Debt Mutual Fund

Invest in fixed income assets such as bonds, securities, and treasury bills.

Know more

Major Mutual Fund

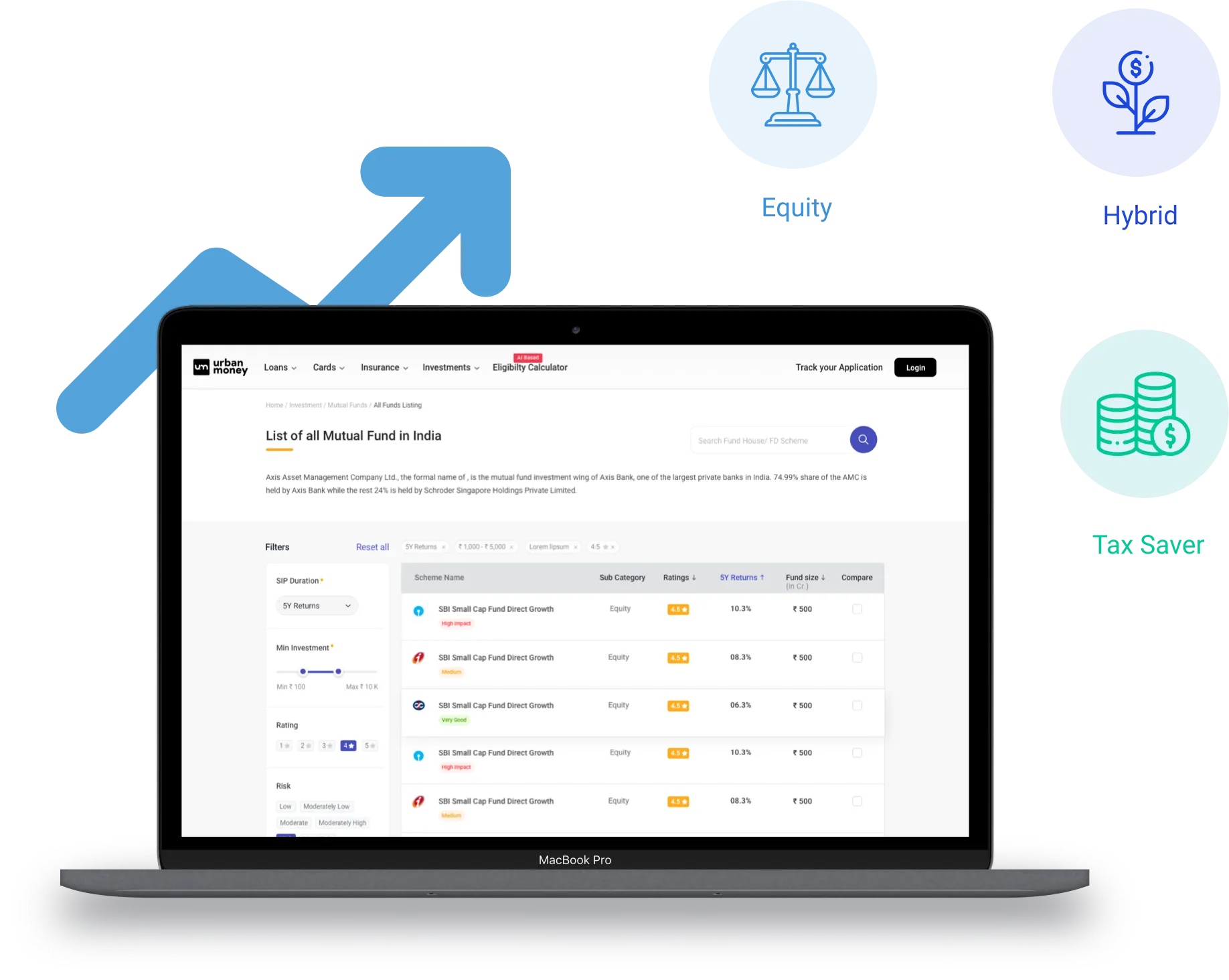

Categories

Choose the mutual funds scheme that best-fits your financial requirement from the extensive range including equity schemes, debt schemes, hybrid schemes, and much more.

Explore all Mutual Funds

List of Best Mutual Funds in India

One stop shop for investors looking for the best mutual fund schemes available in a single place. Now, get acquainted with the key features offered by the best mutual funds options and make informed choices.

Tax Saving

Short Term Deposit

Large Cap

Mid Cap

Small Cap

Multi Cap

Mutual Fund Houses

The presence of various mutual fund houses in India seeds the availability of different schemes. It allows investors to choose the one that best fits with their investment goals.

View All Fund HousesTop Mutual Fund Categories

Acquaint yourself with the best mutual fund categories offering lucrative returns.

Equity

Hybrid

Elss

Debt

Commodity

Other

Best Performing Sectoral Mutual Funds

Find all the relevant information on the best sectoral mutual funds in the market. Which are sure to stimulate your investments and accentuate your corpus significantly. We’ve covered a wide range of industries, from auto components to hospitality, so you can find the fund that complements your investment goals.

View All Sectors

Broadcasting

Auto Parts & Equip

Conglomerate

Bonds

Hospitality

Distributors

Energy

Diversified Chemicals

Auto Components

Car Manufacturers

Calculate Your Mutual Fund Returns

How Do Mutual Funds Work?

Mutual funds collect money from many people, then invest it in stocks, bonds, or both. Professional managers handle the investments. Investors get returns based on their share of the fund, minus fees. It’s an easy way for regular folks to invest in a variety of assets.

Types of Mutual Funds in India

Based on Asset Class

- Equity Funds

- Debt Funds

- Money Market Funds

- Hybrid Funds

Based on Investment Goals

- Growth Funds

- Income Funds

- Liquid Funds

- Tax-Saving Funds

- Aggressive Growth Funds

- Capital Protection Funds

- Fixed Maturity Funds

- Pension Funds

Based on Structure

- Open-Ended Funds

- Closed-Ended Funds

- Interval Funds

Based on Risk

- Very Low-Risk Funds

- Low-Risk Funds

- Medium-risk Funds

- High-Risk Funds

Mutual Funds – Modes of Investment

Direct Investment

- Online Platforms for Mutual Fund Investment

- Using a Demat Account

- Mutual Fund Agents

Why Invest in Mutual Funds?

Mutual funds (MF) have a good amount of built-in diversification and are simple to purchase. They rank among the most well-liked investment options for experienced and novice investors.

Most of the time, MFs are the best choice for investors looking to diversify their portfolios. A mutual fund invests in various securities rather than betting everything on one sector or business to reduce your portfolio risk.

You dont have to manage everything yourself, unlike stocks. The management of your mutual funds will handle everything. You can benefit from rapid liquidity and tax advantages with mutual funds.

If you have never invested before, you should start with mutual funds because they carry less risk than stocks.

Benefits of Investing in Mutual Funds

Begin Investing with a Small Amount

Mutual funds allow you to start investing with as little as INR 100 or less. Systematic Investment Plans might help you begin your investment journey even if you dont have a sizable sum of money to invest (SIPs). The investor can invest through a SIP per the economic and market conditions. SIP will provide excellent profits and aid in forming the habit of investing.

You do need to Manage Everything Yourself

You dont have to manage mutual funds on your own, unlike stocks. Your portfolio will be managed by mutual fund managers, who will also evaluate the market performance of various securities to determine whether to buy or sell them. You just need to enter the investment amount; nothing else is required.

Instant Liquidity

The fact that you can easily redeem the units whenever you want is one of the biggest advantages of mutual funds. You can withdraw your investment if something goes wrong, such as an underperforming mutual fund or an unanticipated financial disaster. Depending on the type of mutual fund, you will normally receive the redemption amount in your connected bank account within one to three business days.

It Helps Diversify Your Investments

Putting all of your money into one stock, bond, or other assets could be dangerous. You can diversify your investments with mutual funds by investing in various securities and asset types. As a result, your risk would be extremely low, even if there is a decline or disaster in the equities market.

Help You Review the Past Performance Before Investing

To see how the mutual fund has done in the past, look at its past performance. With the help of the data, you may identify a fund that offers decent returns while having a lower risk profile. But its important to remember that past performance is no guarantee of future success.

What are the Risks of Mutual Funds?

The warning that Mutual Funds investments are subject to market risks is common knowledge. This disclaimer is intended to inform investors associated with mutual funds. To avail of the maximum possible benefits in terms of returns, knowing about the best mutual funds to invest in is not enough. In addition to that you must get acquainted with the associated risk factors.

You must comprehend the real risks associated with mutual funds to manage them effectively.

Risks in Equity Mutual Funds

- Market Risk

- Liquidity Risk

- Concentration Risk

- Currency Risk

Risks in Debt Mutual Funds

- Credit Risk

- Interest Rate risks

- Inflation Risk

- Reinvestment Risk

How Are Returns Calculated for Mutual Funds?

There are several ways to calculate mutual fund returns applicable for a lump sum and SIP investments. The computation method you count on usually depends on your personal choices.

Annual Return

As the name insinuates, the annual return is computed for a period of one year. It is expressed in terms of time-weighted yearly percentage. In other words, the annual return is the overall gain or loss incurred from the invested amount within one year.

With the annual return, you can analyse the actual performance of the mutual fund for any year in which you held an investment in it. Generally, these returns are considered because they are easy to compute compared to other investment computations.

Annual return = [(Ending NAV) – (Beginning NAV)] / Beginning NAV.

Here is an example for better understanding:

Lets say the NAV on the mutual fund is 100 on the first day of investment, i.e. June 1, 2023. After completion of one year, i.e. May 31, 2024, the NAV value clocks at 110.

Then the Annual return on the invested amount for one year would be:

[(1100-(100)]/100

0.1 or 10%

Point-to-point or Absolute Return

Computation is somewhat similar to the Annual Returns. However, you can use a point-to-point calculation method to determine investment returns at any time, not just at the end of one year. The formula is useful for calculating returns when the holding period is less than 12 months.

Since the computation is not associated with the investment period or the compounding effect, people don’t consider this formula to evaluate the performance of the funds for a longer time.

Point-to-Point Return = [(Current NAV – Beginning NAV) / Beginning NAV] x 100.

Let us understand the formulas working through a quick example:

Person A purchased your mutual fund on June 27, 2019, with 100 NAC. On September 26, the NAV of the mutual fund rose by 10, making it 110.

For three month tenure, the point-to-point return will be calculated as:

(110-100)/100

0.1 x 100 = 10%

Annualised Return

Investors use annualised return in several ways to evaluate the mutual funds performance over time. Dissimilar to the annual return, annualised returns are determined through the full investment holding period. It can be used to compute returns for a short and long tenure.

Annualised Return is calculated through the following formula:

Annualised Return = [(1 + R1) x (1 + R2) x (1 + R3) x …. x (1 + Rn)]1/n – 1

In this equation, n represents the number of investment years.

Heres a quick example to understand the formulas working:

Lets say you invested in a mutual fund in 2019 and decided to keep it invested for five years. To decode the performance, initially, you will have to compute the annual return for each investment year.

Once you have these values, add them and divide the overall value by 5, i.e. the number of investment years.

Annual return for 2019 will be 3%

Annual return for 2020 will be 7%

Annual return for 2021 will be 5%

Annual return for 2024 will be 12%

Annual return for 2024 will be 1%

Annualised Return i.e. Adding the returns of five years and dividing it by investment years

[(1 + 0.03) x (1 + 0.07) x (1 + 0.05) x (1 + 0.12) x (1 + 0.01) ]1/5 – 1

Annualised Return will be 5.53%

Compounded Annual Growth Rate (CAGR)

When the investment period is more than a year, investors find the CAGR computing method more significant. It incorporates the time value of the invested funds and denotes the mean annual growth rate. Incorporating time value allows to smoothen out the volatility at the end returns over the investment horizon.

CAGR = (Ending value / Beginning value)1/n– 1.

Lets understand this through an example:

Suppose Person B invested INR 1 lakh in a mutual fund three years ago. The initial NAV for the MF was recorded at INR 20. As per the current scenario, the NAV is INR 40. For this case, the: CAGR = 25.99%.

Compared with the absolute returns, this computation method provides a reliable picture of the mutual fund performance for the given investment time frame. However, if the mutual fund investment stretches for a prolonged period with regular instalments (SIP), the CAGR method seems to be less effective.

Extended Internal Rate of Return for SIPs

XIRR or Extended Internal Rate of Returns computes the ‘internal’ return rate (annualised yield) specifically for scheduled cash flows occurring at irregular intervals. XIRR represents the aggregation of diverse CAGRs for a Systematic Investment Plan. In such an investment, you regularly invest a certain amount for a long tenure and get returns at maturity.

You get several units based on the NAV value of the invested mutual fund. You keep on accumulating these units from the first day of your investment. When you decide to redeem the total units on the final day, you will be getting the maturity amount for the invested funds. This amount will equal the NAV value in multiplication with the total number of units you own. For calculating the mutual fund returns on the invested amount through XIRR in Excel, you need to have the SIP amount, investment dates, redemption date and maturity amount. There is no need to know the NAV value of the investment.

Mutual Fund Investing Eligibility Criteria

You need to adhere to the following eligibility criteria to start investing in mutual funds:

- An individual must be an Indian resident for single or joint investment.

- In the case of minors, the investment will be carried out through parents or lawful guardians.

- Non-resident Indians, Persons of Indian Origin, can also invest in mutual funds. However, individuals might need approval from the RBI.

- Religious Trusts, Charitable Trusts, and Private trusts

- Partnership Firms

- Member (Karta) of a Hindu Undivided Family

- Banks: Co-operative, Regional, Financial Institutions

- SEBI-registered Foreign Institutional Investors (FIIs)

- Organisations, corporate bodies, Societies, and Public Sector undertakings

- Organisations associated with Science and Research

- Provident, Pension, Gratuity, and other funds if permitted by the organization

- Multinational companies (approved by the Government and the Reserve Bank of India)

- Trustees, Sponsors, AMCs and their associates:

If you successfully cope with the mutual fund investment eligibility criteria, start your investment today and secure huge returns.

A mutual fund is a potent investment choice that could help individuals build wealth over the long run. Mutual funds offer plans for every aspect of life, from retirement to accumulating wealth. You offer investments for conservative and risk-averse investors. The benefit of diversity, cheap cost, flexibility to invest in lesser quantities, and expert fund management are all advantages of the alternative. Mutual fund investing is made simple and rapid when used with an online investment platform.

Get your latest Credit Score, FREE

Guide

Get in-depth knowledge about all things related to and your finances

ARN Code in Mutual Fund

Everyone has heard the commercial line, "mutual fund investments are subject to market risk." But one can still take greater precautions to lower the risk. Therefore, it is the intermediary's responsi

Money Market Instruments in India

More often than not, individuals require funds on a short-term basis and Money Market Instruments provide a platform for investors to create short-term wealth. Investors do so by putting a safe deposi

Best Investment Plans to Invest in India 2023

Investors look for fast gratification even though patience and discipline can lead to superior results. We want to accomplish our life goals as quickly as we can. The same is true with investments. In