- Home

- Personal Loan

- Navi Finserv Loan

Navi Personal Loan

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Individuals can avail of Navi personal loans to meet their financial requirements, like funding a wedding or paying credit card bills. Navi personal loan interest rate starts from 9.9% pa for terms of up to 84 months, and loan amounts of up to INR 20 lakh can be availed. Using the Navi app, borrowers can obtain a digital personal loan without processing fees. Based on PAN and Aadhaar Number, the cash loan processing is entirely paperless. Navi personal loans are approved in 10 minutes and disbursed immediately to the applicant’s bank account.

Navi Personal Loan Highlights 2023

|

Navi Personal Loan Quick Details |

|

| Interest rates | 9.9% – 45% p.a. |

| Loan amount | Up to ₹20 Lakh |

| Repayment tenure | 72 months |

| Processing Fees | 3.99% to 6% of the loan amount |

| Foreclosure Charges | Zero |

Navi Personal Loan Interest Rate

The Navi personal loan interest rate starts from 9.9% pa and goes up to 45% pa. The personal loan interest rate is affected by the borrower’s eligibility, credit score, repayment history, and other factors. The option of flexible EMIs is available, and a borrower can use the Navi personal loan EMI calculator to understand their interest rates and EMIs better.

| Starting Interest Rate | 9.9% p.a. |

| Maximum Interest Rate | 45% p.a. |

Features of Navi App Loan

Navi app is a digital app that grants personal loans to borrowers without them having to visit the store physically. The features of Navi personal loans are given below.

- Navi personal loans do not require any collateral or guarantor

- The flexible repayment tenure ranges from 12 months to 84 months.

- Loan amounts availed under personal loans can also be utilised to fulfil business requirements.

- The documents required to enjoy the Navi personal loan offers are pretty minimal.

- The loan amount is disbursed into the borrower’s account when they meet the lender’s terms and conditions.

- Low Navi personal loan interest rate to borrowers with good credit scores.

- A borrower can utilise the Navi personal loan EMI calculator to determine the EMI on their loan amount.

- There is a facility to prepay the loan before the tenure. This will reduce the borrower’s EMI burden.

Eligibility Criteria for Navi Personal Loan

To enjoy the benefits that Navi personal loan offers, they must meet certain eligibility criteria set in place. One can use the Navi personal loan eligibility calculator to check if they can avail of the personal loans offered by the Navi app. The following Navi personal loan eligibility must be met:

- Applicant must be an Indian resident

- Navi personal loan age limit ranges between 18 and 65 years

- They must hold a valid PAN card

- Salaried and self-employed individuals are eligible

- A minimum credit score of 650 is required

Why choose Navi Personal Loans?

Navi personal loan offers the best services and attractive interest rates. A borrower must choose Navi personal loans for the following reasons.

Instant Disbursal

Borrowers can get their Navi personal loan instantly in minutes. There is no longer a need to wait days to get the loan amount. However, a borrower must meet the Navi personal loan eligibility criteria in order to get the desired loan amount sanctioned.

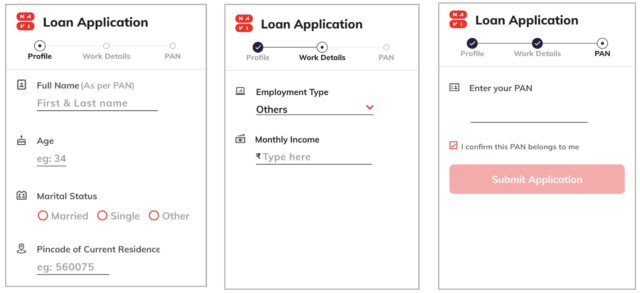

Paperless Process

Navi personal loans escape the hassle of paperwork by sanctioning the loan using the internet. This 100% paperless process is entirely based on the Navi app. From filling out the loan application to disbursal of the loan amount, the navigation is easy and is accessible anytime, anywhere.

Flexible EMI Option

Navi personal loan offers flexible EMI options. Borrowers can pay EMIs at their convenience. The repayment tenure of the Navi personal loan goes up to 72 months or six years. The app also offers borrowers the freedom to choose the tenure that suits them and repay loans without worry.

Minimal Documentation

Navi Personal Loan processing does not require heavy paperwork. A borrower can instantly get attractive Navi personal loan interest rates by providing documents like a PAN card.

No Collateral Required

The Navi personal loan offers unsecured loans where the borrower is not required to submit any collateral or a guarantor. However, the sanctioned loan amount depends upon the borrower’s eligibility and other requirements.

Where is Navi Personal Loan available?

One can avail of the Navi personal loans through the Navi app. The application is available on the app store for Apple users and the play store for android users. There is no hassle or elaborate process involved for Navi personal loan apply online.

Documents Required for Navi Loan

There are certain documents that must be produced when applying for Navi personal loans. Applicants must keep the following documents handy to ensure a smooth Navi Personal Loan processing.

- PAN card

- Aadhaar card

- A selfie as identity proof

Navi App Personal Loan Interest Rate VS Other Top Lenders’ Interest Rate

Borrowers must be aware of the various lenders offering personal loans. The table below compares Navi personal loan interest rates and other lenders’ interest rates.

| Banks/NBFCs | Interest Rate (pa) | Processing Fee |

| Navi Personal Loan | 9.90% onward | Check with the Lender |

| HDFC Personal Loan | 10.50% onward | Up to 2.5% |

| Yes Bank Personal Loan | 13.99% | Up to 2.5% |

| Kotak Mahindra Personal Loan | 10.25% onward | Up to 2.5% |

| Axis Bank Personal Loan | 12% onward | Check with the Lender |

| IndusInd Bank Personal Loan | 11% onward | 2.5% onward |

| IDFC FIRST Personal Loan | 12% | Up to 3.5% |

| Aditya Birla Capital Personal Loan | 14% | Up to 2% |

| IIFL Personal Loan | 24% | 2% onward |

Note: The comparison is dated February 24, 2023

Navi Customer Support

A customer may find themselves in a turmoil when applying for Navi personal loans. The app has set up a customer support system to guide its customers through the process. One can reach the representatives of the Navi personal loans through email. The mail ID is help[@]navi[dot]com No information is available on Navi personal loan helpline number for a customer to resolve their issues.

Conclusion

Navi app is the beginning of a new era. This digital platform allows Indians to avail of home loans, personal loans, and cash loans and invest in mutual funds by merely fulfilling basic requirements and out of the comfort of home. Navi personal loan offers attractive interest rates and flexible repayment tenure. Welcome to the digital age!

FAQ's About Navi Personal Loan

Is Navi a registered NBFC?

Navi is registered with the Reserve Bank of India as Systemically Important Non-Deposit Taking NBFC (ND-SI). It lends through the Navi app.

How do I borrow from the Navi app?

You must first install the Navi app and carry on by creating an account. Follow our guide to know more.

What is the minimum salary required for Navi's Personal Loan?

A borrower must have a minimum salary of INR 20,000 for a Navi personal loan.

Can I get a personal loan from Navi?

Yes, you can get a personal loan from Navi at an interest rate starting from 9.9% pa.

Is the Navi app approved by RBI?

What is the rate of interest in Navi?

Navi personal loan interest rate starts from 9.99% pa and can go up to 45% pa.

Can I get a loan from the Navi app?

Yes, you can get a loan from the Navi app. There will be zero processing fee charged.

Quick Links

Personal Loan by Private Bank

- RBL Bank Personal Loan

- DCB Bank Personal Loan

- Kotak Bank Personal Loan

- Reliance Capital Personal Loan

- Federal Bank Personal Loan

- YES Bank Personal Loan

- Deutsche Bank Personal Loan

- IDBI Bank Personal Loan

- karnataka bank Personal Loan

- karur Vysya Bank Personal Loan

- IDFC FIRST Bank Personal Loan

- HDFC Bank Personal Loan

- ICICI Bank Personal Loan

- CITI Bank Personal Loan

- Axis Bank Personal Loan

- HDFC Sales Personal Loan

- IndusInd Bank Personal Loan

- HSBC Personal Loan

Personal Loan by Nationalized Bank

Personal Loan by NBFC

- Prefr Personal Loan

- Tata Capital Financial Services LTD Personal Loan

- Bhanix Finance Personal Loan

- Ujjivan Small Finance Bank Personal Loan

- Hero FinCorp Personal Loan

- MoneyWide Personal Loan

- Piramal Finance Personal Loan

- PaySense Personal Loan

- Clix Capital Personal Loan

- Edelweiss Financial Services Personal Loan

- Muthoot Finance Ltd Personal Loan

- InCred Financial Services Personal Loan

- IndiaBulls Personal Loan

- DHFL Personal Loan

- IIFL Finance Personal Loan

- FT Cash Personal Loan

- Fullerton India Personal Loan

- Loantap Credit Products Private Limited Personal Loan

- L&T Finance Personal Loan

- Shriram Urban Co Operative Bank Limited Personal Loan

- AU Small Finance Bank Personal Loan

- Tata Capital Housing Finance Limited Personal Loan

- Capital First Ltd. Personal Loan

- Bajaj Finserv Personal Loan

- Aditya Birla Finance Limited Personal Loan

- Poonawalla Fincorp Limited Personal Loan

- Privo Personal Loan

Personal Loan Calculators

Bank wise Personal Loan Calculators

- Indiabulls Personal Loan Calculator

- Muthoot Finance Ltd Personal Loan Calculator

- Paysense Personal Loan Calculator

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Piramal Finance Personal Loan Calculator

- Tata Capital Housing Finance Limited Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Axis Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

Bank Wise Personal Loan Interest Rate

- RBL Bank Personal Loan Interest Rate

- DCB Bank Personal Loan Interest Rate

- Kotak Bank Personal Loan Interest Rate

- Reliance Capital Personal Loan Interest Rate

- Federal Bank Personal Loan Interest Rate

- YES Bank Personal Loan Interest Rate

- Deutsche Bank Personal Loan Interest Rate

- IDBI Bank Personal Loan Interest Rate

- karnataka bank Personal Loan Interest Rate

- karur Vysya Bank Personal Loan Interest Rate

- IDFC FIRST Bank Personal Loan Interest Rate

- HDFC Bank Personal Loan Interest Rate

- ICICI Bank Personal Loan Interest Rate

- CITI Bank Personal Loan Interest Rate

- Axis Bank Personal Loan Interest Rate

- HDFC Sales Personal Loan Interest Rate

- IndusInd Bank Personal Loan Interest Rate

- HSBC Personal Loan Interest Rate

- Bank of Baroda Personal Loan Interest Rate

- Punjab National Bank Personal Loan Interest Rate

- Bank of India Personal Loan Interest Rate

- Union Bank of India Personal Loan Interest Rate

- Canara Bank Personal Loan Interest Rate

- Punjab & Sind Bank Personal Loan Interest Rate

- Indian bank Personal Loan Interest Rate

- State Bank of India Personal Loan Interest Rate

- Bank of Maharashtra Personal Loan Interest Rate

- Prefr Personal Loan Interest Rate

- Tata Capital Financial Services LTD Personal Loan Interest Rate

- Bhanix Finance Personal Loan Interest Rate

- Ujjivan Small Finance Bank Personal Loan Interest Rate

- Hero FinCorp Personal Loan Interest Rate

- MoneyWide Personal Loan Interest Rate

- Piramal Finance Personal Loan Interest Rate

- PaySense Personal Loan Interest Rate

- Clix Capital Personal Loan Interest Rate

- Edelweiss Financial Services Personal Loan Interest Rate

- Muthoot Finance Ltd Personal Loan Interest Rate

- InCred Financial Services Personal Loan Interest Rate

- IndiaBulls Personal Loan Interest Rate

- DHFL Personal Loan Interest Rate

- IIFL Finance Personal Loan Interest Rate

- FT Cash Personal Loan Interest Rate

- Fullerton India Personal Loan Interest Rate

- Loantap Credit Products Private Limited Personal Loan Interest Rate

- L&T Finance Personal Loan Interest Rate

- Shriram Urban Co Operative Bank Limited Personal Loan Interest Rate

- AU Small Finance Bank Personal Loan Interest Rate

- Tata Capital Housing Finance Limited Personal Loan Interest Rate

- Capital First Ltd. Personal Loan Interest Rate

- Bajaj Finserv Personal Loan Interest Rate

- Aditya Birla Finance Limited Personal Loan Interest Rate

- Poonawalla Fincorp Limited Personal Loan Interest Rate

- Privo Personal Loan Interest Rate