- Home

- Home Loan

- Bank Of Maharashtra

- Bank of Maharashtra Home Loan Eligibility Calculator

Bank of Maharashtra Home Loan Eligibility Calculator

In the pursuit of homeownership, the journey can often make you excited and uncertain. Finding the perfect home is just the stepping stone as securing financial needs is crucial. Here in India, the real estate market is as dynamic as ever. It offers a variety of options for those seeking to buy their dream home. However, understanding your eligibility for a home loan can be a puzzling task for your mind.

Enter the Bank of Maharashtra Home Loan Eligibility Calculator, a powerful tool designed to simplify the loan qualification process. It doesn’t matter if you’re a first-time buyer or a seasoned homeowner; this calculator can be your compass in navigating toward the land of home loan eligibility. So, if you’ve ever wondered about your eligibility to step into the world of homeownership, the Bank of Maharashtra Home Loan Eligibility Calculator is your partner. Let’s embark on this journey of discovery together and unlock the doors to your dream home with the Bank of Maharashtra Home Loan Eligibility Calculator.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

Last Updated: 1 March 2026

Key Features & Benefits

Features

- User-Friendly Interface: Bank of Maharashtra Home Loan Eligibility Calculator provides a user-friendly interface. This interface makes this tool accessible and easy to navigate for users. Even an individual with limited technical expertise can easily use it.

- Eligibility Estimation: The calculator utilises your financial information for the eligibility calculation. This includes factors like your income, age, existing loan obligations, and credit score. The calculation provides you with an estimated loan amount for which you are likely eligible.

- Customisation Options: Users get the flexibility to input various parameters, such as the desired tenure and interest rates. This allows them to visualise how exactly adjustments in these factors impact their eligibility and the amount of their Equated Monthly Instalments (EMIs).

- Instant Results: One of the key features of this tool is its ability to deliver quick and immediate results. It eliminates the need for a long application process and offers an almost instant snapshot of your potential eligibility.

Benefits

- Facilitates Financial Planning: The calculator is a valuable resource for individuals looking to plan their finances effectively. Users can assess their ability to afford a home loan within their current financial framework by gaining insight into their eligible loan amount.

- Time Efficiency: Instead of investing significant time and effort in a formal loan application, prospective borrowers can rapidly gauge their eligibility, access the overall process and save valuable time.

- Informed Decision-Making: Armed with the knowledge of their estimated eligibility, users can make well-informed decisions regarding the purchase of a property. This information allows them to align their property search with their financial capabilities.

- Pre-Approval Indicator: The calculator essentially acts as a pre-approval indicator. If it suggests that you are eligible for a certain loan amount, you can use this as a reference point when formally applying for a home loan. This may enhance your chances of a smoother approval process.

- Interest Rate Comparison: Another noteworthy benefit is the ability to experiment with different interest rates. Users can analyse how variations in interest rates impact their eligibility and monthly EMIs. This empowers them to select the most suitable loan product that aligns with their financial goals and budget.

In summary, Bank of Maharashtra Home Loan Eligibility Calculator serves as a valuable tool in the home-buying journey. Its user-friendly nature, customisation options, and ability to provide instant results make it an essential resource for those seeking to understand their potential eligibility and make informed decisions when considering a home loan.

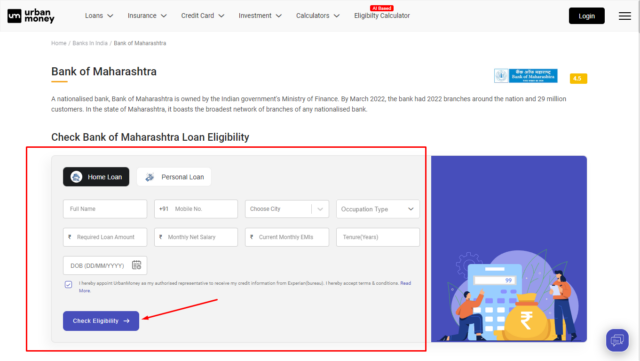

How to use the Bank of Maharashtra Home Loan Eligibility Calculator?

Urban Money’s website offers you the Bank of Maharashtra home loan eligibility calculator at no extra cost. All you need to do is simply follow these steps and start calculating.

- Visit www.urbanmoney.com on your desktop or smartphone.

- Click on the ‘Loans’ menu and Choose the ‘Home Loan’ option from the list.

- Now, from the list of various banks and NBFCs, choose ‘Bank of Maharashtra’

- The website will direct you to the ‘Bank of Maharashtra Home Loan‘ page.

- Enter all the required details in the next part and accept the terms and conditions.

- The next step is to click on ‘Check Eligibility’.

- Enter the OTP you receive on your provided phone number and get your estimation.

Users who are satisfied with the generated eligibility can click on ‘Apply Now’ and proceed to apply for the loan.

Bank of Maharashtra Home Loan Eligibility Criteria

Below are mentioned the general eligibility criteria for the Bank of Maharashtra Home Loan:

Eligibility Criteria for Salaried Individuals

Generally, a salaried individual should be 21-60 years of age. It requires a minimum general income of ₹1,80,000 per annum to apply for a Bank of Maharashtra home loan for a salaried employee. A salaried employee should have 2-3 years of current job experience with a credit score of 720 and above for a home loan application at the Bank of Maharashtra.

Eligibility Criteria for Self-Employed Individuals

Generally, the age of a self-employed individual should range from 21 to 60 years. The general minimum income requirement of a self-employed individual is ₹1,80,000 per annum. A self-employed applicant should have a minimum of 3 years of business stability with a credit score of 720 and above.

Note: The upper-mentioned eligibility criteria represent a general eligibility criterion for Bank of Maharashtra home loan, which can be changed depending on the bank’s policy. You can visit the bank’s website to get the latest eligibility criteria.

Factors Affecting Bank of Maharashtra Home Loan Eligibility

Below are the factors that affect the Bank of Maharashtra Home Loan Eligibility:

- Financial Standing: The Bank of Maharashtra always checks a borrower’s financial standing to discover the repayment potential of the borrower. Banks verify a candidate’s financial remaining through their month-to-month income and work insight.

- Age: The Bank of Maharashtra, for the most part, inclines toward more youthful and reliable candidates as they offer higher possibilities of loan settlement.

- Residence Status: This is a significant boundary similar to an adjustment of a candidate’s residence status; the loan terms likewise change. Home loan qualification models contrast for Indian and Non-Indian occupants.

- Credit Score: Credit score addresses a candidate’s financial way of behaving. Banks incline toward borrowers with high credit scores while supporting home loan demands.

- Property-Related Elements: A home loan is reached out after intensive confirmation of the concerned property. Area, condition, and a few different factors exceptionally impact the home loan sums.

Tips to Improve Your Bank of Maharashtra Home Loan Eligibility

Each candidate can expand their home loan qualification. Follow these tips to acquire a higher loan amount by improving your Bank of Maharashtra home loan eligibility:

- Keep up major areas of strength with a healthy CIBIL Rating: Candidates with unfortunate credit scores are advised to do whatever it may take to further develop them. Credit scores can be worked on through ideal repayments and proper financial ways of behaving. Additionally, candidates need to follow their credit evaluations now and again.

- Apply Mutually: Joint applications include the pay and credit evaluations of different candidates to reinforce one’s loan application. You can apply with your life partner, the parent or other co-borrowers as well.

- Keep a low ratio of outstanding debt to net income: This essentially implies a guarantee that your pay is higher than your borrowings. It guarantees the bank of your repayment potential and expands your possibilities of approval.

- Steady Employment: Banks lay their confidence in individuals who grandstand ordinary income over the long course of time. If you want to purchase a house in future, focusing on your employment record will unquestionably help.

Understanding the Impact of Credit Score on Bank of Maharashtra Home Loan Eligibility

It assists loan lenders with analysing your credit history

Banks can perceive how you handle credit, from the various sorts of loans you have taken in the past to the ones you are repaying at present (while applying for the loan). Credit scores are determined from the loans you have taken, yet from how you have utilised your credit cards. Banks can get knowledge about the amount you utilise from your credit card, your credit usage proportion and whether you have settled both your credit card bills and past and current loans on time, without defaulting. In that capacity, the credit score gives your moneylender a point-by-point investigation of how you deal with a wide range of loans.

It assists the bank with checking whether you can repay the loan

At the point when you apply for a home loan, you want to demonstrate your qualifications. One of the most incredible ways of checking, assuming you are qualified, is through your pay sources. Banks expect you to constantly make monthly income. If you are not drawing a specific monthly pay, you may not be qualified for the loan. Your pay and credit scores assist moneylenders with choosing if you can be sure to repay the loan on time, which is the reason banks consider your credit score for a home loan.

It assists moneylenders with checking whether borrowers have some other continuous loans

Banks view borrowers with numerous loans while applying for another one as somewhat hazardous. Another loan implies an additional financial obligation while your pay continues as before. Through your credit score, the bank computes on the off chance that you can repay a high-esteem home loan. They take a look at your loan-to-income proportion – for example, the monthly pay drawn and how much funds are spent in repaying your credit card bills and your other loan EMIs. If the loan-to-income proportion surpasses 60%, banks can consider you ineligible for the loan.

People Also Asked

How can I check my Bank of Maharashtra home loan eligibility?

You can check your Bank of Maharashtra home loan eligibility on the Urban Money website.

How much loan am I eligible for Bank of Maharashtra?

The loan amount depends on the lender’s eligibility criteria, policies, and other factors.

How will I know if my eligibility criteria have been met for Bank of Maharashtra home loans?

You can provide all the asked information on the eligibility calculator at the Urban Money website. If the calculator shows your eligible amount, that means you are eligible for a Bank of Maharashtra home loan.

How can I increase my eligibility for a higher Bank of Maharashtra home loan amount?

You can increase your eligibility for a higher Bank of Maharashtra home loan amount by considering the above-mentioned factors that affect the Bank of Maharashtra home loan amount.

Quick Links

Loan Offers By Bank Of Maharashtra's

Home Loan Calculators

Bank Of Maharashtra Calculators

Bank wise Home Loan Calculators

- Axis Bank Home Loan Calculator

- Canara Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Hsbc Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Aditya Birla Finance Limited Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Iifl Finance Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Bank Of Baroda Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Citi Bank Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Yes Bank Home Loan Calculator

- Icici Bank Home Loan Calculator