- Home

- Personal Loan

- ICICI Bank Personal Loan

ICICI Personal Loan

Unlock Best Personal Loan Offers From Icici Bank

ICICI Bank Personal Loan

Interest Rate

10.45% - 16.5%

Loan Amount

₹2.5L - ₹50L

EMI Per Lakh

₹2,147 - ₹2,458

Processing Fees

Pre-Payment Charges

- 3% plus applicable taxes on principal outstanding after payment of 1st EMI and Nil if 12 or more EMIs are paid. For MSE classified customers, charges are Nil after payment of the 1st EMI for Loan amount upto 50 lakhs.

For salaried customers

Why Opt for an ICICI Bank Personal Loan?

A personal loan from ICICI Bank is favored for its flexible terms, attractive interest rates, swift digital application, and minimal paperwork, providing hassle-free funding for diverse financial needs.

Key Advantages

- Has no restriction on the way funds are used.

- Collateral security is not required to avail the loan.

- Rapid loan disbursal process.

- Fixed ICICI Bank Personal Loan interest rate.

- Offers flexible loan repayment tenure.

- Minimum documents required for ICICI Bank Personal Loan.

- Easy ICICI Bank personal loan requirements.

ICICI Bank provides convenient repayment options, featuring competitive personal loan interest rates and easy eligibility criteria.

- ICICI instant personal loans start at {pl_icici-bank} per annum.

- ICICI Bank has no restrictions on the way funds are used.

- Minimum documents are required with the fast processing of the application.

ICICI Personal Loan Fees and Charges

| Credit Type | Loan Charges Applicable |

| Personal Loan Interest Rates | 10.75% per annum to 19% per annum |

| Charges for Loan Processing Charges or Origination (Non-Refundable) | Up to 2.50% of total loan amount + GST |

| Charges for Prepayment | 5% on principal outstanding plus GST (for salaried customers) |

| Nil, if loan is closed using own funds (MSME classified customers) | |

| Additional Interest on late payment | 24% per annum |

| Charges for Repayment Mode Swap | ₹500 per transaction plus GST |

| Charges for Loan Cancellation | ₹3000 plus GST |

| Charges for EMI Bounce | ₹400 per bounce plus GST |

Types of Personal Loans by ICICI Bank

ICICI Bank provides a diverse range of personal loan schemes tailored to meet various financial needs. These personal loans cater to different situations such as personal expenses, business needs, and special circumstances. Below is an overview of the types of personal loans offered by ICICI Bank:

-

NRI Personal Loan: Designed to meet the financial requirements of Non-Resident Indians with easy documentation and faster processing.

-

Top-Up Loan: Allows existing ICICI Bank personal loan customers to avail additional funds quickly and easily to address their evolving financial needs.

-

Balance Transfer: Lets customers transfer existing personal loans from other banks or NBFCs to ICICI Bank to benefit from lower interest rates.

-

New Personal Loan: Available to salaried and self-employed individuals by providing personal and professional information and selecting a suitable loan amount.

-

Fresher Funding: Supports new employees and fresh graduates with personal expenses by offering loans up to ₹1.5 lakh without hassle.

-

Pre-Qualified Loan: Offers quick personal loans online with a simplified application process and faster approval.

-

FlexiCash: A short-term overdraft facility for ICICI Bank salary account holders to cover unexpected expenses with quick access to funds.

-

Business Loan: Similar to a personal loan but customized specifically for business or company requirements.

-

Pre-Approved Loan: Selected customers can enjoy instant personal loans with disbursal within seconds, ensuring immediate financial support.

Apart from these options, ICICI Bank also provides a variety of personal loan schemes designed to suit different needs and situations, Check Now!

Documents Required for ICICI Bank Personal Loan

Both salaried and self-employed individuals need to furnish the documents required for ICICI Bank Personal Loan. Both the documents for salaried and self-employed are mentioned in the sections below.

| Document Category | Salaried Individuals | Self-Employed Individuals |

|---|---|---|

| Proof of Identity | PAN Card, Aadhaar, Passport, Driving Licence, Voter ID | Same as salaried |

| Proof of Address | Recent utility bills (within 3 months), Passport, Lease Agreement | Same as salaried |

| Income Proof | Last 3 months’ salary slips | Audited financials for last 2 years |

| Bank Statements | Last 3 months (showing salary credits) | Last 6 months |

| Business Proof | Not required | Office address proof, ownership documents, business continuity |

| Photographs | 2 passport-sized photos | 2 passport-sized photos |

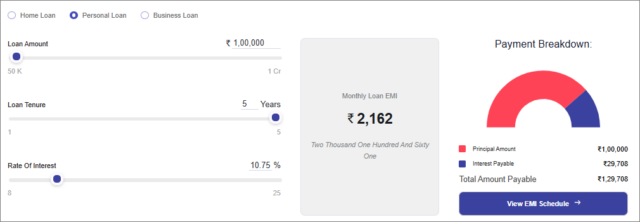

How is the EMI Calculated for ICICI Bank Personal Loans?

If you take out a personal loan for a certain length of time, the EMI (Equated Monthly Instalment) is the monthly payment. Throughout the loan term, the EMI amount will be used to pay down both the Principal Loan Amount and the Personal Loan Interest until the loan is paid in full. The EMI will remain the same throughout the duration of the contract.

Let’s say Mr. Sharma needs ₹1,00,000 personal loan for some urgent expenses. He applies for a personal loan from ICICI Bank at an interest rate of 10.75% per annum and wants to repay it over 5 years.

Using the EMI calculation, his monthly payment will be around ₹2,162.

This fixed monthly EMI includes both the repayment of the ₹1,00,000 loan amount and the interest charged by the bank.

Over 5 years, Mr. Sharma will pay a total of about ₹1,29,708, which includes ₹29,708 as interest.

Knowing his EMI upfront helps Mr. Sharma budget his monthly expenses with confidence, ensuring he never misses a payment while clearing his loan comfortably within the tenure

How to Check and Apply for Instant Personal Loan Online from ICICI Bank

Here’s a simple step-by-step guide on how to check and apply for an instant personal loan online with ICICI Bank:

- Login – Access your account via ICICI NetBanking or iMobile Pay app.

- Navigate to Loans Section – Go to the Personal Loan option.

- Choose Loan Amount & Tenure – Select the loan amount and repayment period as per your needs.

- Review Offer – View applicable interest rate, EMI, and processing charges.

- Submit Application – Complete the process by uploading KYC and income documents.

- Instant Disbursal – Get funds credited instantly to your ICICI Bank account (for pre-approved customers).

How to Apply for ICICI Personal Loan Online via Urban Money

Apply for an ICICI Personal Loan online via Urban Money in just 3 simple steps – fill a quick form, verify your details instantly, and get expert loan assistance for fast approval and disbursal.

-

Fill a Quick Online Form

Enter your name, mobile number, city, and basic loan details. -

Get Verified Instantly

Our system checks your eligibility and verifies your contact details in seconds. -

Receive Loan Assistance

Get a call from Urban Money Loan Experts within 24 hours to guide you through the ICICI Bank personal loan process.

FAQs

From loans to affordable interest rates, we have the answers for everything you need to know.

Can I switch to a floating rate from a fixed rate during my loan tenor?

ICICI Bank offers a fixed ICICI Bank Personal Loan interest rate which is less likely to be converted into a flexible one. But if you have a good relationship with the bank, you can talk it out with the representatives.

Is opting for an ICICI Bank Personal Loan worth It?

A personal loan is a beneficial choice when you are lacking funds in some cases, such as a home renovation, trip with family, unexpected medical conditions, etc. Hence, the personal loan is a worthy choice to consider.

What is the minimum salary for an ICICI Bank Personal Loan?

The minimum salary of an individual should be ₹30,000 to avail a personal loan from ICICI Bank.

Does ICICI Bank have a fixed rate of interest on a personal loan?

Yes, ICICI Bank personal loan interest rate is a fixed value that starts from 10.5% per annum and can go up to 19% per annum, depending upon loan amount, tenure, the profile of the applicant, etc.

How to check personal Loan Status in ICICI Bank?

You can check your personal loan status through the loan application reference number on the official website of ICICI, calling the customer care services or by visiting the nearest ICICI Bank.

Does ICICI Bank Checks for CIBIL Score for Personal Loan?

CIBIL/Credit score is an important contributing factor that ICICI Bank considers. This score helps them to know the creditworthiness of the applicant and his capacity to repay the loan.

What is the maximum and minimum personal Loan amount I can get from ICICI Bank?

ICICI Bank offers loan amounts ranging from ₹50,000 up to ₹20 lakhs.

Quick Links

Loan Offers By Icici Bank's

Personal Loan by Nationalized Bank

Personal Loan by Private Bank

- RBL Bank Personal Loan

- Unity Small Finance Bank Personal Loan

- DCB Bank Personal Loan

- Reliance Capital Personal Loan

- Federal Bank Personal Loan

- karnataka bank Personal Loan

- IDBI Bank Personal Loan

- Kotak Bank Personal Loan

- HDFC Bank Personal Loan

- YES Bank Personal Loan

- CITI Bank Personal Loan

- HDFC Sales Personal Loan

- IndusInd Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- HSBC Personal Loan

- Axis Bank Personal Loan

- karur Vysya Bank Personal Loan

Personal Loan by NBFC

- Bhanix Finance Personal Loan

- Prefr Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- Hero FinCorp Personal Loan

- Capital First Ltd. Personal Loan

- Zype Personal Loan

- FatakPay Personal Loan

- Clix Capital Personal Loan

- PaySense Personal Loan

- DHFL Personal Loan

- MoneyWide Personal Loan

- AU Small Finance Bank Personal Loan

- FT Cash Personal Loan

- Edelweiss Financial Services Personal Loan

- Muthoot Finance Ltd Personal Loan

- InCred Financial Services Personal Loan

- SMFG India Credit Company Ltd Personal Loan

- IndiaBulls Personal Loan

- IIFL Finance Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- Piramal Finance Personal Loan

- EpiFi Personal Loan

- L&T Finance Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- Bajaj Finserv Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- Privo Personal Loan

- Loantap Credit Products Private Limited Personal Loan

Personal Loan Calculators

Latest from the Personal Loan Blog

Get in-depth knowledge about all things related to Personal Loan and your finances

Education Loan Eligibility in India: Criteria, Documents & Mistakes to Avoid

Education loan eligibility is important for students and parents who want to fund higher education without financial stress. With rising education costs, understanding the eligibility criteria for edu

Reasons For Personal Loan Rejection

Applying for a personal loan can be a tough and slow process. This is especially true when you really need money. A personal loan can help cover unexpected expenses, fund a big purchase, or consolidat

Cost to Company (CTC)

When considering a job offer, it’s easy to become fixated on the attractive “CTC” figure. But there’s more to this figure than strikes the eye. Realising the value of CTC requires going beyond its ini

EMI: Meaning, How It Works, Calculation Method, Benefits & Drawbacks

EMIs have become one of the most common forms of payment for any financial obligation, from college fees to purchasing a new phone. This fixed monthly amount saves lakhs of citizens annually by preven

Top 10 Best Private Banks in India List 2025

Today, the banking system incorporates 21 private banks in India along with 12 public sector banks, foreign banks, rural banks, cooperative banks, and financial institutions. In total, the retail cred