High |

| 700 – 749 | Good | High |

| 650 – 699 | Fair | Moderate |

| 600 – 649 | Subnormal | Low |

| Below 600 | Poor | Very Low |

Credit Bureaus in India

Four main credit bureaus are available in India. Credit Information Companies (CICs) are also called and operate subject to the Reserve Bank of India (RBI). They collect and maintain credit-related information on individuals and businesses, which is used to generate credit reports and scores. The following are those four Credit Information Companies:

- TransUnion CIBIL is India’s Prime Credit Bureau. It provides credit scores and reports and plays a significant role in the financial ecosystem.

- Experian: A global information services company in India that offers credit reports and scores.

- Equifax is an international credit bureau that provides detailed credit reports and risk analyses, enabling consumers to know their credit position.

- CRIF High Mark: A credit bureau that offers credit information services in India where one can access detailed credit information.

What is a CIR and How is It Related to the CIBIL Score?

CIR stands for Credit Information Report. It is a statement that demonstrates your credit history, including your credit accounts, loan applications (enquiries), and repayment behaviour. The CIBIL Score, on the other hand, is a numerical representation of the CIR. Your CIBIL Score is proportional to your Credit Information Report (CIR). Thus, a more positive credit report leads to a higher credit score, suggesting you have good credit behaviour and a higher likelihood of loan approval. A negative credit report makes you worse as it indicates a potential risk to lenders.

How is a CIBIL Score Used in Credit Card Applications?

Below are the expected elements that a CIBIL Score can influence regarding your credit card application:

Eligibility Check: Lenders use the CIBIL Score to quickly assess your creditworthiness and determine eligibility for a credit card.

Credit Limit: A higher CIBIL Score can lead to a higher credit limit, as it indicates responsible credit behaviour and a lower risk of default.

Interest Rates: Lenders offer lower interest rates if you have a higher credit score, considering you a less risky applicant.

Approval Process: A higher CIBIL Score, usually above 750, can result in faster approval of your credit card applications.

Loan Offers: A strong CIBIL Score also qualifies you for more offers and better terms, as well as a pre-approved loan and other credit products.

Role of CIBIL Score in Personal Loan Applications

Below are the key elements that a CIBIL Score can influence regarding your loan application:

- Assessment of Creditworthiness: Lenders use the CIBIL Score to gauge your credit history and repayment behaviour.

- Loan Approval: A good CIBIL Score increases the likelihood of loan approval, whereas a lower score can lead to challenges and even result in rejection.

- Interest Rates: Borrowers with higher CIBIL Scores can often secure loans at more favourable interest rates. This is because a high score suggests a lower risk of default.

- Loan Terms: Better CIBIL Scores can lead to more favourable loan terms, such as a higher loan amount, longer tenure, and more flexible repayment options.

- Loan Processing Time: A strong CIBIL Score can also expedite loan processing, enabling quicker disbursal of funds.

How Does a CIBIL Score Influence Home Loan

Below are the key elements that a CIBIL Score can influence regarding your home loan application:

- Loan Approval: Lenders view a high score as an indicator of lower risk and responsible credit behaviour, empowering you to get your application approved faster.

- Interest Rates: Borrowers with higher CIBIL Scores often qualify for lower interest rates, resulting in substantial savings over the loan term.

- Loan Terms: A good CIBIL Score can lead to more favourable loan terms, such as a higher loan amount, longer repayment tenure, and flexible repayment options.

- Negotiation Power: A strong CIBIL Score boosts your negotiation power, which enables you to seize lower interest rates or better loan terms.

- Quick Processing: A good credit score can facilitate minimal documentation and quicker fund disbursement, making it faster and more efficient.

Common Misconceptions About CIBIL Scores

Let’s examine the common misconceptions about the CIBIL Score:

- Income Determines CIBIL Score: Many believe a higher income leads to a higher CIBIL Score. However, income does not directly impact the score.

- Only Loan Repayment History Counts: While repayment history is crucial, other factors like credit utilisation, length of credit history, and number of credit inquiries also affect the CIBIL Score.

- Debit Card Usage does not Affect your CIBIL Score. Debit card transactions are linked to your bank account and do not involve borrowing, so they do not impact your CIBIL Score.

- Checking Your Own CIBIL Score Lowers It: Checking your own CIBIL Score is a soft inquiry and does not affect it. However, multiple hard inquiries by lenders can lower the score slightly.

- Closing a Loan Improves CIBIL Score Immediately: Closing a loan does not erase its history. The repayment record, good or bad, remains part of your credit history for some time.

- A Low CIBIL Score is Always Bad. A low score may indicate a lack of credit history rather than poor credit behaviour. Lenders also consider other factors, like income and collateral.

CIBIL Credit Report Checklist

Here is a CIBIL scorer checklist to help you review your credit report effectively:

- Check Your Personal Information: Verify your name, date of birth, PAN, Aadhaar, and other personal details are correct.

- Examine Contact Information: Ensure your address, phone number, and email are up-to-date.

- Review Employment Information: Confirm the accuracy of your occupation type and income as reported by banks.

- Inspect Account Information: Check your loan and credit card records for discrepancies, including lender names, loan amounts, payment history, and current balances.

- Analyse Credit Utilisation: Assess how much credit you use compared to your available credit limit.

- Scrutinise Enquiry Information: Check for any hard inquiries and ensure they were made with your consent.

- Identify Frauds and Errors: Look for any unfamiliar transactions or inquiries that could indicate fraud.

- Understand Your CIBIL Score: Know where your score stands and what factors might affect it.

- Dispute Errors: If errors are found, report them to CIBIL for correction via the official website of TransUnion CIBIL.

Consent Withdrawal Process

Our consent withdrawal policy states that you can revoke the usage of the information you have provided to Urban Money during the CIBIL score check process. This means that every information we have pertaining to you shall be discarded from our database without any discretion. Furthermore, the Right to Consent Withdrawal states that we shall not hold any of your information for our usage, including its storage, sharing with third parties and our network of lending partners, and permission to contact you. Upon your request to withdraw consent, we are required to remove your personal information completely. However, if there is any legal compliance that needs to be adhered to where holding your personal information is compulsory, we are required to hold on to your specific components of the information.

The information we adhere to retain includes the following. These parts of information are necessary to be kept by us owing to legal prerequisites.

- Compliance with applicable laws

- Protection and enforcement of our legal rights

- Providing information required by regulatory authorities for investigations related to fraud or unlawful activities.

Furthermore, if your loan or credit card application has been forwarded to a partnered financial institution for loan processing or if you have obtained a credit facility through them, the Lending Partner retains the right to continue processing your information. This includes contacting you regarding your application or maintaining your records until the repayment of the credit facility, including any applicable interest and outstanding dues, is completed. Additionally, as permitted by law, the Lending Partner may instruct us to retain your information if any services related to the credit product, such as debt collection, have been outsourced to us. In such cases, we will be required to store your data accordingly.

Escalation Matrix

| Level | Response Time | TAT | Name along with designation | Contact Details (including address, phone and email) |

| Level 1 | 72 Hours | 30 Days | The initial complaint will be handled by customer experience executive (Monday To Saturday 09:00 AM to 7:00 PM) | Address: 1st Floor, Tower A, M3M Urbana Business Park,Sector 67, near M3M Urbana, Gurugram, Haryana 122001 Email: connect@urbanmoney.com |

| Level 2 | 48 Hours | 14 Days | Name: Mr. Piyush Bothra Designation: Grievance Redressal Officer |

Address: 1st Floor, Tower A, M3M Urbana Business Park,Sector 67, near M3M Urbana, Gurugram, Haryana 122001 Email: piyush.bothra@squareyards.com |

Note: We will provide our final response or clarify any need for additional time to address your query or complaint. Our goal is to do so within the specified turnaround time (TAT) from the date of receipt.

Grievance Redressal Process

At Urban Money, we prioritise delivering exceptional customer experiences to foster long-lasting relationships. We strive to provide empathetic and compassionate support to our customers. However, we acknowledge that disagreements may arise, leading to complaints.

We regard complaints as valuable opportunities to showcase our dedication to customer satisfaction and to improve our products, processes, technology, and team. If you have concerns or grievances related to credit reports, consent withdrawal, or other issues, please follow the process outlined below to register your complaint.

Process of Grievance Redressal

Level 1

The customer may raise his/her complaint through “alka.rathod@urbanmoney.co.in” and the customer will receive the update/response within 72 working hours from Urban Money support team.

Level 2

The customer may raise his/her complaint through “randeep.sond@urbanmoney.co.in” and the customer will receive the update/response within 60 working hours from Urban Money support team.

Level 3

In case, the complaint is not addressed within 7 days from the date of filing the complaint or the Customer is not satisfied with the resolution provided at Level – 1, the customer may escalate by writing to us at:

- Grievance Officer: Mr. Piyush Bothra

- Contact Email ID: piyush.bothra@squareyards.com

- Address: 1st Floor, Tower A, M3M Urbana Business Park,Sector 67, near M3M Urbana, Gurugram, Haryana 122001

Escalation Matrix

| Level | Response Time | TAT | Name along with Designation | Contact Details (including address, phone and email) |

| Level 1 | 72 Hours | 30 Days | Name: Ms. Alka Rathod Designation: Senior Manager |

Address: Unit A (401- 403) & B – 406, Rustmjee Central Park, Andheri, Mumbai – 400069. Email: alka.rathod@urbanmoney.co.in |

| Level 2 | 60 Hours | 22 Days | Name: Mr. Randeep Sond Designation: Associate Principal Partner |

Address: K-10, Tower SCO 22-23, Office no-403, Feroze Gandhi Market, Ludhiana – 141001 Email: randeep.sond@urbanmoney.co.in |

| Level 3 | 48 Hours | 14 Days | Name: Mr. Piyush Bothra Designation: Grievance Redressal Officer |

Address: 1st Floor, Tower A, M3M Urbana Business Park,Sector 67, near M3M Urbana, Gurugram, Haryana 122001 Email: piyush.bothra@squareyards.com |

Note: Any doubtful consumer can contact the TransUnion CIBIL (https://www.cibil.com/contact-us-faq). Urban Money will respond within the specified TAT upon receipt of your query or will inform you if additional time is required to address your concern.

Frequently Asked Questions (FAQs)

How do I raise a dispute for an error in my CIBIL Credit Information Report?

If you notice any error or discrepancy in your CIBIL Credit Information Report, you can reach out directly to TransUnion CIBIL – www.cibil.com/consumer-dispute-resolution to raise a dispute.

How do I withdraw my consent for my Credit Information Report?

To withdraw your consent, please email us at connect@urbanmoney.com . Once we receive your request, our team will review it and initiate the deletion of your Credit Information Report/consent within 7 days.

Quick Links

EMI Calculator

Eligibility Calculator

Top 10 Banks

Investment Options

Gold & Silver Rate

Home Loan By Other Banks

- Axis Bank Home Loan

- Bank of Baroda Home Loan

- HDFC Bank Home Loan

- ICICI Bank Home Loan

- Bajaj Finserv Home Loan

- Canara Bank Home Loan

- IndiaBulls Home Loan

- CITI Bank Home Loan

- Union Bank of India Home Loan

- DHFL Home Loan

- YES Bank Home Loan

- IndusInd Bank Home Loan

- Federal Bank Home Loan

- State Bank of India Home Loan

- IDFC FIRST Bank Home Loan

- Hero FinCorp Home Loan

- Punjab National Bank Home Loan

- IDBI Bank Home Loan

- Kotak Bank Home Loan

- Piramal Finance Home Loan

- Tata Capital Housing Finance Limited Home Loan

- HDFC Sales Home Loan

- Aadhar housing Finance Home Loan

- IIFL Finance Home Loan

- Clix Capital Home Loan

- Aditya Birla Finance Limited Home Loan

- Capital First Ltd. Home Loan

- Home First Finance Company Home Loan

- Capri Global Home Loan

- Reliance Capital Home Loan

- L&T Finance Home Loan

- SMFG India Credit Company Ltd Home Loan

- Indian bank Home Loan

- Bank of India Home Loan

- Edelweiss Financial Services Home Loan

- Bank of Maharashtra Home Loan

- Hero Housing Finance Home Loan

- Poonawalla Fincorp Limited Home Loan

- karnataka bank Home Loan

- DCB Bank Home Loan

- LIC Housing Finance Home Loan

- Punjab & Sind Bank Home Loan

- Punjab National Bank Housing Finance Home Loan

- Muthoot Finance Ltd Home Loan

- Ujjivan Small Finance Bank Home Loan

- karur Vysya Bank Home Loan

- Cholamandalam Finance Home Loan

- RBL Bank Home Loan

- Godrej Housing Finance Home Loan

- HSBC Home Loan

- Housing Development Finance Corporation Home Loan

- Vastu Housing Finance Home Loan

- Deutsche Bank Home Loan

Personal Loan By Other Banks

- Axis Bank Personal Loan

- Bank of Baroda Personal Loan

- HDFC Bank Personal Loan

- ICICI Bank Personal Loan

- Bajaj Finserv Personal Loan

- Canara Bank Personal Loan

- IndiaBulls Personal Loan

- CITI Bank Personal Loan

- Union Bank of India Personal Loan

- DHFL Personal Loan

- YES Bank Personal Loan

- IndusInd Bank Personal Loan

- Federal Bank Personal Loan

- State Bank of India Personal Loan

- IDFC FIRST Bank Personal Loan

- Hero FinCorp Personal Loan

- Punjab National Bank Personal Loan

- IDBI Bank Personal Loan

- Kotak Bank Personal Loan

- Piramal Finance Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- HDFC Sales Personal Loan

- IIFL Finance Personal Loan

- Clix Capital Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- Reliance Capital Personal Loan

- L&T Finance Personal Loan

- SMFG India Credit Company Ltd Personal Loan

- PaySense Personal Loan

- InCred Financial Services Personal Loan

- Indian bank Personal Loan

- Bank of India Personal Loan

- Edelweiss Financial Services Personal Loan

- Bank of Maharashtra Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- karnataka bank Personal Loan

- DCB Bank Personal Loan

- Punjab & Sind Bank Personal Loan

- FT Cash Personal Loan

- Muthoot Finance Ltd Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- AU Small Finance Bank Personal Loan

- karur Vysya Bank Personal Loan

- RBL Bank Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- HSBC Personal Loan

- MoneyWide Personal Loan

- Privo Personal Loan

- Prefr Personal Loan

- Bhanix Finance Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- Zype Personal Loan

- EpiFi Personal Loan

- Unity Small Finance Bank Personal Loan

- Deutsche Bank Personal Loan

Latest from the Credit Score Blog

Get in-depth knowledge about all things related to Credit Score and your finances

Is 750 a Good Credit Score? Benefits and How to Achieve It

Easy Ways to Achieve a Credit Score of 750 A credit score of 750 is considered very good. It helps you get loans easily with low interest rates. You must manage your credit well and follow good financial habits to achiev

CIBIL Score Check For Union Bank of India

How to Check Union Bank of India CIBIL Score Urban Money offers a simple method to check your Union Bank of India cibil score at no cost! Here’s how to check your credit score on Urban Money’s website: Visit the Urban M

How a Single Missed Payment Can Impact Your CIBIL Score

Short-Term Consequences of Defaulted Repayments Defaulting on a repayment can hurt your financial reputation and lead to several immediate effects. Here are a few short-term consequences that can happen if you miss a sin

How to Resolve CRIF High Mark Credit Report Errors

Common Errors Found in CRIF High Mark Credit Reports Here are the common errors found in CRIF High Mark credit reports: Closed Accounts Showing as Open: Accounts you have paid off may still appear open. This can affect

Why Checking Your CIBIL Score is Crucial Before Applying for a Loan

Understanding CIBIL Score A CIBIL score is a three-digit number that shows how responsible you are with money and credit. It ranges from 300 to 900, with a higher score meaning you handle credit well. Credit Information

How Gold Loans Affect Your CIBIL Score and Tips to Protect It

Does Taking a Gold Loan Affect Your CIBIL Score? The short answer is yes, it does. However, whether the impact is positive or negative depends entirely on how you manage your gold loan. When you take out a gold loan, you

Managing CIBIL Score and Financial Emergencies

Understanding CIBIL Score Basics A CIBIL score is a three-digit number between 300 and 900 that shows your creditworthiness. It is based on your credit history, which includes how you have handled loans and credit cards.

Role of CIBIL Score in Car Loan Approval and Terms

How CIBIL Scores Influence Car Loan Approval? The CIBIL score is a three-digit number that ranges between 300 and 900. A higher score indicates better creditworthiness and vice versa. Lenders typically prefer applicants

Kotak CIBIL Score: How to Check & Loan Requirements

How to Check Your Kotak CIBIL Score? Checking your CIBIL score regularly is crucial for maintaining a healthy credit profile. Here is a step-by-step details to checking your Kotak CIBIL score: Visit the Official CIBIL W

CIBIL Score for Car Loans: Top Picks for 2025

List of Best Car Loan in India 2025 Here are some of the best available car loan options in India with minimal interest rates and low processing fees: State Bank of India Car Loan SBI offers a fantastic deal to finance

Does Checking Your CIBIL Score Impact Your Credit Score?

Does Checking Your CIBIL Score Affect It? True or False? The short answer is false. Checking your CIBIL score is considered a soft inquiry and does not impact your credit score. People often get confused because they fai

How to Avoid Credit Repair Scams and Protect Your Credit Score

Understanding Credit Repair Scams Credit repair scams are traps set by individuals into luring you by offering you a magical solution that practically holds no meaning. They use sneaky tricks to make you believe they can

Difference Between Equifax & CIBIL Score

Equifax Vs CIBIL Understanding credit scores is paramount for securing loans and credit cards in India. Equifax and CIBIL (TransUnion CIBIL) are prominent players in this arena. While both provide credit information to l

How Student Loans Influence Your Credit Score

The Impact of Student Loans on Your Credit Score The impact of education loans on CIBIL scores can be positive and negative. As mentioned above, the outcome largely depends on managing your credits. For a more detailed i

How Bankruptcy Impacts Your Credit Score

Impact of Bankruptcy on Your Credit Score Here are the key aspects of how bankruptcy impacts on your credit score and beyond: 1. Significant Drop in Credit Score Your credit score takes a massive hit when you file for ba