- Home

- Personal Loan

- State Bank Of India

- SBI Personal Loan Eligibility Calculator

SBI Personal Loan Eligibility Calculator

Understanding the eligibility criteria for personal loans is crucial to ensure a smooth application process and favourable outcomes. To this end, Urban Money offer tools like the SBI personal loan eligibility calculator, designed to provide individuals with an estimation of their eligibility for an SBI personal loan. This calculator takes into account a range of factors, allowing individuals to gauge their eligibility without diving directly into the intricacies of the topic.

- Personalized Personal Loan solutions

- Expert guidance

- Application assistance

- Credit score discussion

- Personal Loan Interest rate comparison

Table of Content

Last Updated: 7 February 2026

SBI Personal Loan Eligibility Calculator – Key Features & Benefits

Key features of the SBI Personal Loan Eligibility Calculator:

- Online Convenience: SBI offers an online personal loan eligibility calculator that allows you to quickly and easily check your eligibility for a personal loan without visiting a branch.

- User-Friendly Interface: The calculator usually has a user-friendly interface where you input basic details such as your monthly income, existing loan obligations, desired loan amount, and tenure.

- Customisation: You can adjust the loan amount and tenure in the calculator to see how it affects your eligibility and monthly EMI (Equated Monthly Instalment).

- Privacy: The calculator typically ensures privacy by not requiring you to disclose personal details like your name, contact information, or PAN number during the initial calculation.

- Budgeting: The calculator provides you with an estimated EMI amount, helping you understand how much you need to allocate from your monthly budget for loan repayment.

- Avoid Rejection: Using the calculator can help you avoid loan rejection by giving you a clearer understanding of the loan amount that aligns with your financial profile.

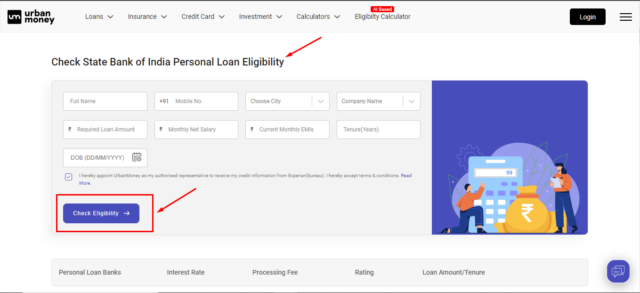

How to Use SBI Personal Loan Eligibility Calculator?

- Go to the official website of Urban Money.

- Select “Loans” and then “Personal Loan.”

- You will find a list of India’s biggest banks and NBFCs.

- Scroll down to “SBI.” This will land you to “SBI Personal Loan” page.

- The calculator will appear under the heading “Check State Bank of India Personal Loan Eligibility.”

- Enter the necessary information, such as your name, phone number, city, desired loan amount, loan tenure, and so on.

- Click on the “Check Eligibility” button.

- Within a minute, you will receive a 6-digit OTP to the phone number you previously entered.

- Enter the OTP and then press “Submit.”

- The calculator will quickly display the entire amount available from the bank. Along with the result, you can see the interest rate, tenure, monthly EMI, and total cost.

SBI Personal Loan Eligibility Criteria

- Age: You must be between 21 and 60 years of age at the time of loan application.

- Income: You must have a minimum net monthly income of Rs. 5,000 for salaried individuals and Rs. 10,000 for self-employed individuals.

- Employment: You must be employed in a regular salaried job or self-employed in a business or profession for at least 2 years.

- Residential Status: You must be a resident of India.

- Credit Score: SBI does not have a minimum credit score requirement for personal loans. However, a good credit score will improve your chances of loan approval and may also get you a lower interest rate.

- EMI/NMI Ratio: Your EMI/NMI ratio (where EMI is your monthly equated monthly instalment and NMI is your net monthly income) should not exceed 50%. This means that your monthly EMIs should not be more than 50% of your net monthly income.

List of Factors Affecting SBI Personal Loan Eligibility

State Bank of India (SBI) and other banks typically consider a variety of factors when determining an individual’s eligibility for a personal loan. While specific criteria may vary from bank to bank, here are some common factors that can affect your SBI personal loan eligibility:

- Income: Your income, both monthly and annual, is a crucial factor. A higher income indicates your ability to repay the loan. SBI usually has a minimum income requirement for personal loan eligibility.

- Credit Score: A good credit score demonstrates your creditworthiness and repayment history. Banks often have a minimum credit score requirement. A higher score improves your chances of approval and may also lead to better interest rates.

- Employment Type: SBI typically prefers borrowers with stable employment. Salaried individuals might have an advantage over self-employed individuals due to their steady income source.

- Employment History: Your job stability and work history play a role. Longer employment with the same employer can be viewed positively by the bank.

- Age: Generally, you need to be within a certain age range (for example, 21 to 58 years) to be eligible for an SBI personal loan. This may vary based on the bank’s policy.

- Residential Stability: Banks may look at how long you’ve lived at your current residence. A stable address could reflect positively on your application.

- Debt-to-Income Ratio (DTI): Your DTI ratio compares your monthly debt payments to your monthly income. A lower DTI indicates your ability to manage additional debt.

- Loan Amount: The loan amount you apply for can affect your eligibility. It’s typically evaluated in relation to your income.

- Employer Type: The reputation of your employer or company might be considered, as it could reflect the stability of your income source.

- Loan Repayment History: If you have an existing relationship with SBI or other banks and have repaid loans on time, it can positively impact your eligibility.

- Number of Dependents: The number of dependents you have can affect your disposable income and, consequently, your eligibility.

- Loan Tenure: The loan tenure (repayment period) you choose can impact your eligibility. A longer tenure might improve eligibility by reducing your monthly repayment burden.

How Can You Improve Your SBI Personal Loan Eligibility?

- Improve your credit score: A good credit score shows lenders that you are a reliable borrower and that you are likely to repay your loans on time. You can improve your credit score by paying your bills on time, keeping your credit utilisation low, and avoiding applying for too many loans at once.

- Get a co-signer: If your credit score is not very good, you can get a co-signer to improve your chances of getting approved for a loan. A co-signer is someone who agrees to be responsible for repaying the loan if you default.

- Choose a shorter loan tenure: The shorter the loan tenure, the lower your monthly EMIs will be. This will make it easier to repay the loan and improve your chances of getting approved.

- Apply for a lower loan amount: If you apply for a lower loan amount, you will be less of a risk to the lender. This will improve your chances of getting approved.

Understanding the Impact of Credit Score on SBI Personal Loan Eligibility

A higher credit score significantly enhances eligibility for SBI personal loans. The credit score reflects an individual’s creditworthiness and repayment history. SBI favours applicants with scores above 750, indicating responsible financial behaviour.

Such individuals enjoy lower interest rates and higher loan amounts. A lower score may lead to rejection or higher interest rates. Thus, maintaining a good credit score is pivotal for favourable personal loan terms from SBI.

Comparing Eligibility across Different SBI Personal Loan Products

| SCHEME | 2 yr MCLR | Spread over 2 yr MCLR | Effective Interest Rates |

| I. XPRESS CREDIT | |||

| A. Defence/CAPF/Coast Guard | 8.65% | 2.40% – 3.90% | 11.05% – 12.55% |

| B. Govt./Police/Railway/CPSEs (RATNA) | 8.65% | 2.40% – 4.90% | 11.05% – 13.55% |

| C. Other Corporates | 8.65% | 3.40% – 5.40% | 12.05% – 14.05% |

| II. XPRESS ELITE SCHEME | |||

| Salary Account with SBI | 8.65% | 2.40% – 2.90% | 11.05% – 11.55% |

| Salary Account with another Bank | 8.65% | 2.65% – 3.15% | 11.30% – 11.80% |

| III. XPRESS FLEXI SCHEME | |||

| Diamond Salary Package | 0.25% ↑ | Higher of I & II | |

| Platinum Salary Package | 0.25% ↑ | Higher of I & II | |

| IV. XPRESS LITE SCHEME | |||

| All Brackets | 1.00% ↑ | Higher of I | |

| V. SBI QUICK PERSONAL LOAN SCHEME | |||

| Non-SBI Salary Account | 0.25% ↑ | Higher of I | |

| VI. XPRESS CREDIT INSTA TOP-UP | |||

| Insta Top-Up Loans | 8.65% | 3.50% | 12.15% |

| VII. PRE-APPROVED PERSONAL LOANS | |||

| Non-CSP Customers | 8.65% | 4.90% – 5.40% | 13.55% – 14.05% |

| VIII. PENSION LOAN SCHEMES | |||

| SBI Pension Loan | 8.65% | 2.55% | 11.20% |

| Jai Jawan Pension Loan | 8.65% | 2.55% | 11.20% |

| Pension Loan for Treasury & PSU | 8.65% | 2.55% – 3.05% | 11.20% – 11.70% |

| Pre-Approved Pension Loans (PAPNL) | 8.65% | 2.55% | 11.20% |

| Pre-Approved Insta Pension Top-Up | 8.65% | 2.55% | 11.20% |

Note: The arrows (↑) indicate an increase in interest rates due to the specified conditions.

People Also Asked

How much salary is eligible for a personal loan in SBI?

The minimum salary requirement for an SBI personal loan varies depending on the loan amount and the borrower’s employment status. For salaried borrowers, the minimum salary requirement is typically Rs. 15,000 per month for a loan amount of Rs. 5 lakhs. However, the minimum salary requirement can be higher for larger loan amounts or for borrowers with a shorter credit history.

What is the minimum CIBIL Score for SBI Personal Loan?

The minimum CIBIL score required for an SBI personal loan is 750. However, a higher CIBIL score will improve your chances of getting approved for a loan and getting a lower interest rate.

Do I need to be an existing customer of SBI to get their personal loan?

No, you do not need to be an existing customer of SBI to get a personal loan from them. However, if you are an existing customer, you may be eligible for a lower interest rate and a faster approval process.

Will my income ensure my eligibility for a SBI personal loan?

No, your income alone will not ensure your eligibility for a SBI personal loan. The bank will also consider your CIBIL score, employment history, and other factors when making a decision on your loan application.

How can I increase my eligibility for a higher SBI personal loan amount?

To increase your chances of securing a higher SBI personal loan, adopt key strategies. Prioritise improving your CIBIL score through prompt payments and reduced debts. Elevate your income as it directly impacts your loan amount eligibility. A creditworthy cosigner can bolster your application. Consider collateral if feasible, as it can positively sway the lender’s decision for a larger approved loan amount.

Quick Links

Loan Offers By State Bank Of India's

Personal Loan Calculators

State Bank Of India Calculators

Bank wise Personal Loan Calculators

- Axis Bank Personal Loan Calculator

- Canara Bank Personal Loan Calculator

- Idfc First Bank Personal Loan Calculator

- Hsbc Personal Loan Calculator

- Indusind Bank Personal Loan Calculator

- Hdfc Bank Personal Loan Calculator

- Kotak Bank Personal Loan Calculator

- State Bank Of India Personal Loan Calculator

- Idbi Bank Personal Loan Calculator

- Indiabulls Personal Loan Calculator

- Muthoot Finance Ltd Personal Loan Calculator

- Paysense Personal Loan Calculator

- Bajaj Finserv Personal Loan Calculator

- Tata Capital Financial Services Ltd Personal Loan Calculator

- Hero Fincorp Personal Loan Calculator

- Karur Vysya Bank Personal Loan Calculator

- Union Bank Of India Personal Loan Calculator

- Punjab National Bank Personal Loan Calculator

- Bank Of India Personal Loan Calculator

- Bank Of Baroda Personal Loan Calculator

- Punjab Sind Bank Personal Loan Calculator

- Indian Bank Personal Loan Calculator

- Bank Of Maharashtra Personal Loan Calculator

- Citi Bank Personal Loan Calculator

- Rbl Bank Personal Loan Calculator

- Karnataka Bank Personal Loan Calculator

- Federal Bank Personal Loan Calculator

- Deutsche Bank Personal Loan Calculator

- Yes Bank Personal Loan Calculator

- Dcb Bank Personal Loan Calculator

- Icici Bank Personal Loan Calculator