Top 10 Best Private Banks in India List 2025

January 09, 2025

CERSAI charges are fees you pay when taking a home loan to register your property with the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). This helps prevent fraud and ensures your loan details are transparent. For instance, if you get a home loan from SBI,…

Home Loans offer many attractive features. Unlike other types of loans, they feature lower interest rates, longer repayment terms, moderate eligibility criteria, and associated tax benefits. Though home loan borrowers know these benefits, many buyers doubt whether tax benefits on such loans are allowed if taken for the second time.…

It is important for anyone considering obtaining a home loan in India to be informed about the Prime Lending Rate (PLR) and other benchmark rates, such as the MCLR, Base Rate, and Repo Rate. Because they determine the interest rates on various loans, these rates have a big influence on…

With numerous extra charges and long documentation processes, getting a home loan to build your dream house can be daunting. However, with proper preparation and deep knowledge of all property-related expenses, you can avoid getting into trouble due to a lack of appropriate documents. Many people confuse stand-duty charges with…

A loan from any institution is a significant financial move that can affect you and your loved ones. While many banking institutions advertise a provisional interest rate on the borrowed amount, an Annual Percentage Rate helps discover the true expenditure and various annual charges. This amount enables you to budget…

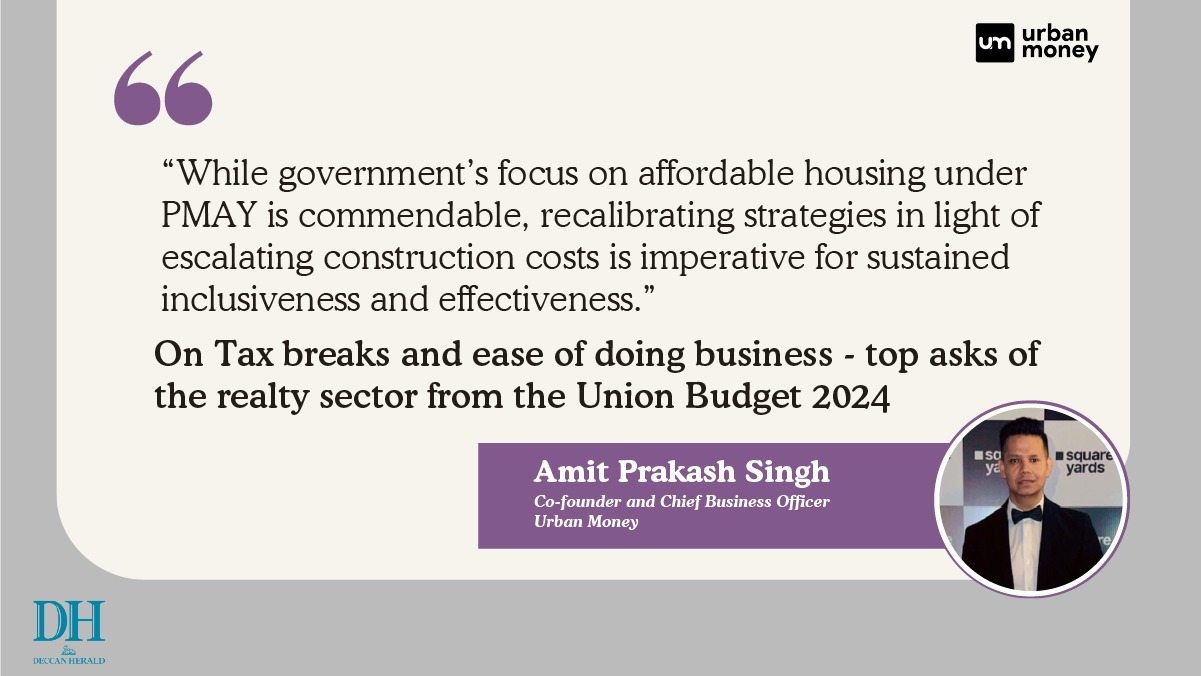

The real estate market eagerly awaits the 2024 budget announcements to revitalise affordable housing. In the interim budget presented in February earlier this year, Finance Minister Nirmala Sitharaman outlined the government’s plans to make homeownership more accessible and alleviate the middle class’s concerns. The budget included extensions of existing schemes…

To safeguard home buyers' interests, the Real Estate Regulation and Development Act was adopted in 2016. Additionally, it encourages the growth of the real estate sector by guaranteeing complete openness. All areas of the country's real estate market are governed and regulated under the RERA Act. Nonetheless, each state has…

Buy Now Pay Later or BNPL is a payment method that allows an individual to make a payment without actually paying for it. The payer can avail of this revolutionary service by signing up for a company offering BNPL. They will be required to pay the borrowed amount within an…

Clear land titles refer to the legal ownership of a piece of land with no pending disputes or litigation related to the property. For home loan applicants in India, clear land titles are of utmost importance as it is one of the essential factors that lenders consider when approving a…

Indian borrowers can opt from a wide range of Home loan products available to raise funds for real estate acquisition. The loan recipient must meticulously research the wide range of products available to get the best possible deal in the market. Or you can refer to this piece to thoroughly…

Top 10 Best Private Banks in India List 2025

January 09, 2025

Top10 List of Petrol Pump Companies in India

January 09, 2025

Dairy Farm Loan in 2025 : Online Procedure

January 09, 2025

Top 10 Best Bank for Home Loan In India…

January 09, 2025

Top10 Best Student Credit Cards in India 2025

January 09, 2025

© 2026 www.urbanmoney.com. All rights reserved.

Need Loan Assistance?