Top 10 Best Private Banks in India List 2025

January 09, 2025

Home Loan Archive | How to Track Your ICICI Home Loan Application Status

August 09, 2023

Owning a home is a cherished dream for many. ICICI Bank, one of India’s leading financial institutions, aims to turn this dream into reality with its attractive home loan offerings. Applying for a home loan is a significant step towards acquiring your dream home. ICICI Bank ensures a seamless and transparent application process for its customers by providing facilities like ICICI home loan tracking. Once you’ve applied for an ICICI home loan, you may track the ICICI home loan status of your application to stay informed about its progress.

This feature not only saves a borrower’s time and money but also maintains full transparency. So, without further ado, let’s delve into the guide listing various ICICI home loan tracking methods.

Table of Contents

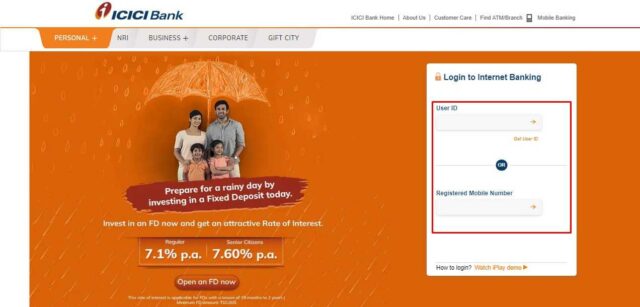

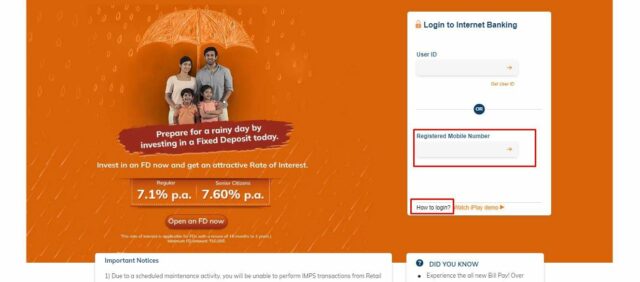

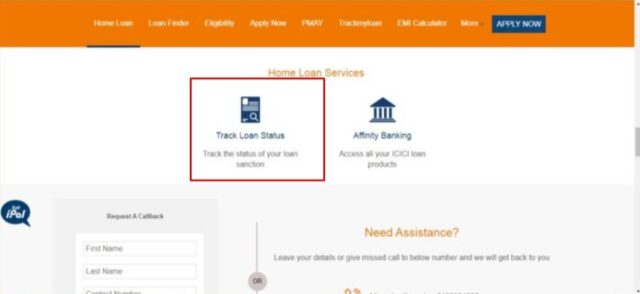

ToggleStaying informed about the ICICI home loan application status ensures a smooth and hassle-free loan processing experience. ICICI Bank offers a user-friendly online portal that allows applicants to check the status of their home loan application conveniently. The below-mentioned steps must be followed for ICICI home loan tracking.

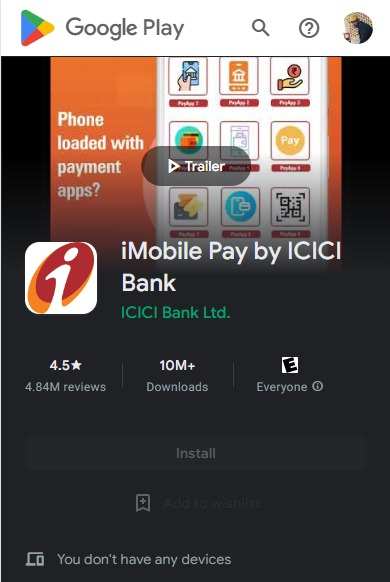

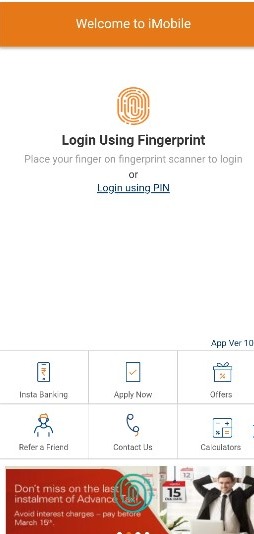

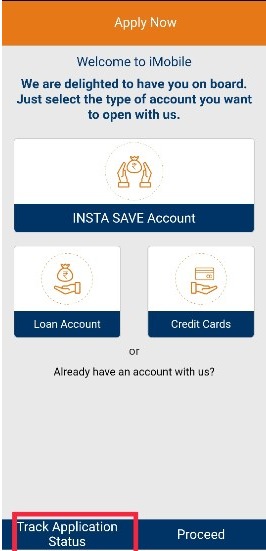

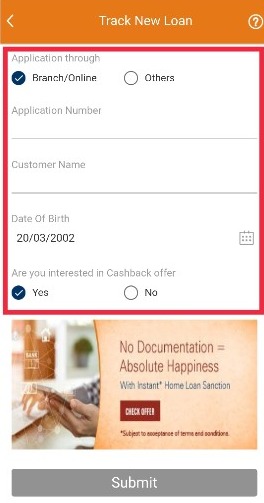

ICICI Bank also provides a convenient mobile application for tracking your ICICI home loan status on the go. The user-friendly interface of the iMobile app ensures effortless ICICI Home loan tracking, ensuring that you stay informed throughout the application process while on the move. To track your ICICI home loan application on the go, follow these simple steps:

If you prefer a more traditional approach, you can check your ICICI home loan status offline by contacting ICICI Bank’s customer care or visiting your nearest branch.

Provide your details when connected to a customer care executive, provide them with the necessary details, such as your application reference number or registered mobile number. The executive will then inform you about the current status of your home loan application.

ICICI Bank’s dedicated customer care team is always ready to assist customers with their home loan queries and concerns. In addition to ICICI Home loan tracking, you can contact the customer care team for any other assistance related to your home loan. Dial the ICICI Bank’s customer care number – 1860 120 7777.

ICICI Bank has provided its customers with the convenience of applying for home loans online and offline. It must be noted that a borrower can avail of the loan through the Urban Money platform as well. The following steps need to be followed to apply for ICICI Bank’s home loan using different platforms.

The validity of the loan sanction letter may vary, but it is typically valid for a few months. It is advisable to confirm the exact validity period with the bank.

Yes, you can prepay your ICICI home loan either in part or in full, subject to the prepayment terms and conditions specified by the bank.

ICICI Home Finance offers a wide range of home loan products, including home purchase loans, home construction loans, home improvement loans, and home extension loans, to cater to different housing needs.

Yes, Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) are eligible to apply for a home loan in India, subject to certain terms and conditions laid down by the bank. How long is the sanction letter for the ICICI home loan valid?

Can I prepay my ICICI Bank home loan?

What are the various types of loans that ICICI Home Finance provides?

Can an NRI/OCI apply for a Home Loan in India?

© 2025 www.urbanmoney.com. All rights reserved.

Need Loan Assistance?