What is Lien Amount: Meaning, Reasons and Removal Process

Lien amount is an amount that is marked or held by the bank against a customer’s account as security. This amount is typically frozen or reserved and cannot be freely accessed or withdrawn by the account holder. By imposing a lien, the bank temporarily blocks access to a certain amount of funds in the account. This ensures that the bank can recover the money if the account holder does not repay dues like loan EMIs, credit card bills, taxes etc. as per terms agreed upon.

We are here to make it easier for you and break down the lien amount and how to tackle this term. This guide also includes the steps to remove the lien amount from various bank accounts and how to check for the lien amount.

- Personalized solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Interest rate comparison

Table of Content

Last Updated: 7 February 2026

Lien Amount Overview

| Lien Amount | |

|---|---|

| Definition | A lien amount refers to a certain amount of money in your bank account that gets blocked or frozen by the bank. |

| Reasons for Lien |

|

| How to Remove Lien |

|

| Importance of Lien Removal |

|

What is the Lien Amount?

A Lien amount is the locked or frozen amount available in your account that is not accessible for a specific time frame. Usually, the bank authorities restrict this amount from being used. It will remain in your account, but neither can you withdraw the amount nor transfer it to another account. The lien amount will be frozen until the bank authorities decide to remove the lock from your account. There is no specified limit for the locked amount, as the bank authorities have full rights to restrict the entire bank balance and turn it into a lien amount.

What is Lien Amount or Lien Marked Meaning?

The next thing to discover when familiar with the lien mount is what the lien mark on a bank account means. A bank account with a lien mark means that the borrower has permitted the lender to do so in accordance with the recovery of money associated with the mutual fund. Typically, bank authorities mark an account lien when the borrower fails to repay the amount per the agreed terms. To recover the loan sanctioned against mutual funds, banks place a lien mark specifying the fund units used by the lender for the security.

Reason for Lien Amount in Banks

Here are some common reasons why banks impose a lien on customer accounts:

- Loan Repayment Default: If there is any missed or delayed EMI on a loan taken from the bank, a lien can be placed to secure the repayment. The lien amount would cover the outstanding loan amount.

- Credit Card Bill Default: Similarly for unpaid credit card bills, the bank may impose a lien on the account for the outstanding bill amount. This prevents use of funds until dues are cleared.

- Minimum Balance Breach: If minimum average balance is not maintained, banks put a lien on the shortfall amount as penalty. Lien is removed once balance is restored.

- Cheque Bounce/Failed Transactions: If cheques issued against the account bounce repeatedly or transactions fail, a lien is imposed to protect the bank against potential losses.

- Suspicious Transactions: Any transactions deemed suspicious by the bank’s fraud algorithms may also trigger a lien to block the account until investigation.

- Income Tax Dues: If income tax is due and not paid, the IT department can instruct banks to place liens on accounts of defaulters.

- Loan Against FD: If you avail a loan against your Fixed Deposit, the FD amount is lien marked as security against loan repayment.

- Court Order: Banks have to comply if there is any legal order from courts to place a lien on accounts in certain disputes or cases.

How to Remove Lien Amount?

Here are some tips on how to remove a lien amount from your bank account:

- First identify the reason why the lien was imposed – loan default, minimum balance, taxes due etc. This helps approach resolution better.

- For issues like loan/credit card EMI default or minimum balance breach, make the necessary payments to become regular. The bank will then remove the lien.

- If lien is due to non-payment of taxes, clear outstanding tax dues and any penalties. This will get the lien removed.

- If any linked service like virtual card or UPI is causing the lien, uninstall and delete it. The lien should automatically revoke.

- In case of technical errors or arbitrary lien imposition, contact your bank’s customer care and follow up with them to remove it.

- You can also visit your bank branch and speak to officials there to understand the lien reason and get clarity on resolution steps.

- If lien is due to KYC pending, update your KYC immediately as per bank process to remove lien.

- Be polite but firm with bank officials in your follow-ups on lien removal. Escalate to higher authorities if needed.

- Once the bank confirms the issue is resolved, verify directly that the lien mark is lifted and account is restored.

Being persistent and diligent while dealing with the bank can help in getting the lien amount revoked quickly and resuming full access to your account.

How to Remove Lien Amount in SBI?

To remove a lien amount in SBI, you must initially get familiar with why the bank authority placed the lien mark.

Suppose the bank account is restricted by ASBA ( Applications Supported by Blocked Amount) mandated by SEBI for applying for an IPO. In that case, you will have to submit a request for withdrawal to the IPO registrar. However, if you don’t have any urgency, you can wait till the IPO allotment. The lien will be eliminated if you don’t receive the allotment for the requested IPO.

When the SBI bank lien marks your bank account for a virtual card, you can remove the lien right away by deleting the virtual card. You can also negotiate with the bank executive or terminate your card if the lien is associated with your credit card.

For all other cases like non-payment of taxes, skipped EMI towards SBI loan, etc., you will have to pay the default amount and applicable interest to lift the lien. Once you clear your dues, the bank will remove the lien.

Additionally, the lien mark can be due to any technical or system error. If that is the case, visit the nearest SBI bank branch, and ask the bank executive for the rectification.

If you don’t have any idea about why the bank has raised the line mark, contact the SBI bank executive and ask for an explanation.

Additionally, you can make an in-person visit to the SBI bank branch to query about the same. The bank executives will provide the relevant reason and how to resolve the lien mark.

You can call SBI’s 24X7 helpline number to resolve your query. 1800 1234, 1800 11 2211, 1800 425 3800, 1800 2100, or 080-26599990 are the toll free numbers.

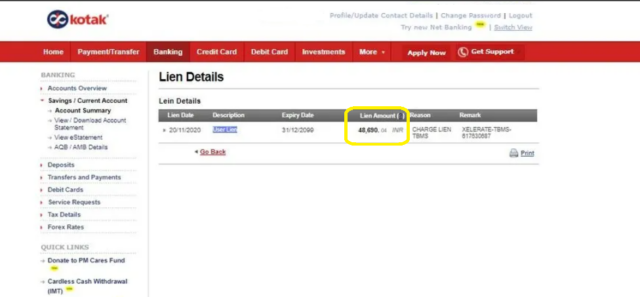

How to Remove the Lien Amount in a Kotak Bank Account?

If you are a Kotak Bank account holder and want to remove the lien amount in a Kotak bank account, you will have to start with the root cause. Figure out the reason for which the lien mark exists on your account.

If your Kotak Bank account is frozen by ASBA and regulated by SEBI towards an IPO request, you must withdraw your IPO to remove the lien mark. If not urgent, wait until the IPO allotment, as the lien mark will be lifted immediately after the allotment.

When Kotak bank puts a lien mark on your account for a virtual card associated with the bank account, delete the card and remove the lien right away.

If the lien mark exists towards a credit card, you can either contact the Kotak bank executive or terminate your card to uplift the lien mark.

If the tax department sets the lien amount towards non-payment of taxes or skipped EMIs, repay the default amount, clear the taxes, and remove the lien.

Additionally, your bank account can be lien marked because of a system error. To remove such a lien mark, make an in-person visit to the nearest Kotak bank branch and rectify it.

If you are not sure about the reason behind the lien mark, contact the Kotak bank executive and raise the query for the same. The bank executives will help you know the root cause of the lien mark and help you resolve the problem.

You can contact a customer care executive to inquire about the lien removal. Make a call on 1860 266 2666 to clear your queries. However, this is not a toll-free number, so local call rates will be applicable. The customer care executives are available from 9 am to 7 pm, Monday to Saturday.

How to Remove Lien Amount in ICICI Bank?

Unlock the key reason to remove the lien amount in the ICICI bank account. Understand why your account is lien marked and what is the lien amount. If you are already familiar with the key reason, resolve it to remove the lien amount.

- If an IPO request is the reason, withdraw your request. If lien removal is not urgent, wait until the IPO allotment, as the lien will be removed immediately.

- Pay your taxes and remove the lien amount if it is a tax lien.

- When the lien is associated with the virtual card, delete your card.

