- Home

- Personal Loan

- Axis Bank

- Axis Bank Personal Loan Eligibility Calculator

Axis Bank Personal Loan Eligibility Calculator

The Axis Bank Personal Loan Eligibility Calculator is a valuable tool provided by Urban Money, one of India’s prominent loan advisor, to help individuals determine their loan eligibility for Axis Bank personal loans. Namely, this calculator aids in computing an estimated loan amount an individual could be eligible for, the anticipated monthly EMI you are supposed to pay, the total loan tenure you can avail of, and the applicable interest rate. All you need to do is enter some basic information about your financial details; in a jiffy, the calculator will display the result.

Hereunder, Urban Money presents a detailed view of the Axis Bank loan eligibility calculator. We will discuss its key features, benefits, how to use it, and other pertinent details regarding Axis personal loans. Moreover, in this all-in-one guide, we offer information such as Axis personal loan eligibility criteria, factors that influence those criteria, how to improve your eligibility if you fall short of the minimum criteria, and more.

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Last Updated: 14 December 2025

Axis Bank Personal Loan Eligibility Calculator – Key Features & Benefits

Following are some of the key features and benefits of the Axis personal loan eligibility calculator:

Completely Digital

You can easily access the Axis Bank personal loan eligibility calculator through the official Urban Money website anytime and from anywhere. Namely, with this all-in-one website, you can check your eligibility, compare different options, and apply for the most cost-effective home loan. By doing so, you are no longer required to visit the bank branch occasionally and then eliminating any time or geographical limitations.

Comparison Capabilities

This remarkable feature allows you to compare different personal loan options that Axis Bank offers. Specifically, using the Axis personal loan eligibility calculator, you can compare interest rates, EMIs, loan tenure, and other relevant parameters across a diverse range of loan products you might qualify for from Axis Bank. This ultimately empowers you to pinpoint the most cost-effective option, perfectly aligned with your unique financial situation and needs.

Ultimately Handy

Axis Bank loan eligibility calculator is renowned for its easy-to-understand UX design. I.e., instead of presenting a tedious description in a textual format, this handy tool employs a more visually engaging interface to display information. As a result, with a quick glance, you can easily perceive your current financial status regards your personal loan eligibility.

Real-Time Updates

Axis Bank personal loan eligibility check calculator is regularly updated with real-time data. This ensures you can perform calculations based on the most up-to-minute parameters, enhancing accuracy and relevance. By doing so, you can ultimately avoid rejecting your loan application, as it provides a clear understanding of your eligibility.

How to use Axis Bank Personal Loan Eligibility Calculator?

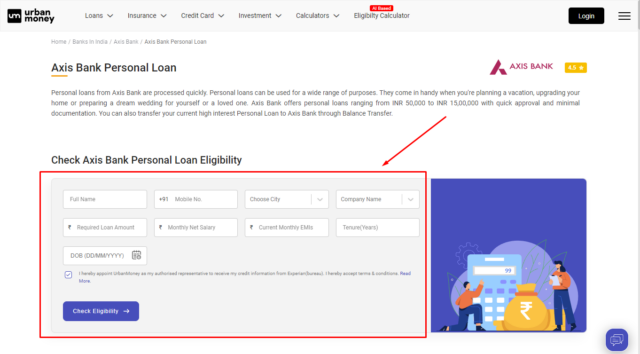

To use the Axis Bank loan eligibility calculator, follow these simple steps:

- Visit the official website of “Urban Money.”

- Click on the “Loans” option and “Personal Loan.” You can locate these options from the horizontal menu bar of the home page.

- You will be redirected to the “personal loan page,” where you can find an array of leading banks and NBFCs in India.

- Scroll down and select “Axis Bank.” This will redirect you to a new page which is “Axis Bank Personal Loan“.

- The calculator will appear under the title “Check Axis Bank Personal Loan Eligibility”.

- Enter the required information, such as your name, phone number, city, desired loan amount, loan tenure, etc.

- Tap the “Check Eligibility” button.

- Within a minute, you receive a 6-digit OTP to the phone number you entered before.

- Enter the OTP and click “Submit.”

- The calculator will quickly show your eligible loan amount from the bank and the interest rate, tenure, monthly EMI, and other pertinent details.

- Furthermore, click the “Apply Now” button to apply for the loan. Alternatively, click “View All Offers” to explore and compare offers from other prominent lenders in India.

Axis Bank Personal Loan Eligibility Criteria

Axis Bank provides an array of personal loans tailored to various individuals and occupations. These loans can be categorised into four types: personal loans for salaried individuals, personal loans for self-employed individuals, personal loans for non-resident Indians, and personal loans for women applicants. Let’s examine the eligibility criteria for each category:

Axis Bank Personal Loan Eligibility Based on Salary

The following are the Axis Bank personal loan eligibility criteria for salaried individuals:

- The applicant must be a salaried individual, such as a salaried doctor, an employee of public or private limited companies, or a government sector employee.

- The applicant must be between 21 and 60 years of age at the time of maturity of the loan.

- The minimum net monthly income of the applicant should be Rs. 15,000.

- The applicant must have a good credit score and a stable employment history.

- The applicant should be an Indian resident.

Axis Bank Personal Loan Eligibility Criteria for Self-Employed Individuals

The following are the Axis Bank personal loan eligibility criteria for self-employed individuals:

- The applicant should be a self-employed individual/professional or businessman.

- The applicant must be at least 21 years old when applying and not more than 60 years old at the loan’s maturity.

- The applicant must have a minimum business history of 5 years.

- The applicant should have a minimum credit score of 750 and above.

- The applicant should be an Indian resident.

Axis Bank NRI Personal Loan Eligibility: Requirements for Non-Resident Indians

The following are the Axis Bank personal loan eligibility criteria for NRI individuals:

- The applicant must be a Non-Resident Indian (NRI), a Person of Indian origin (PIO), or an Overseas Citizen of India (OCI).

- The applicant must be at least 24 years old and not more than 60 years old or retirement age (whichever is earlier) at the time of loan maturity.

- The applicant must have a minimum monthly income of USD 1,000 or equivalent in other currencies.

- Minimum Total Work Experience: 2 years, including at least 1 year with the current organization.

- The applicant must have a good credit score and a stable employment history.

- The applicant must have a valid passport and visa/work permit/residence permit.

- The applicant must have a co-applicant who is a resident Indian or an NRI close relative.

- The applicant might be required to provide property as collateral.

List of Factors Affecting Axis Bank Personal Loan Eligibility

Following is the list of factors affecting Axis Bank Personal loan eligibility:

- Credit Score: Your credit score is the first thing the bank considers when evaluating your eligibility. This score ideally shows the bank how creditworthy you are, as it is calculated based on your repayment behaviour and credit history.

- Income: The higher your income, the more likely you are to secure a loan, often resulting in a lower interest rate and a substantial loan amount. On the other hand, applicants with lower income or frequent job changes may find it difficult to obtain a loan, as the bank deems them risky.

- Debt-To-Income Ratio (DTI): The debt-to-income ratio shows how much your monthly income is spent paying off your existing debts. The debt-to-income ratio gauges the proportion of your monthly income allocated to debt payments. A low debt-to-income ratio significantly improves your chances of loan approval. Conversely, a high ratio may lead to the denial of your loan application.

- Loan Amount: The relationship between the loan amount you want to borrow, your income, credit score, and debt-to-income ratio will ultimately affect your home loan eligibility.

- Co-applicants: Adding a co-applicant with a strong financial profile and a robust credit history can significantly enrich the likelihood of your loan approval, as the bank considers both of your financial capacities.

How Can You Improve Your Axis Bank Personal Loan Eligibility?

Here are certain tips you can follow to improve your Axis Bank personal loan eligibility.

Maintain a Good Credit Score

Pay your bills and existing loans on time while reducing your credit card utilization can significantly improve your home loan eligibility. Typically, the bank considers a credit score of 750 and above favourable.

Reduce Your Debt-to-Income Ratio

A higher Debt-to-Income Ratio implies fewer funds available for loan repayment, potentially leading the bank to reject your loan application. You can lower your Debt-to-Income ratio by increasing your income or reducing your debts.

Present All Your Income

In addition to your monthly salary, deploy all other sources of income — if applicable. This could encompass income from investments, rental properties, retail businesses, income-generating hobbies, and more. Thus the bank becomes more confident about your ability to repay the loan, ultimately enriching your personal loan eligibility.

Affix Co-applicant

Including your spouse, sibling, or other family members as co-applicants can bolster your chances of loan approval. In such instances, the bank evaluates the financial capability of both you and your co-applicants, thereby reinforcing the overall eligibility of your home loan application.

Keep your EMIs within a limit

Maintaining your EMIs below 40% of your take-home salary can significantly improve the likelihood of your loan approval. However, exceeding this threshold might lead to rejecting your loan application, as the bank could assume you cannot handle additional EMIs. To prevent this, consider reducing the loan amount you want to apply for and extending the loan tenure. This can lower your EMI amount, allowing you to manage your EMI payments better and enhance your personal loan eligibility.

Avoid Multiple Loan Applications

Each loan application you have applied for will be recorded on your credit report and can lower your credit score. Besides, an excess of loan applications in a short span of time can trigger apprehension for banks, as it indicates that you are credit-hungry and may have the potential challenge of repaying debts.

Understanding the Impact of Credit Score on Axis Bank Personal Loan Eligibility

A credit score is a numerical representation of your creditworthiness, meticulously computed by the Credit Information Bureau India Limited (CIBIL). To calculate your credit score, CIBIL considers various factors, including your credit history, repayment behaviour, outstanding debts, and other pertinent financial dimensions. Generally, your credit score ranges from 300 to 850; the higher your credit score, the greater your eligibility for a personal loan. However, the bank typically considers a credit score of 750 and above as ideal.

Comparing Eligibility across Different Axis Bank Personal Loan Products

The following is the comparison of eligibility across different Axis Bank personal loan products:

| Product Name | Minimum Age | Maximum Age | Minimum Income | Credit Score |

| Personal Loan for Salaried Individuals | 21 years | 60 years | Rs 15,000 p.m. | Not specified |

| Personal Loan for Self-Employed Individuals | 21 years | 60 years | Annual income as per bank’s criteria (may vary depending on location and profile) | Minimum 750 or above |

| NRI Home Loan | 24 years | 60 years | Minimum USD 1,000 or equivalent net monthly income | Not specified |

| NRI Car Loan | 21 years | 60 years | Minimum USD 1,000 or equivalent net monthly income | Not specified |

| NRI Education Loan | 21 years | 60 years | Not specified | Not specified |

More Resources for Axis Bank

People Also Asked

How much salary is eligible for a personal loan in Axis Bank?

Ideally, you would need Rs 15,000 to be eligible for a personal loan at Axis Bank.

What is the minimum CIBIL Score for an Axis Bank Personal Loan?

The minimum CIBIL score required for an Axis Bank Personal Loan is 750, ensuring a quick and hassle-free approval process. However, the bank also considers candidates with credit scores below 750.

Do I need to be an existing customer of Axis Bank to get their personal loan?

No, you do not need to be an existing customer of Axis Bank to get their personal loan. Typically, the bank considers both their existing customers and others equally.

Will my income ensure my eligibility for an Axis Bank personal loan?

Your income determines your IDFC First Bank personal loan eligibility. However, it is not the only factor; you must also meet other criteria such as age, credit score, occupation, and existing liabilities.

How can I increase my eligibility for a higher Axis Bank personal loan amount?

To enhance your eligibility for a larger Axis Bank personal loan amount, you can consider these steps: maintain a positive credit score, lower your debt-to-income ratio, Affix a co-applicant, present all your income sources, Keep your EMIs within a limit, and avoid multiple loan applications.

Quick Links

Loan Offers By Axis Bank's

Personal Loan Calculators

Axis Bank Calculators

Bank wise Personal Loan Calculators

- Canara Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Indiabulls Personal Loan Calculator

- Muthoot Finance Ltd Personal Loan Calculator

- Paysense Personal Loan Calculator

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator