Canara Bank Net Banking

Canara Bank net banking is an offered product for customers to carry out their transactions and other services from the comfort of their homes. It eliminates the need to go to the bank and stand in long queues. Established in 1906, Canara Bank is India’s fourth largest nationalised bank. Headquartered in Bangaluru, it is owned by the Ministry of Finance. This bank aims to provide its customers with excellent services reducing the hassle of offline banking operations.

This piece covers detailed information on the canara bank net banking registration and activation process, its features and benefits, the login process and more.

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Table of Content

Last Updated: 1 February 2026

Features Of Using Canara Bank Net Banking Facility

Net banking canara bank allows a user to conduct banking-related activities like making transactions, displaying account statements, checking mini statement, initiating service requests, etc., without going to the bank. The features of using the online personal net banking of canara bank are given as follows:

- It displays the account summary to keep track of any account-related activities.

- By logging in to their account, they can access the detail of the account

- It helps a user monitor the activity of their account, among other things

- It is a platform from which the user can avail of various services offered by the bank like fixed deposits, recurring deposits, loans, etc

- It can be used through any laptop or smartphone with an active internet connection

- It is a hassle-free tool that saves both time and money

- With access to the account details, the account holder can set their financial goals and design a plan to meet them accordingly.

- One can update their Aadhaar and PAN card details.

- It eases the payments of various utilities like electricity, water and landline bills.

- One can make transactions online through modes like IMPS, NEFT and RTGS

Canara Bank Net Banking Registration Process Step by Step Guide

Net banking is the most convenient service made available by the bank. One needs to register to avail of this service. The below-mentioned steps will guide you on how to get registered for Canara Bank net banking activation.

-

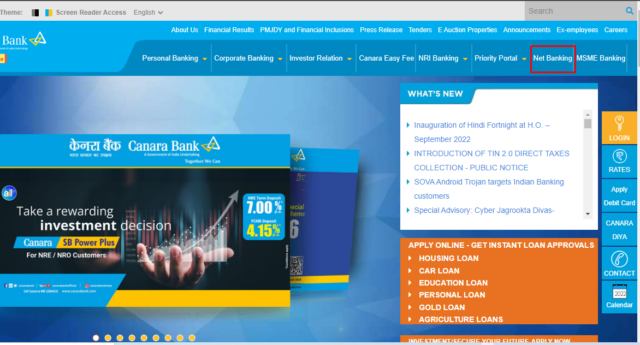

- Visit the official website of Canara Bank.

- Select the ‘Net Banking’ option on the right-hand side of the page.

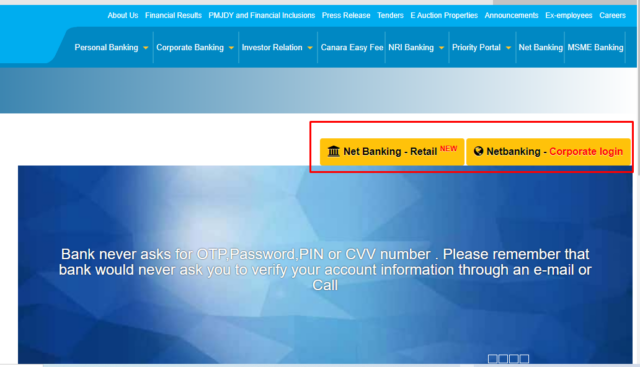

- The new window will display two options – ‘Net banking – Retail’ and ‘Net Banking – Corporate’. Select the option you wish to register.

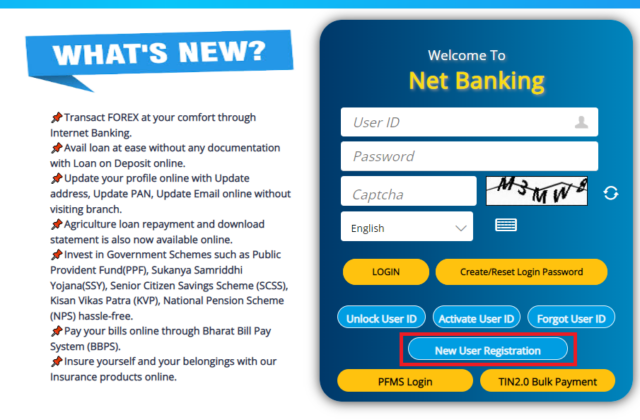

- Select ‘New Registration’, and a new page will pop-open.

