- Home

- Personal Loan

- Union Bank Of India

- Eligibility Calculator Plelgcalc

Union Bank Personal Loan Eligibility Calculator

The Union Bank’s personal loan eligibility calculator is a digital financial planning tool. Using the calculator, a loan seeker can instantly get estimates of the personal loan amounts they’re eligible for. One of the most consumer-friendly banking tools, the UBI personal loan eligibility calculator offers quick estimates at no additional cost.

Personal loans are among the bank’s most popular products. With ready eligibility checks, loan seekers can now smoothly plan their foreign trips, family ceremonies, vehicle purchases or any other personal loan expense.

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Last Updated: 9 March 2026

Union Bank Personal Loan Eligibility Calculator – Top Features

UBI personal loan eligibility calculator is designed to smoothen the banking experience for potential borrowers. Have a look at some of the prominent features and benefits of this tool.

- No Hassle: The calculator demands information which is easily available to the users. The online calculator uses basic financial information like one’s income and expense details to produce results in a jiffy.

- Click and Compute: With the coming of online financial calculators, users are no longer required to perform complex calculations themselves. Nor do they need to fill out pages of bank forms to check their eligibility. With one simple click, the online calculator does all the work for you.

- Near-Accurate Estimates: The bank regularly updates its digital calculator to offer near-accurate estimates despite the dynamic nature of personal loans.

- Vibrant UI: The Union Bank’s vibrant and interactive online interface offers ease of use to borrowers. Users can also easily understand the calculator’s results.

- Robust Application: The calculator encourages borrowers to request only as much loan amount as is comfortably repayable by them. This makes their application credible and increases its chances of approval.

Union Bank Personal Loan Eligibility Calculator – Usage Guide

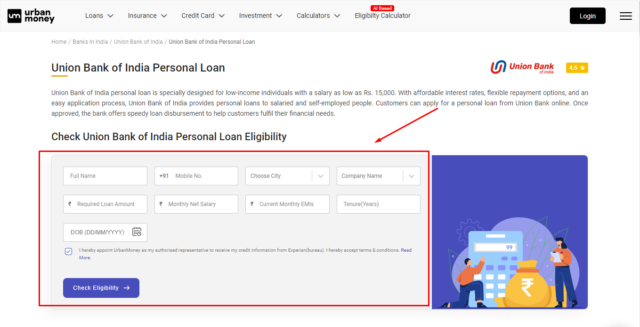

Urban Money’s free Union Bank personal loan eligibility calculator can be accessed using these simple steps:

- Visit www.urbanmoney.com

- Under the ‘Loans’ category, select ‘Personal Loan’.

- Select ‘Union Bank of India’ from the list of banks.

- The portal will direct you to the ‘Union Bank of India Personal Loan’ page.

- Enter the required details and accept the calculator’s T&Cs.

- Click on ‘Check Eligibility’.

- Complete the OTP verification using your mobile number and get instant results.

The calculator also offers details of interest rates, loan tenure and EMIs along with estimates of the loan amount. Satisfied loan seekers can apply for the loan right away by clicking on ‘Apply Now’. One can also check other available offers by clicking on ‘View All Offers’.

Who Can Use the Union Bank Personal Loan Eligibility Calculator?

Union Bank personal loan eligibility calculator can be used by the following candidates seeking a personal loan:

- Salaried Employees

- Non-salaried earners

- Women Applicants

- Existing/New home loan borrowers

- Central Government/ State Government/ PSUs/ Ministry/ Defense/ military employees

- Government teaching/ non-teaching staff

- NRIs

A comparative table discusses the eligibility criteria of the bank’s different personal loans further ahead in the blog.

Factors Affecting Union Bank Personal Loan Eligibility

The Union Bank Personal Loan eligibility calculator takes many factors into account. The individual significance of all the factors affecting a borrower’s personal loan eligibility is highlighted below:

- Age: The bank aims to gauge an applicant’s repayment potential through their age. Young applicants enjoy easier approvals than the ones nearing retirement.

- Income: The bank specifies a minimum level of regular income. Regular income helps establish a candidate’s financial stability and ability to successfully settle the loan.

- Employment Details: The nature of employment helps the bank establish a candidate’s source of specified income. Candidates showing consistent employment over the years have higher chances of success than others while applying for personal loans.

- Co-Applications: Co-applications serve as guarantees for the bank in case of unsecured personal loans. In some cases, co-applicants also have to adhere to the credit ratings specified for them by the bank.

- Security: Home loan borrowers seeking a personal loan are required to mortgage the property with the bank. The authenticity of the security provided by the applicant impacts the loan approval.

- Credit Score: Candidates with higher credit scores enjoy greater chances of personal loan approvals than candidates with low credit ratings.

- Citizenship Status: The Union Bank of India offers personal loans to applicants with Indian citizenship.

Ways to Improve Union Bank Personal Loan Eligibility

Personal loans are one of the most sought-after banking products. While the UBI personal loan eligibility calculator helps check loan eligibility, the following steps can help raise your loan eligibility.

- The bank appreciates applicants who have not applied for personal loans at multiple banks. Therefore, doing proper research before application and applying for the right amounts with the Union Bank can help with quicker approvals.

- Maintaining a healthy Fixed obligation-to-income ratio (FOIR) communicates to the bank that an applicant uses appropriate portions of their earnings to pay off their liabilities. This works to the applicant’s advantage and raises their credibility.

- Maintaining high credit ratings can go a long way. One must remember the thumb rule – the better the credit scores, the more competitive the loan offer.

- Joint loan applications help to reassure the bank of timely loan settlement. This significantly improves the likelihood of loan approval.

- Using the Union Bank’s personal loan eligibility calculator can help an applicant apply for loan amounts which align with their incomes. This is seen favourably by the bank and loan requests are readily approved.

Credit Scores and Union Bank Personal Loan Eligibility

Credit scores have been emphasised throughout the blog and rightly so. Banks keep a close eye on a loan applicant’s credit scores. Candidates with high ratings are more likely to get their loan requests approved. Candidates with low credit scores not only face difficulty in approvals but may also attract higher rates of interest from the bank.

Union Bank of India suggests a credit score of 650 or more for potential personal loan borrowers. Credit scores reflect an individual’s financial history and behaviour. Simple measures like ensuring timely payments, using a good credit mix and ensuring proper credit utilisation can improve one’s credit scores with time.

Eligibility Across Different Union Bank Personal Loan Products

The UBI personal loan eligibility calculator provides eligibility checks across the bank’s diverse personal loan products. Check out the eligibility criteria for different Union Bank personal loans.

| Product/ Criteria | Minimum Age | Target Group | Salary (in Rs.) | Security |

| Education Loan –

Union Women’s Professional Personal Loan Scheme. |

18 years | Salaried and Non-salaried women. | 5 lakhs annually. | Taking mandatory insurance.

Co-application of spouse/ co-employer with a CIC score of 700 or higher. |

| Union Personal – Salaried. | 18 years | Permanent salaried employees. | 15,000 per month. | No security.

Co-application of spouse/co-employer. |

| Union Personal – Non salaried. | 25 years | Non-salaried existing customers of the bank.

Applicants must have a current/savings account at the bank with a quarterly balance of 25,000 or above. |

Any regular source of income. | No security.

Co-application of spouse/co-employer. |

| Personal Loan-

Government Employees. |

18 years | Confirmed government servants including teaching and non-teaching staff. | N/A | No security.

Co-application of spouse/co-employer. |

| Union Professional Personal Loan Scheme. | 18 years for salaried applicants.

25 years for non-salaried applicants. |

Salaried and non-salaried individuals. | 12 lakhs annually. | No security.

Co-application of spouse/ co-employee with a CIC score of 700 or higher. |

| Union Ashiyana Personal Loan Scheme. | 18 years | Existing/new home loan borrowers. | N/A | Property mortgaged for home loan continues.

Co-applicant/guarantor of home loan continues. |

| Union Ashiyana Overdraft Scheme. | 18 years | Existing/new home loan borrowers. | N/A | Property mortgaged for home loan continues.

Co-applicant/guarantor of home loan continues.

Guarantee of local resident Indians for NRI applicants. |

People Also Asked

What is the minimum salary requirement for a Union Bank personal loan?

Depending upon the type of loan, the salary requirements can range from 15,000 per month to 12 lakhs annually for Union Bank of India Personal Loans.

Does Union Bank only provide personal loans to existing customers?

No, the bank also extends personal loans to new applicants.

How important is my income for a Union Bank personal loan?

Having a stable income increases one’s loan eligibility. Candidates fulfilling the bank’s minimum income requirements have higher chances of loan approvals.

How can I increase my eligibility and apply for higher Union Bank personal loan amounts?

Maintaining good credit scores is a sure-shot way of ensuring easy personal loan approvals. Further, settling existing debts before applying can also increase one’s personal loan eligibility.

What is the minimum CIBIL score criterion for Union Bank Personal Loan?

The bank accepts candidates with CIBIL scores of 650 or higher. However, in some cases, the bank may also demand co-applicants to have a CIBIL score of 700 or higher.

Quick Links

Loan Offers By Union Bank Of India's

Personal Loan Calculators

Union Bank Of India Calculators

- Union Bank Business Loan Calculator

- Union Bank FD (Fixed Deposit) Calculator

- Union Bank Loan Against Property (LAP) Calculator

- Union Bank of India Personal Loan Calculator

- Union Bank RD (Recurring Deposit) Calculator

- Union Bank of India Home Loan EMI Calculator

- Union Bank PPF (Public Provident Fund) Calculator

Bank wise Personal Loan Calculators

- Axis Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Indiabulls Personal Loan Calculator

- Muthoot Finance Ltd Personal Loan Calculator

- Paysense Personal Loan Calculator

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator