- Home

- Home Loan

- Union Bank Of India

- Union Bank Home Loan Eligibility Calculator

Union Bank Home Loan Eligibility Calculator

Have you been thinking of getting a home loan? But you’re confused if you’re eligible or not! There is nothing to worry about since knowing the eligibility for the Union Bank Home Loan has never been more convenient. All thanks to the innovative Union Bank Home Loan Eligibility Calculator available on Urban Money’s website. This tool serves as your virtual guide, navigating you through the intricate landscape of loan approvals and aiding you in realising the possibilities for your dream home.

Furthermore, you can leverage this tool to enhance your home loan eligibility and secure the most advantageous deal for your home. In this guide, learn the optimal ways to utilise the Union Bank Home Loan Eligibility Calculator.

- Personalized Home Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Home Loan Interest rate comparison

Table of Content

Last Updated: 15 December 2025

Union Bank Home Loan Eligibility Calculator – Key Features & Benefits

Let’s explore the primary features and advantages of the Union Bank Home Loan Eligibility Calculator:

User-Friendly Interface

The Union Bank Home Loan Eligibility Calculator is designed with a user-friendly interface. Instead of dense textual information, it employs an intuitive design to present your financial standing regarding home loan eligibility visually appealingly. A quick glance at the interface allows you to grasp your eligibility effortlessly.

Comparison Capability

The Union Bank Home Loan Eligibility Calculator offers a useful comparison feature. It lets you easily compare different home loan options provided by Union Bank. You can evaluate interest rates, EMIs, loan tenure, and other important aspects across various loan products you might qualify for. This functionality lets you pinpoint the most appropriate and economical financing choice based on your financial circumstances and needs.

Precision and Accuracy

Use the Union Bank Housing Eligibility Calculator tool for precise results. You don’t need to resort to manual calculations that can yield erroneous results.

Efficiency and Ease of Use

The Union Bank Home Loan Eligibility Calculator allows you to assess your eligibility in seconds. You won’t need to go through manual and complicated calculations or rely on financial experts. Additionally, the calculator is easily accessible on Urban Money’s official website, removing any restrictions related to time or location.

How to use the Union Bank Home Loan Eligibility Calculator?

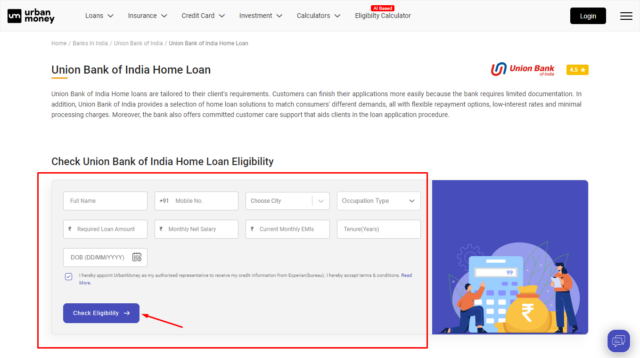

To utilise the Union Bank home loan eligibility calculator on Urban Money, here’s a step-by-step guide:

- Go to www.urbanmoney.com.

- Navigate to the ‘Loans’ section and choose ‘Home Loan’ from the top horizontal menu.

- You’ll be directed to the home loan page, which showcases various prominent banks and NBFCs in India.

- Scroll through the options and select ‘Union Bank’ from the list. This will redirect you to the ‘Union Bank of India Home Loan‘ page.

- The Union Bank home loan eligibility calculator will appear on your screen.

- Fill in the necessary information, including your name, phone number, city, desired loan amount, loan tenure, etc.

- Click the ‘Check Eligibility’ button.

- Within moments, a 6-digit OTP will be sent to the phone number you provided.

- Enter the OTP and click ‘Submit.’

- Almost instantly, the calculator will display your eligibility result.

- If you want to apply for a home loan from Union Bank, click on the ‘Apply Now’ button. Alternatively, click ‘View All Offers’ to explore and compare Union Bank’s and other lenders’ offerings on the website.

Union Bank Home Loan Eligibility Criteria

The Union Bank home loan eligibility calculator is a great tool to assess whether or not one is ready to apply for a loan scheme. However, there are general guidelines that one has to adhere to. Here are some specific category-based criteria.

Union Bank Home Loan Eligibility Based on Salary

The minimum monthly income of the primary applicant for a salaried person is Rs 15,000, and the minimum monthly income of any co-applicant for a salaried person is Rs 10,000. The loan’s eligibility also depends on the borrower’s repayment capacity and the property’s value.

Union Bank Home Loan Eligibility Criteria for Self-Employed Individuals

The minimum business income for a self-employed person is Rs. 2 lakh per annum. The loan’s eligibility also depends on the business’s stability, the borrower’s CIBIL score, and the property’s value.

Union Bank NRI Home Loan Eligibility

The applicant must be an Indian citizen residing abroad or of Indian origin with a valid passport and visa. The applicant must have a minimum monthly income of Rs 15,000 in foreign currency and a minimum work experience of two years abroad. The loan’s eligibility also depends on the borrower’s repayment capacity and the property’s value.

Special Union Bank Home Loan Eligibility for Women Applicants

Women applicants can avail of a special interest rate concession of 0.05% on Union Bank of India home loans. The female applicant must be the sole owner or one of the co-owners of the property and also the sole applicant or one of the co-applicants for the loan.

Factors Affecting Union Bank Home Loan Eligibility

With several factors that affect Union Bank home loan eligibility, customers can understand them and make the required changes to get the best deal. The best way to assess yourself is to use a Union Bank home loan eligibility calculator first. The tool tells you how much you can afford as a customer. With the information, you can start by improving on all the factors that affect Union Bank Home Loan Eligibility. The major factors are as follows:

- Age of the applicant

- Credit score of the applicant

- Having a stable income and a steady job

- Salary of the applicant

- Citizenship status

- Repayment capacity

- Lack of debt or any outstanding payments

How Can You Improve Your Union Bank Home Loan Eligibility?

Improving your eligibility for a Union Bank home loan involves taking strategic financial steps to enhance your creditworthiness and financial standing. Here are some effective ways to boost your eligibility:

- Ensure a healthy credit score by paying bills and EMIs on time.

- Lower your outstanding debt, including credit card balances and other loans.

- A higher income improves your repayment capacity and eligibility for a larger loan amount.

- Save for a substantial down payment, as it reduces the loan amount and increases eligibility.

- Aim for a stable employment history with consistent income. Lenders view stable employment positively when evaluating loan eligibility.

- Include a co-applicant with a good credit score and a steady income to enhance your eligibility.

- Select an appropriate loan tenure as it may reduce the EMI burden and increase eligibility; consider the overall interest cost over the loan term.

- Resolve any outstanding dues or disputes with financial institutions.

- Build a strong financial profile, adding to your credibility.

- Stay updated on Union Bank’s home loan policies, eligibility criteria, and requirements.

- Consult a financial advisor or mortgage expert to understand Union Bank’s specific requirements and receive personalised guidance to enhance your eligibility.

Impact of Credit Score on Union Bank Home Loan Eligibility

A credit score plays a significant role in determining an individual’s eligibility for a home loan from Union Bank or any other financial institution. The importance of a credit score to enjoy the benefits of Union Bank home loan products can be understood from the following pointers.

- A higher credit score increases the chances of loan approval. Like most banks, Union Bank typically prefers borrowers with a good credit score, as it indicates a lower credit risk.

- Union Bank may offer better interest rates to individuals with high credit scores, saving them money over the loan’s tenure.

- Union Bank is more willing to lend a higher sum to individuals with a good credit history and a demonstrated ability to manage debt.

- Union Bank might offer individuals with a good credit score more favourable loan terms, such as a longer repayment period or reduced fees.

- A strong credit score provides you with better negotiation leverage. You can negotiate for better terms, lower interest rates, or a higher loan amount based on your creditworthiness.

Comparing Eligibility across Different Union Bank Home Loan Products

The Union Bank of India offers different home loan products for different purposes and segments of customers. The eligibility criteria for these products may vary depending on the loan type and features. Here is a comparison of eligibility across some of the popular Union Bank home loan products:

Union Home

This basic home loan product can purchase, construct, extend, or renovate a residential property. The eligibility criteria for this product are:

- Indian citizens and NRIs

- The minimum entry age is 18 years, and the maximum exit age is up to 75 years

- Individuals may apply singly or jointly with other eligible individuals

- Minimum monthly income of Rs. 15,000 for salaried persons and Rs. 2 lakhs for self-employed persons

- Minimum work experience of 2 years for salaried persons and 3 years for self-employed persons

- There is no limit on the quantum of loan, subject to repayment capacity and value of property

- The maximum loan-to-value ratio is 90% for loans up to Rs. 30 lakhs and 80% for loans above Rs. 30 lakhs

Union Top-Up

This is an additional loan that existing home loan borrowers can avail of for any personal or business purpose. The eligibility criteria for this product are:

- Existing home loan borrowers with a satisfactory repayment record of at least 12 months

- The minimum entry age is 18 years, and the maximum exit age is up to 75 years

- Individuals may apply singly or jointly with other eligible individuals

- Minimum monthly income of Rs. 15,000 for salaried persons and Rs. 2 lakhs for self-employed persons

- Minimum work experience of 2 years for salaried persons and 3 years for self-employed persons

- Maximum loan amount of Rs. 25 lakhs or 50% of the original home loan amount, whichever is lower

- Maximum loan-to-value ratio of 75%, including the existing home loan

Union Awas

This is a special home loan product for rural and semi-urban areas, with lower interest rates and processing charges. The eligibility criteria for this product are:

- Indian citizens residing in rural or semi-urban areas

- The minimum entry age is 18 years, and the maximum exit age is up to 70 years

- Individuals may apply singly or jointly with other eligible individuals

- Minimum monthly income of Rs. 8,000 for salaried persons and Rs. 1 lakh for self-employed persons

- Minimum work experience of 2 years for salaried persons and 3 years for self-employed persons

- Maximum loan amount of Rs. 30 lakhs or four times the annual income, whichever is lower

- The maximum loan-to-value ratio of 90% for loans up to Rs. 30 lakhs

Union Smart Save

This unique home loan product allows borrowers to park their surplus funds in a linked current account and reduce their interest burden. The eligibility criteria for this product are:

- Indian citizens and NRIs.

- The minimum entry age is 18 years, and the maximum exit age is up to 75 years.

- Individuals may apply singly or jointly with other eligible individuals.

- Minimum monthly income of Rs. 15,000 for salaried persons and Rs. 2 lakhs for self-employed persons.

- Minimum work experience of 2 years for salaried persons and 3 years for self-employed persons.

- There is no limit on the quantum of the loan, subject to repayment capacity and value of property.

- The maximum loan-to-value ratio is 90% for loans up to Rs. 30 lakhs and 80% for loans above Rs. 30 lakhs.

People Also Asked About Union Bank Housing Loan Eligibility Calculator

Is there a way to check my Union Bank home loan eligibility?

Much of the eligibility can be self-assessed. Union Bank has set general guidelines for applying for a home loan. You can also check your Union Bank home loan eligibility by incorporating home loan eligibility calculators. The tool will help you understand how much you can afford, depending on your financial situation.

How much home loan can I procure from Union Bank?

The loan amount you are eligible for can be assessed using the home loan eligibility calculator. You must provide your income details, interest rate, and other information.

How can I meet my eligibility criteria for taking out Union Bank home loans?

You can apply for Union Bank home loans by meeting the parameters set by the bank. There will be an age bracket, a minimum income requirement, and other parameters. Start by self-assessing and working on becoming eligible. You can also check the eligibility calculator to assess how much loan you should apply for.

Can I increase my eligibility for a higher Union Bank home loan amount?

Some proven ways to increase your eligibility for a higher Union Bank home loan amount are to increase your income, add a co-applicant, improve your credit score, choose a longer tenure, and repay all the existing loans.

Quick Links

Loan Offers By Union Bank Of India's

Home Loan Calculators

Union Bank Of India Calculators

Bank wise Home Loan Calculators

- Canara Bank Home Loan Calculator

- Indusind Bank Home Loan Calculator

- Hdfc Bank Home Loan Calculator

- Kotak Bank Home Loan Calculator

- Axis Bank Home Loan Calculator

- State Bank Of India Home Loan Calculator

- Aditya Birla Finance Limited Home Loan Calculator

- Idbi Bank Home Loan Calculator

- Iifl Finance Home Loan Calculator

- Karur Vysya Bank Home Loan Calculator

- Piramal Finance Home Loan Calculator

- Tata Capital Housing Finance Limited Home Loan Calculator

- Punjab National Bank Home Loan Calculator

- Bank Of India Home Loan Calculator

- Lic Housing Finance Home Loan Calculator

- Punjab Sind Bank Home Loan Calculator

- Indian Bank Home Loan Calculator

- Bank Of Maharashtra Home Loan Calculator

- Hsbc Home Loan Calculator

- Citi Bank Home Loan Calculator

- Rbl Bank Home Loan Calculator

- Karnataka Bank Home Loan Calculator

- Federal Bank Home Loan Calculator

- Deutsche Bank Home Loan Calculator

- Union Bank Of India Home Loan Calculator

- Yes Bank Home Loan Calculator

- Idfc First Bank Home Loan Calculator

- Icici Bank Home Loan Calculator

- Bank Of Baroda Home Loan Calculator