- If the bank has a lien mark for a credit card, terminate your card.

- Clear your dues when the account is lien marked due to skipped payments.

- One reason can be technical errors. Get in touch with the bank executive and resolve your problem.

You can either get in touch with the executive by calling on the customer care number or can make an in-person visit to the nearest ICICI bank branch.

The toll-free customer care number of ICICI bank is 1800 200 3344. Get in touch with the customer care executive between 9 am to 6 pm from Mon. to Fri.

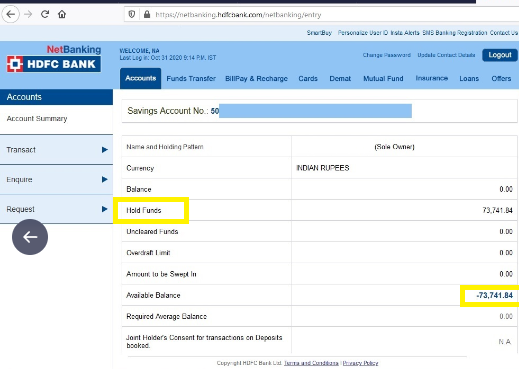

How to Remove Lien Amount in HDFC Bank?

If you don’t know why there is a lien mark, speak with your dedicated bank executive. If you visit the bank branch with your account on, you can call the customer care executive via a toll-free number.

If you know the reason, you can resolve it at your end without getting any rectification from the bank executives. Have a line mark because of credit card dues or skipped payments towards the loan, clear your dues today. Your lien mark will be removed once you clear the pending payments.

If you haven’t paid your taxes by now, do it today. The reason can be the tax department, as you have lacked tax payments. If you have recently requested an IPO and since you have been lien marked, withdraw it by submitting a request to the IPO Registrar.

The HDFC bank toll-free number to contact the customer care executive is 1800 202 6161 and 1860 267 6161.

How to Remove Lien Amount in BOB Bank?

If you are a customer of Bank of Baroda and your bank account is lien marked, you can take several steps to remove it. Start by familiarising yourself with the reason for getting the lien marked. Understanding the reason is vital as the method to remove a lien may vary as per the key cause. Here is what you can do to remove the lien amount in BOB bank:

- If you have made an IPO request lately and faced this lien account issue, withdraw your request by writing to the IPO Registrar.

- Clear your pending taxes and the penalty amount to remove the lien from your bank account when it is a tax lien.

- If associated with a virtual card, delete the card, and the lien will be removed right away.

- If the BOB has put a lien mark on your account for a credit card, ask for the termination. If you have an unpaid credit card bill, clear it today.

- When the account is lien marked due to skipped loan payments, repay them to remove the lien mark from your account.

- One reason can be system errors. You can get in touch with the bank executive and ask them to remove the lien mark.

You can contact the executive by calling the toll-free numbers, i.e. 1800 258 44 55 or 1800 102 44 55. Additionally, you can make an in-person visit to the nearest Bank of Baroda branch.

No matter in which bank you hold your account, having a lien mark is not suitable because it disrupts the banking transaction from the account. So, if you face any such issues, get in touch with the bank executive to figure out the root cause. Once familiar with the reason, remove the lien mark from your account as soon as possible to reinitiate the transactions.

FAQ's About Lien Amount

Do I get bank interest on the lien amount in SBI?

SBI bank provides interest on the entire amount, including the lien amount. Additionally, you can make withdrawals from the account. However, the restricted amount, i.e. lien amount, will not be available for withdrawal.

How to withdraw the lien amount in SBI?

To withdraw the lien amount in SBI, initially, you will have to remove the lien from your account. Once the bank resolves the issues and the lien mark is terminated, you get the option to withdraw the lien amount.

Is the lien on my bank account considered as bad?

No, the lien on your bank account isn’t considered a bad thing. However, it restricts the transactions and withdrawal of a certain amount, so you must resolve it as soon as possible.

What is the easiest way of getting rid of the lien amount?

The easiest way to eliminate the lien amount is to rectify the issue by contacting the bank executive or clearing the dues.