- Home

- Home Loan

- Home Loan Interest Rate

- State Bank of India Interest Rate

SBI Home Loan Interest Rates

State Bank of India home loan interest rate caters to the diverse needs of borrowers, including salaried individuals, NRIs, and women. Offering loans for up to 90% of the property value, SBI provides flexible tenure options of up to 30 years. Specialised products like Flexipay, Maxgain, and Pre-approved Loans ensure customised solutions for buyers. With no prepayment penalties and a range of services such as top-ups and balance transfers, SBI remains a trusted choice. The bank also supports government housing initiatives like PMAY, making affordable housing accessible to many customers.

Offer for You

7.25% - 8.45%

Interest Rate (p.a.)₹5L - ₹40Cr

Tenure(1 - 30 Years)₹1,992 - ₹2,049

EMI Per Lakh

Compare State Bank of India Home Loan Interest Rates with Other Lenders

The table given below shows how a home loan from SBI compares to home loans offered by other lenders:

- Starting Interest Rate (p.a)

- Processing Fee

- Rating

- Min. Loan Amount

Bank of India HL Interest Rate

7.1% - 12.65%

Up to 1% of loan amount + GST

4.5

₹5L - ₹7.5Cr

Tenure(3 - 30 Years)

Indian bank HL Interest Rate

7.4% - 10.4%

Up to 1% of loan amount

4.5

₹5L - ₹75L

Tenure(1 - 30 Years)

Union Bank of India HL Interest Rate

7.45% - 10%

Up to 1% of the loan amount

4.5

₹5L - ₹2Cr

Tenure(1 - 30 Years)

Canara Bank HL Interest Rate

7.15% - 10%

Up to 1% of loan amount

4.5

₹10L - ₹50L

Tenure(1 - 30 Years)

- 5 Lac

- 20 Cr

- 5

- 30

- 6

- 20

Monthly Loan EMI

Payment Breakdown:

Principal Amount

₹10,00,000

Interest Payable

Total Amount Payable

Highlights on SBI Home Loan Interest Rate

State Bank of India offers home loans with attractive interest rates that vary based on loan amount, tenure, and applicant profile. Home loan percentage in SBI is directly influenced by the Repo Linked Lending Rate (RLLR), ensuring alignment with market trends.

| Feature | Details |

| Interest Rate | Starting from 8.25% p.a.* |

| Loan Tenure | Up to 30 years |

| Processing Fee | 0.35% of the loan amount plus GST |

| Loan Amount | Up to 90% of the property cost |

| Benchmark Rate | RLLR-based rates |

| Prepayment Charges | NIL for floating-rate loans |

SBI Home Loan Interest Rates For Salaried vs. Self-Employed Individuals

State Bank of India offers competitive home loan interest percentage for both salaried and self-employed individuals. While salaried individuals often benefit from slightly lower rates due to stable income sources, self-employed applicants are assessed based on their business stability and financial records. A strong credit score and consistent financial history can help self-employed individuals secure favourable rates. State Bank of India evaluates income consistency, creditworthiness, and repayment ability before finalising the applicable home loan interest percentage.

| Applicant Type | Loan Amount | Interest Rate Range |

| Salaried Women | Up to ₹30 lakh | 8.25% – 8.35% |

| ₹30 lakh – ₹75 lakh | 8.50% – 8.60% | |

| Above ₹75 lakh | 8.60% – 8.70% | |

| Self-Employed Women | Up to ₹30 lakh | 8.40% – 8.50% |

| ₹30 lakh – ₹75 lakh | 8.65% – 8.75% | |

| Above ₹75 lakh | 8.75% – 8.85% | |

| Salaried Men | Up to ₹30 lakh | 8.30% – 8.40% |

| ₹30 lakh – ₹75 lakh | 8.55% – 8.65% | |

| Above ₹75 lakh | 8.65% – 8.75% | |

| Self-Employed Men | Up to ₹30 lakh | 8.45% – 8.55% |

| ₹30 lakh – ₹75 lakh | 8.70% – 8.80% | |

| Above ₹75 lakh | 8.80% – 8.90% |

Choose Your Best SBI Home Loan

By Professions

By Property

By Other

State Bank of India Home Loan Interest Rates For Women

SBI promotes homeownership among women by offering concessional interest rates. Women applicants generally receive a concession of 0.05% compared to standard rates. This initiative supports financial inclusion and encourages women to invest in property. The lower interest rate translates to reduced EMIs, making home loans more affordable. Women borrowers should also check for additional benefits or special schemes introduced by State Bank of India from time to time.

| Loan Amount | Interest Rate for Women (p.a.) |

| Up to ₹30 lakh | 8.25% – 8.35% |

| ₹30 lakh – ₹75 lakh | 8.50% – 8.60% |

| Above ₹75 lakh | 8.60% – 8.70% |

SBI Home Loan Interest Rates – Scheme Wise

State Bank of India (SBI) provides different housing loan options to meet the needs of various borrowers. These include home loans for salaried individuals, self-employed professionals, NRIs, government employees, and defence personnel. Some loans offer additional benefits, such as lower interest rates or flexible repayment options. The table below lists SBI’s home loan schemes and their interest rates.

| Home Loan Scheme | Interest Rate (p.a.) |

| Regular Home Loan | 8.50% – 9.65% |

| Flexipay Home Loan | 8.70% – 9.85% |

| NRI Home Loan | 8.70% – 9.85% |

| Privilege Home Loan | 8.70% – 9.85% |

| Shaurya Home Loan | 8.70% – 9.85% |

| Tribal Plus Home Loan | 8.60% – 9.55% |

| Realty Home Loan | 9.45% – 9.85% |

| Top-Up Loan | 8.80% – 11.30% |

| Home Loan Maxgain (Overdraft) | 8.70% – 9.85% |

| YONO Insta Home Top-Up Loan | 9.35% |

SBI Home Loan Schemes For You

How to Calculate The Effective Interest Rate on A State Bank of India Home Loan?

The effective home loan percentage in SBI depends on multiple factors, including the base rate, applicable mark-ups, and discounts. Borrowers should consider their credit score, loan tenure, and employment status to estimate the actual rate they will be charged. Below is a step-by-step guide to calculating the effective interest rate:

Steps to Calculate the Effective Interest Rate:

- Identify the Base Rate : SBI follows the Repo Linked Lending Rate (RLLR), which is influenced by RBI’s monetary policies.

- Check the Applicable Spread or Mark-up : SBI adds a markup based on the loan amount, borrower profile, and tenure.

- Account for Concessions : Women borrowers, government employees, and defence personnel may receive interest rate concessions.

Final Interest Rate Calculation

- Formula:

Effective Interest Rate = Base Rate + Mark-up – Concessions

For example, if the RLLR is 6.50%, and SBI applies a 1.75% mark-up for a particular borrower while offering a 0.05% concession for women, the effective interest rate would be:

6.50% + 1.75% – 0.05% = 8.20% per annum

Borrowers can also use SBI home loan EMI calculator on the website to estimate their EMI based on loan tenure, amount, and applicable interest rate.

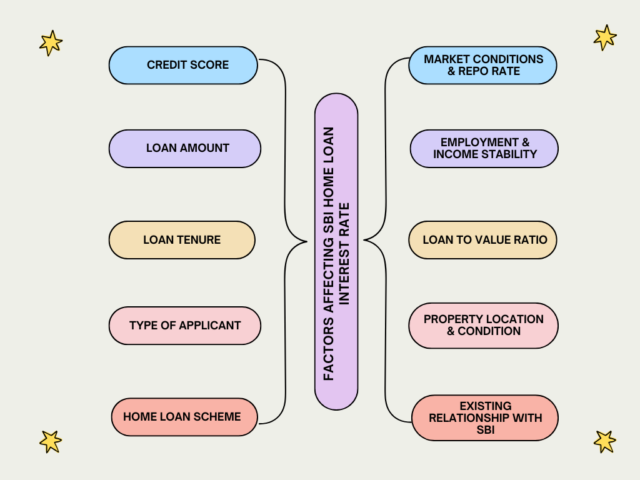

List of Factors That Affect State Bank of India Home Loan Interest Rate and EMI

The interest rate and EMI (Equated Monthly Instalment) of an SBI home loan depend on several key factors. These factors determine the overall cost of borrowing and influence how much a borrower pays over the loan tenure.

1. Credit Score

- A higher credit score (750 and above) improves loan eligibility and may result in lower interest rates.

- A lower credit score can lead to higher interest rates or loan rejection.

2. Loan Amount

- SBI offers different interest rates based on the loan amount slab.

- Generally, higher loan amounts attract slightly higher interest rates.

3. Loan Tenure

- A longer tenure (up to 30 years) results in lower EMIs but increases the total interest paid.

- A shorter tenure leads to higher EMIs but reduces the overall interest burden.

4. Type of Applicant (Salaried vs. Self-Employed)

- Salaried individuals generally get lower interest rates due to stable income.

- Self-employed applicants may face slightly higher rates as their income can be irregular.

5. Type of Home Loan Scheme

- SBI offers different home loan schemes with varying interest rates: Regular Home Loan, Flexipay, NRI Home Loan, and Shaurya Home Loan.

- Special schemes for women and defence personnel offer additional benefits.

6. Market Conditions and Repo Rate

- SBI’s home loan interest rates are linked to the RBI’s Repo Linked Lending Rate (RLLR).

- If the RBI cuts the repo rate, SBI home loan interest rates may decrease, reducing EMI.

7. Employment and Income Stability

- Borrowers with stable jobs in reputed companies or government sectors may get better loan terms.

- Higher-income levels can increase loan eligibility and help secure lower interest rates.

8. Loan-to-Value (LTV) Ratio

- The LTV ratio determines how much of the property’s value SBI finances.

- If a borrower makes a higher down payment, the loan amount is lower, which can result in better interest rates.

9. Property Location and Condition

- Properties in prime locations may attract better interest rates.

- If the property is newly constructed and in a well-developed area, banks consider it lower risk.

10. Existing Relationship with SBI

- Existing SBI customers (having salary accounts or previous loans) may get preferential interest rates.

- Borrowers with a good repayment history may also receive pre-approved home loan offers.

Apply For SBI Home Loan upto 5 Crore and Calculate EMIs

How To Get The Best Interest Rate on State Bank of India Housing Loan?

Securing the lowest possible interest percentage in SBI home loan requires careful financial planning and an understanding the factors influencing loan pricing. Here are some effective ways to get the best interest rate:

1. Maintain a High Credit Score

- A credit score of 750 or above improves loan eligibility and helps secure lower interest rates.

- Regularly check your CIBIL score and resolve any discrepancies.

- Pay credit card bills and existing loan EMIs on time to maintain a good credit history.

2. Compare SBI Home Loan Schemes

- State Bank of India offers multiple home loan schemes, such as Regular, Flexipay, Privilege, Shaurya, and NRI Home Loans.

- Each scheme has different interest rates and benefits, so choose the one that suits your financial profile.

3. Opt for a Shorter Loan Tenure

- While longer tenures (20-30 years) reduce monthly EMIs, they increase the overall interest paid.

- A shorter tenure (10-15 years) can help reduce the total interest burden.

4. Choose a Floating Interest Rate

- Floating interest rates fluctuate based on the RBI’s repo rate changes.

- If market conditions indicate a rate drop, a floating rate can help lower EMIs over time.

5. Apply for a Joint Home Loan

- A joint loan with a co-applicant (spouse or parent) can increase eligibility and improve the chances of a lower interest rate.

- Women co-applicants often get 0.05% lower interest rates under SBI’s schemes.

6. Check for Special Discounts and Offers

- SBI frequently introduces seasonal offers with reduced processing fees or interest rate discounts.

- Some professions, such as government employees, defence personnel, and women borrowers, get preferential rates.

7. Maintain a Strong Banking Relationship with SBI

- Existing SBI customers (salary account holders, previous borrowers) may receive pre-approved home loan offers with better rates.

- A long-term banking relationship can also help negotiate favourable terms.

8. Make a Higher Down Payment

- A lower Loan-to-Value (LTV) ratio can lead to better interest rates.

- Increase the down payment to reduce the loan amount and improve loan terms.

State Bank of India Home Loan Interest Rates of Last 10 Years

Understanding the historical trends of State Bank of India’s home loan interest rates over the past decade provides valuable insights for prospective borrowers. SBI’s home loan rates are influenced by various factors, including the Reserve Bank of India’s (RBI) monetary policies, economic conditions, and internal benchmarks like the Marginal Cost of Funds-based Lending Rate (MCLR).

| Year | Interest Rate Range (%) |

| 2025 | 8.50 – 9.65 |

| 2024 | 8.65 – 8.95 |

| 2023 | 8.10 – 8.55 |

| 2022 | 7.55 – 8.00 |

| 2021 | 6.70 – 7.55 |

| 2020 | 7.40 – 8.15 |

| 2019 | 8.05 – 8.75 |

| 2018 | 8.45 – 8.95 |

| 2017 | 8.65 – 9.10 |

| 2016 | 9.30 – 9.70 |

| 2015 | 9.70 – 9.85 |

Apply Home Loan in Your City

Frequently Asked Questions (FAQs)

What is the EMI for an Rs. 35 lakhs home loan in SBI?

For this instance, we assume the interest rate to be 8.25% per annum. In this case, the EMI for a loan of 10 years would be Rs. 42,835; for 20 years, it would be Rs. 29,713; and for 30 years, it would be Rs. 26,171.

Is the SBI home loan interest rate floating?

State Bank of India provides home loans above Rs. 75 lakhs at floating interest rates at prevailing standards based on a monthly reducing balance.

What is the interest of Rs. 25 lakh in SBI?

For this instance, we assume the interest rate to be 8.25% per annum. In this case, the EMI for a loan of 10 years would be Rs. 31,655. For 20 years, it would be Rs. 22,477, and for 30 years, it would be Rs. 20,098.

When do the SBI home loan interest rates change?

State Bank of India issues a change in the home loan interest rate policies following a change in the Repo Rate offered by the Reserve Bank of India.

What is the EMI for a Rs 60 lakh SBI home loan?

For this instance, we assume the interest rate to be 8.25% per annum. In this case, the EMI for a loan of 10 years would be Rs. 73,911. For 20 years, it would be Rs. 51,501, and for 30 years, it would be Rs. 45,498.

What is the processing fee for SBI Home Loan?

State Bank of India charges a processing fee to the tune of 0.35% of the sanctioned amount, subject to a minimum of Rs. 2,000 to a maximum of Rs. 10,000.

Quick Links

Bank Wise Home Loan Interest Rate

- Bank of Baroda Home Loan Interest Rate

- Union Bank of India Home Loan Interest Rate

- Indian bank Home Loan Interest Rate

- Punjab & Sind Bank Home Loan Interest Rate

- Punjab National Bank Home Loan Interest Rate

- Canara Bank Home Loan Interest Rate

- Bank of India Home Loan Interest Rate

- Bank of Maharashtra Home Loan Interest Rate

- Reliance Capital Home Loan Interest Rate

- YES Bank Home Loan Interest Rate

- RBL Bank Home Loan Interest Rate

- IDFC FIRST Bank Home Loan Interest Rate

- DCB Bank Home Loan Interest Rate

- Federal Bank Home Loan Interest Rate

- ICICI Bank Home Loan Interest Rate

- karur Vysya Bank Home Loan Interest Rate

- Axis Bank Home Loan Interest Rate

- CITI Bank Home Loan Interest Rate

- HDFC Bank Home Loan Interest Rate

- Housing Development Finance Corporation Home Loan Interest Rate

- HDFC Sales Home Loan Interest Rate

- Kotak Bank Home Loan Interest Rate

- IndusInd Bank Home Loan Interest Rate

- LIC Housing Finance Home Loan Interest Rate

- HSBC Home Loan Interest Rate

- IDBI Bank Home Loan Interest Rate

- karnataka bank Home Loan Interest Rate

- Clix Capital Home Loan Interest Rate

- Vastu Housing Finance Home Loan Interest Rate

- Aadhar housing Finance Home Loan Interest Rate

- Hero FinCorp Home Loan Interest Rate

- Muthoot Finance Ltd Home Loan Interest Rate

- Edelweiss Financial Services Home Loan Interest Rate

- Cholamandalam Finance Home Loan Interest Rate

- Piramal Finance Home Loan Interest Rate

- SMFG India Credit Company Ltd Home Loan Interest Rate

- Ujjivan Small Finance Bank Home Loan Interest Rate

- Capri Global Home Loan Interest Rate

- Hero Housing Finance Home Loan Interest Rate

- Poonawalla Fincorp Limited Home Loan Interest Rate

- Capital First Ltd. Home Loan Interest Rate

- IndiaBulls Home Loan Interest Rate

- IIFL Finance Home Loan Interest Rate

- L&T Finance Home Loan Interest Rate

- DHFL Home Loan Interest Rate

- Tata Capital Housing Finance Limited Home Loan Interest Rate

- Home First Finance Company Home Loan Interest Rate

- Punjab National Bank Housing Finance Home Loan Interest Rate

- Godrej Housing Finance Home Loan Interest Rate

- Aditya Birla Finance Limited Home Loan Interest Rate

- Bajaj Finserv Home Loan Interest Rate

Home Loan by Nationalized Bank

Home Loan by Private Bank

- Reliance Capital Home Loan

- YES Bank Home Loan

- RBL Bank Home Loan

- IDFC FIRST Bank Home Loan

- DCB Bank Home Loan

- Federal Bank Home Loan

- ICICI Bank Home Loan

- karur Vysya Bank Home Loan

- Axis Bank Home Loan

- CITI Bank Home Loan

- HDFC Bank Home Loan

- Housing Development Finance Corporation Home Loan

- HDFC Sales Home Loan

- Kotak Bank Home Loan

- IndusInd Bank Home Loan

- LIC Housing Finance Home Loan

- HSBC Home Loan

- IDBI Bank Home Loan

- karnataka bank Home Loan

Home Loan by NBFC

- Clix Capital Home Loan

- Vastu Housing Finance Home Loan

- Aadhar housing Finance Home Loan

- Hero FinCorp Home Loan

- Muthoot Finance Ltd Home Loan

- Edelweiss Financial Services Home Loan

- Cholamandalam Finance Home Loan

- Piramal Finance Home Loan

- SMFG India Credit Company Ltd Home Loan

- Ujjivan Small Finance Bank Home Loan

- Capri Global Home Loan

- Hero Housing Finance Home Loan

- Poonawalla Fincorp Limited Home Loan

- Capital First Ltd. Home Loan

- IndiaBulls Home Loan

- IIFL Finance Home Loan

- L&T Finance Home Loan

- DHFL Home Loan

- Tata Capital Housing Finance Limited Home Loan

- Home First Finance Company Home Loan

- Punjab National Bank Housing Finance Home Loan

- Godrej Housing Finance Home Loan

- Aditya Birla Finance Limited Home Loan

- Bajaj Finserv Home Loan

Home Loan Calculators