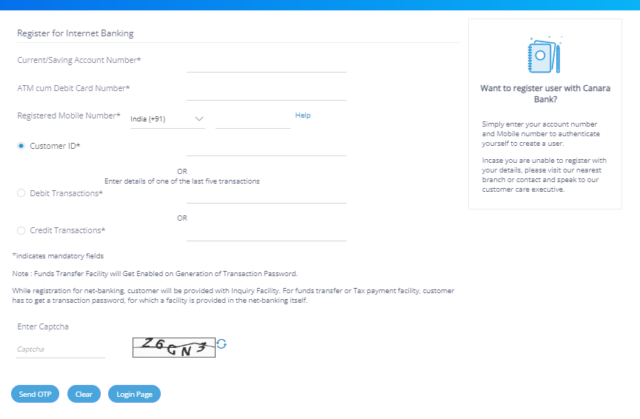

- It is advised to read the terms and conditions of the bank’s net banking service before clicking on ‘Submit.’

- The next window will ask you to enter details like savings/current account number, customer ID, ATM or debit card number, and the mobile number registered with the bank.

- Once satisfied with entered details, click on ‘Submit’ and choose the type of access of the net banking you desire.

- Click on ‘I Agree

- You have registered and can now log in using your Canara Bank net banking user ID.

How to Login to Canara Bank Net Banking?

Canara Bank net banking login can be done once you register for it. The steps to be followed to log in to net banking canara bank are given below:

- Look up the official website of the Canara Bank

- On the right panel of the homepage, click on the ‘Net Banking’ option.

- You can choose between the two options on screen – ‘Net banking – Retail’ and ‘Net Banking – Corporate.’

- Upon selection, a new window will open up, upon which you will have to enter your Canara Bank net banking user ID

- Enter your password and captcha code displayed on the screen

- You must opt for the preferred language and proceed with ‘Sign in.’

If you have forgotten your user ID, click on ‘Forgot User ID and click on ‘Unlock User ID’ if the user ID is locked.

How to Check Account Balance Through Canara Bank online Banking

To check your account balance through Canara Bank net banking, follow the below-mentioned steps:

- Log in to your Canara Bank net banking account on the bank’s official portal

- Go to the ‘Account Details’ corner. This will display the details of your savings/current/recurrent deposit/overdraft account. Your account balance will be displayed here as well.

How to Transfer Funds Through net Banking Canara Bank

Canara Bank net banking allows users to transfer funds using online methods like NEFT, RTGS or IMPS. To transfer funds using the bank’s net banking facility, you must adhere to the following steps:

Transfer Funds to Own

This transfer allows you to transfer funds between your Canara Bank accounts.

- Choose “Funds Transfer.” The choice is accessible from the Funds Transfer menu.

- Funds Transfer is displayed on the next page. In this instance, by default, the source account number and destination account number will match.

- Change the source account number.

- Alter the target account number.

- The source and destination account numbers cannot be the same in this scenario. If they are the same, your system will display an error message.

- Enter the amount you want to transfer in the following step. The amount you enter must be greater than or equal to the balance amount shown by the system.

- Select “Transfer” from the menu. Your transaction password must be entered twice on the subsequent transaction password screen.

- Double-click your current transaction password. Make sure you do it correctly. Simply press the “Submit” button.

- An “Invalid PIN” notice will appear if your transaction password is wrong.

- The system will then display a Funds Transfer screen for verification. You must double-check all the information in this stage and press the “Confirm” button.

- Your system will then show a transfer confirmation screen with information such as the transaction confirmation number, the date the transfer was received, and so forth.

- The transaction number should be noted for future use.

Transfer to Third Party

This transfer allows you to transfer funds to an account registered with a bank other than Canara Bank.

- Pick the option labelled “Funds Transfer” from the Funds transfer menu.

- The page that follows will show the Third-Party Funds Transfer screen. Your account number is used as the source account number here.

- To select the beneficiary you wish to send money to, click the dropdown menu next to the beneficiary box.

- The destination account number will be presented immediately if you select a beneficiary.

- Choose the ‘others’ option from the drop-down menu and type the desired account number to add a beneficiary.

- Enter the required amount of the transfer after that. The amount you enter must be greater than or equal to the balance amount shown by the system.

- The transfer description should be entered next.

- Select “transfer” from the next step’s buttons to complete the transaction.

- The following page will provide a screen for a Funds Transfer verification. Before clicking the “Confirm” button, you must double-check all the information on this page.

- The system will then display the transaction password screen once this is finished. The transaction password must be entered twice in this area.

- Click on “Submit” after entering the password twice.

- The transaction confirmation page, which contains details such as the name of the destination account holder, the transaction confirmation number, the amount transferred, and other information, will be displayed after the transaction has been completed.

Transaction Limit for Canara Bank Internet Banking

The transaction limit for Canara Bank mobile net banking is given below:

- Real Time Gross Settlement (RTGS) – Minimum limit of INR 2 lakhs

- National Electronic Funds Transfer (NEFT) – No minimum or maximum limit

- Immediate Payment Services (IMPS) – Maximum limit of INR 5 lakhs

How to Generate Customer ID for net banking Canara Bank?

You can find the whereabouts of your Canara bank customer ID from the bank’s passbook. In case you do not have the passbook, then you can generate your user ID through the following method:

- Click on Forgot User ID

- You will be redirected to a new window where you will be required to enter your customer ID and registered mobile number.

- You will receive your user ID.

How to Reset Forgotten Canara Bank Net Banking Password?

Canara Bank net banking activation leads to quick funds transfer. You can log in to your account by entering your user ID and password. If you seem to have forgotten your password, Canara Bank allows you to reset it once you follow the below-mentioned steps:

- Visit the portal of Canara Bank and select the ‘Net Banking’ option

- Opt for the ‘Forgot Password option

- The new page you will be redirected to will ask you to enter your aadhaar number, PAN, linked debit card and passport number.

- Enter your account number and the new password

- Enter to confirm the new password and proceed by clicking on ‘Submit.’

- Your new password will be generated

Service Requests

Apart from allowing a customer to make quick transactions and access their account details, Canara bank net banking offers various services:

- Opening account online

- Check account balance

- Make payments of bills, taxes and Sukanya Samriddhi

- Enquire about the status of cheque book, TDS, forex rate

- Access to Public Financial Management System (PFMS)

- Online Trading

- Manage debit and credit cards

- Display mini and detailed bank statements

- Start investment journey

- Update KYC

- Procure insurance

- Transfer funds

- Contact customer care or relationship manager

- Apply for various government schemes

- View the history of transactions

- View e-tax challans

- Manage accounts

FAQ's About Canara Bank net banking

How do I know if I am eligible for net banking services?

You are eligible for net banking services in the bank you have an account with.

Who is eligible to register for Canara Bank Net Banking?

If you have an account with Canara Bank. You will have to register for the net banking facility.

Are any charges applicable for using the Net Banking facility?

No charges are applicable for the use of the net banking facility.

I want to begin using Net Banking. How do I obtain my User ID and Password to login into my account?

The bank passbook contains your customer ID through which you can generate your User ID and password.

Is the Canara Bank Net Banking facility available for use by Non-Resident Indians (NRIs)?

Yes, the Canara Bank Net Banking facility is available for use by Non-Resident Indians (NRIs). However, they must have an account with the bank.

I have two accounts maintained in two branches of the bank. Can I have two user IDs for internet banking?

Yes, you can have two user IDs for internet banking if you have two accounts maintained in two bank branches.

What other services can I avail of on the Canara Bank Net Banking portal?

Canara Bank’s net banking portal allows you to carry out all banking-related activities from the comfort of your home or office.

What is the URL for New Internet Banking?

Canara banks Users can access New Internet Banking from the URL: https://online.canarabank.in/

Whether the User ID and Passwords will change for the New Internet Banking?

No Need to change in USER ID & PASSWORD and the Existing Credentials should be used to Login to New Internet Banking.

I have never used Canara bank Internet Banking. Will I be able to register now?

Yes, you can register yourself online as a new user by visiting official site and using the Option “New User Registration”.

Is there any difference between Canara bank Customer ID & Internet Banking User ID?

Canara bank Customer ID is unique identification number provided by the Bank to identify a particular customer. Internet Banking User ID is provided by the Bank to the Customer for accessing Internet Banking Application. In some cases both Customer ID and Internet Banking User ID can be same.

My Canara bank User ID is Locked. How do I Unlock it?

Use the “Unlock User ID” option available on the website Login page for Activating the User ID. For Activating your User ID you should have your Internet Banking User ID, DOB, Any one of (PAN Number, Passport Number, AADHAR Number, Valid Debit Card Number) and