- Home

- Personal Loan

- Hdfc Bank

- HDFC Personal Loan Eligibility Calculator

HDFC Personal Loan Eligibility Calculator

The HDFC Bank Personal Loan Eligibility Calculator is an online tool that assists individuals in determining their maximum loan amount when applying for an HDFC Bank Personal Loan. The calculator instantly calculates your maximum loan amount and eligibility by inputting personal facts such as age, annual income, existing debt, and other considerations. It also includes information on the associated interest rates, repayment time, processing fees, and other costs. The HDFC personal loan eligibility calculator is a simple tool for understanding and comparing different loan possibilities, making it easier to apply for the loan that best matches your needs.

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Last Updated: 27 December 2025

HDFC Bank Personal Loan Eligibility Calculator – Key Features & Benefits

The personal loan eligibility HDFC has many unique features and benefits other than the simple and user-friendly interface. The features and benefits that add to the tool’s smugness are given below:

If the loan calculator indicates that you are ineligible, you can work on the loan requirements to become eligible.

- The AI-powered tool allows you to quickly determine your eligibility with one or more lenders, saving you time and energy.

- HDFC PL eligibility calculator makes it simple to calculate and provides an accurate review and calculation.

- This application is accessible to anyone with minimal computing skills.

- The calculator does not require a large quantity of data to return appropriate responses to the user.

- It is easier to understand what is going on when data is displayed. Visual representations will help calculator users.

- Users can utilise this artificial intelligence-powered tool as many times as they like till they are happy.

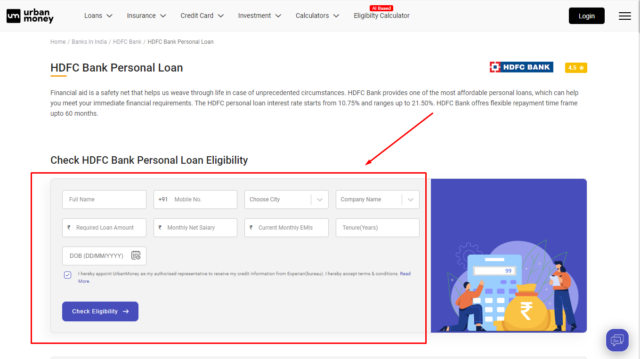

How to use HDFC Bank Personal Loan Eligibility Calculator?

The HDFC personal loan eligibility calculator simplifies the task of performing an HDFC personal loan eligibility check. This step becomes mandatory so as to be best prepared for the loan amount you can get. The following steps must be followed to use the HDFC PL eligibility calculator.

- Visit Urban Money’s official website.

- Choose “Loans” first, followed by “Personal Loan.” The horizontal menu bar on the home page contains these settings.

- You will be taken to the “personal loan page,” which includes a ranking of the largest banks and NBFCs in India.

- To find “HDFC,” scroll down. This will land you on “HDFC Bank Personal Loan” page.

- The calculator will show up under the phrase “Check HDFC Bank Personal Loan Eligibility.”

- Enter the required data, including your name, phone number, city, desired loan amount, desired loan tenure, etc.

- Click on the “Check Eligibility” button to proceed further.

- A 6-digit OTP will be sent to the phone number you previously provided within a minute.

- After entering the OTP, click “Submit.”

- The total amount that is available from the bank will be swiftly displayed by the calculator. You may see the result along with the interest rate, term, EMI, and overall cost.

- Additionally, select “Apply Now” to submit an application for a HDFC home loan. Alternatively, you can research and contrast offers from lenders other than HDFC by clicking “View All Offers”.

HDFC Bank Personal Loan Eligibility Criteria

It is evident to know the personal loan eligibility HDFC before applying for it. This step does not save you from heartbreak but also lets you plan your finances accordingly. The following is the personal loan in HDFC bank eligibility criteria.

HDFC Bank Personal Loan Eligibility Based on Salary

The applicant must be:

- A salaried employee at a few selected public sector undertakings (including central, state and local bodies) and private limited companies

- Between the age of 21 and 60 years

- Having a minimum experience of 2 years, however, a minimum of one year should be with the current employer.

- Having Rs. 25,000 and Rs. 50,000 as minimum net monthly income for HDFC Bank salary account holders and non-HDFC Bank Salary Account holders, respectively.

Special HDFC Bank Personal Loan Eligibility for Women Applicants

The applicant must be:

- A salaried employee at a few selected public sector undertakings (including central, state and local bodies) and private limited companies

- Between the age of 21 and 60 years,

- Having a minimum experience of 2 years, however, a minimum of one year should be with the current employer,

- Having Rs. 25,000 and Rs. 50,000 as minimum net monthly income for HDFC Bank salary account holders and non-HDFC Bank Salary Account holders, respectively.

- A woman.

List of Factors Affecting HDFC Bank Personal Loan Eligibility

There are numerous factors that affect a borrower’s personal loan eligibility HDFC. A few of these factors can be understood below.

Credit Score

Your credit score is an important consideration when checking personal loan eligibility HDFC. A better credit score is regarded by banks as an indication of creditworthiness. This has a significant impact on your loan amount and interest rate eligibility.

Income

A larger income ensures that the loans are paid on time. Banks provide better loan amounts and rates to customers with higher incomes. HDFC Bank prefers salaried employees because their monthly salary swores to monthly EMI.

Employer

Working for a reputable company will earn you a good deal on the HDFC personal loan. When approving a loan, many banks consult a list of accredited employers and trustworthy companies. Employment in these industries ensures job security and a steady supply of money to lenders.

Age

During the personal loan application procedure, the applicant’s age is quite crucial. The borrower’s age determines how long he has to repay the loan. Loan amounts and interest rates are granted to younger-generation applicants as opposed to older candidates.

Relationship with the Bank

Priority is frequently given to long-term banking customers since their credit history is more easily accessible. If you are a current HDFC Bank customer, the bank can verify your account record, any recent credit transfers, and your overall financial situation. As a result, current customers receive preferred interest rates on personal loans.

How can you Improve your HDFC Bank Personal Loan Eligibility?

Your recent HDFC personal loan eligibility check got you worried? Take a deep breath and read these tips to improve your HDFC bank personal loan eligibility. Maybe put in a swish and a flick with the charms.

- Good credit repayment habits may greatly increase your loan eligibility.

- Longer-term loans allow the borrower to repay it over a more extended period of time. This raises the possibility of repaying the personal loan on schedule.

- Before asking for a new personal loan, it is always a good idea to pay off any previous debts.

- Ensure that you have a good payback history by making EMI payments on time.

- Use the HDFC bank personal loan eligibility calculator on a regular basis to see where you fall short.

- Another approach for increasing your HDFC bank personal loan eligibility is to give verification of your variable income together with your fixed income documents.

Understanding the Impact of Credit Score on HDFC Bank Personal Loan Eligibility

HDFC Bank, India’s largest private sector bank, considers credit score to be one of the most important variables in determining a prospective borrower’s eligibility for a personal loan. A good credit score displays the borrower’s creditworthiness and shows the bank that the borrower is capable of repaying the loan amount on time. A higher credit score ensures eligibility for cheaper interest rates, a more significant loan amount, and faster loan approval. You will be able to negotiate better conditions if you have a good CIBIL score.

In brief, if you have a good CIBIL score, you will be regarded as a reliable borrower and will possess HDFC bank personal loan eligibility with advantageous terms. Maintain a high score at all times.

More Resources for HDFC Bank

People Also Asked

How much salary is eligible for a personal loan in HDFC Bank?

A salary of Rs. 25,000 is eligible for a personal loan in HDFC Bank.

What is the minimum CIBIL Score for an HDFC Bank Personal Loan?

The minimum CIBIL score for an HDFC personal loan is 640 and above.

Do I need to be an existing customer of HDFC Bank to get their personal loan?

No, there is no compulsion to be an existing customer of HDFC Bank to get their personal loan. However, you enjoy the benefits of the doubt as an existing customer.

Will my income ensure my eligibility for an HDFC Bank personal loan?

Income is one of the factors that influences the eligibility for personal loans with HDFC Bank.

How can I increase my eligibility for a higher HDFC Bank personal loan amount?

You can increase your eligibility for a higher HDFC Bank personal loan amount by improving your credit score, making timely repayments, and paying off existing debts.

Quick Links

Loan Offers By Hdfc Bank's

Personal Loan Calculators

Hdfc Bank Calculators

Bank wise Personal Loan Calculators

- Canara Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Indiabulls Personal Loan Calculator

- Muthoot Finance Ltd Personal Loan Calculator

- Paysense Personal Loan Calculator

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator